Students and expanding companies are demanding more blockchain courses at Swiss universities. © Keystone / Christian Beutler The rapidly expanding Swiss blockchain industry is facing growing pains: a limited supply of qualified workers to fill the expanding number of job vacancies. Universities are stepping up to meet the challenge by designing new courses around blockchain and decentralised finance. Blockchain is the digital system that powers bitcoin and other...

Read More »How the Fed’s Tampering with the Policy Rate Affects the Yield Curve

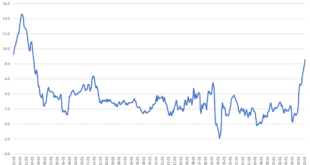

At the end of March this year the difference between the yield on the ten-year Treasury bond and the yield on the two-year Treasury bond fell to 0.010 percent from 1.582 percent at the end of March 2021. Many analysts believe that a change in the shape of the yield spread provides an indication regarding where the economy is heading in the months ahead, with an increase in the yield spread raising the likelihood of a possible strengthening in economic activity in the...

Read More »Keynesians and Market Monetarists Didn’t See Inflation Coming

The government’s latest report puts the twelve-month official consumer price inflation rate at 8.5 percent, the highest since December 1981: As economists debate the causes of, and cure for, this price inflation, it’s worth recounting which schools of thought saw it coming. Although individuals can be nuanced, generally speaking the Austrians have been warning that the Fed’s reckless policies threaten the dollar. In contrast, as I will document in this article, two...

Read More »Why Zoltan Pozsar’s Bretton Woods 3 is SO WRONG [Eurodollar University, Ep. 217]

Zoltan Pozsar says a commodity-based, China-led monetary order—Bretton Woods III—is upon us, resulting in the decline of the US dollar and escalating repudiation of US Treasuries. This is not going to happen! China doesn't want it; neither do exporters nor commodity producers. ----EP. 217 REFERENCES---- (Credit Suisse) Bretton Woods III: https://bit.ly/38H76q8 (Credit Suisse) Money, Commodities, and Bretton Woods III: https://bit.ly/3jK2YI4 (Credit Suisse) The Big $hort:...

Read More »Greenback Starts New Week on Firm Note

Overview: With many financial centers, especially in Europe, closed for the long holiday weekend, risk-appetites remain in check. Most Asia Pacific markets fell, and poor earnings from Infosys and Tata Consultancy, saw India pace the decline with a 2% drop. US futures are also trading with a heavier bias. Interest rates remain firm. The US 2- and 10-year yields are up a couple of basis points to 2.47% and 2.85% respectively. China’s GDP inexplicable rose though...

Read More »Swiss consumed 4.3 percent more electricity in 2021

Nuclear plants fell short by 19.4% because of maintenance work carried out at the Leibstadt plant over several months. © Keystone / Alexandra Wey The Alpine nation consumed 2.4 million kilowatt hours (kWh) more electricity in 2021, equivalent to the annual consumption of 479,800 households. “In addition to the pandemic-related ‘compensatory effects’ in the second quarter, general economic development, the weather and population development increased consumption in...

Read More »Hoppe: “My Dream Is of a Europe Which Consists of 1,000 Liechtensteins.”

[Editor’s note: Earlier this month Dr. Hans-Hermann Hoppe appeared on SERVUS TV for a discussion “On State, War, Europe, Decentralization and Neutrality.” An English translation of the transcript was prepared by Leonhard Paul, a law student from Germany.] Interviewer: I would like to welcome our second guest in the studio. It is the philosopher and economist with an international range Hans-Hermann Hoppe. Nice to meet you, Mr. Hoppe. The dream of a united Europe, the...

Read More »Students demand a bitcoin education

A few years ago, during a bitcoin price rally, a colleague relayed a story about her husband attending a university lecture. He noticed several students glued to their smartphones. Peering over a few shoulders he saw they were more focused on crypto profits than the lecture. Roll on five years and bitcoin has now become the central subject of lectures in several Swiss universities. A study by blockchain start-up incubation company CV VC and PwC has identified 20...

Read More »Swiss government prepares for electricity price shock

Switzerland’s leaders are concerned by the current volatility of electricity prices and have started planning for a potential disaster scenario, reported RTS. Photo by Pok Rie on Pexels.comThe war in Ukraine has impacted energy provision across Europe, said Swiss energy minister Simonetta Sommaruga on Thursday. Price movements have reached historical levels and could worsen if gas supplies from Russia stop. If the price of gas spikes, some electricity suppliers could...

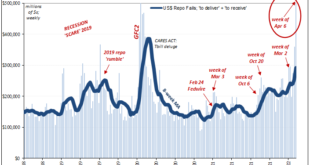

Read More »Yield Curve Inversion Was/Is Absolutely All About Collateral

If there was a compelling collateral case for bending the Treasury yield curve toward inversion beginning last October, what follows is the update for the twist itself. As collateral scarcity became shortage then a pretty substantial run, that was the very moment yield curve flattening became inverted. Just like October, you can actually see it all unfold. According to the latest FRBNY data taken from Primary Dealers, repo fails during the week of April 6 (most...

Read More » SNB & CHF

SNB & CHF