For understanding our modern monetary troubles, Nik Bhatia’s pamphlet-sized book from last year hits exactly the right intersection between money and banking, between the past and the future. Clocking in at around 150 pages of easy prose, it’s accessible but not dumbed down, revealing but not inaccurate. It has a simple framework that Bhatia explains and explores with great expertise. As an introduction to what bitcoin is as a monetary technology, Layered Money: From Gold and Dollars to Bitcoin and Central Bank Digital Currencies is superb, and Bhatia goes through our monetary past to arrive at bitcoin’s role in the monetary future. It’s a little brief on the monetary history front—though as a trained financial historian, I am likely to say that about any book.

Topics:

Joakim Book considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

For understanding our modern monetary troubles, Nik Bhatia’s pamphlet-sized book from last year hits exactly the right intersection between money and banking, between the past and the future. Clocking in at around 150 pages of easy prose, it’s accessible but not dumbed down, revealing but not inaccurate. It has a simple framework that Bhatia explains and explores with great expertise.

As an introduction to what bitcoin is as a monetary technology, Layered Money: From Gold and Dollars to Bitcoin and Central Bank Digital Currencies is superb, and Bhatia goes through our monetary past to arrive at bitcoin’s role in the monetary future. It’s a little brief on the monetary history front—though as a trained financial historian, I am likely to say that about any book.

Bhatia sees the world of money as a pyramid, but interestingly, he flips it onto the right side, which is contrary to the way monetary economics has long depicted our banking system (and what you’d find in most textbooks). Usually, we portray the money as an inverted pyramid, with base money at the base and increasingly wider layers of monetary substitutes above it. The more leveraged the banking system, the longer and wider the sides of the pyramid, and it’s graphically clear that the system consumers interact with every day (the broadest, top layer) rests on a fragile foundation.

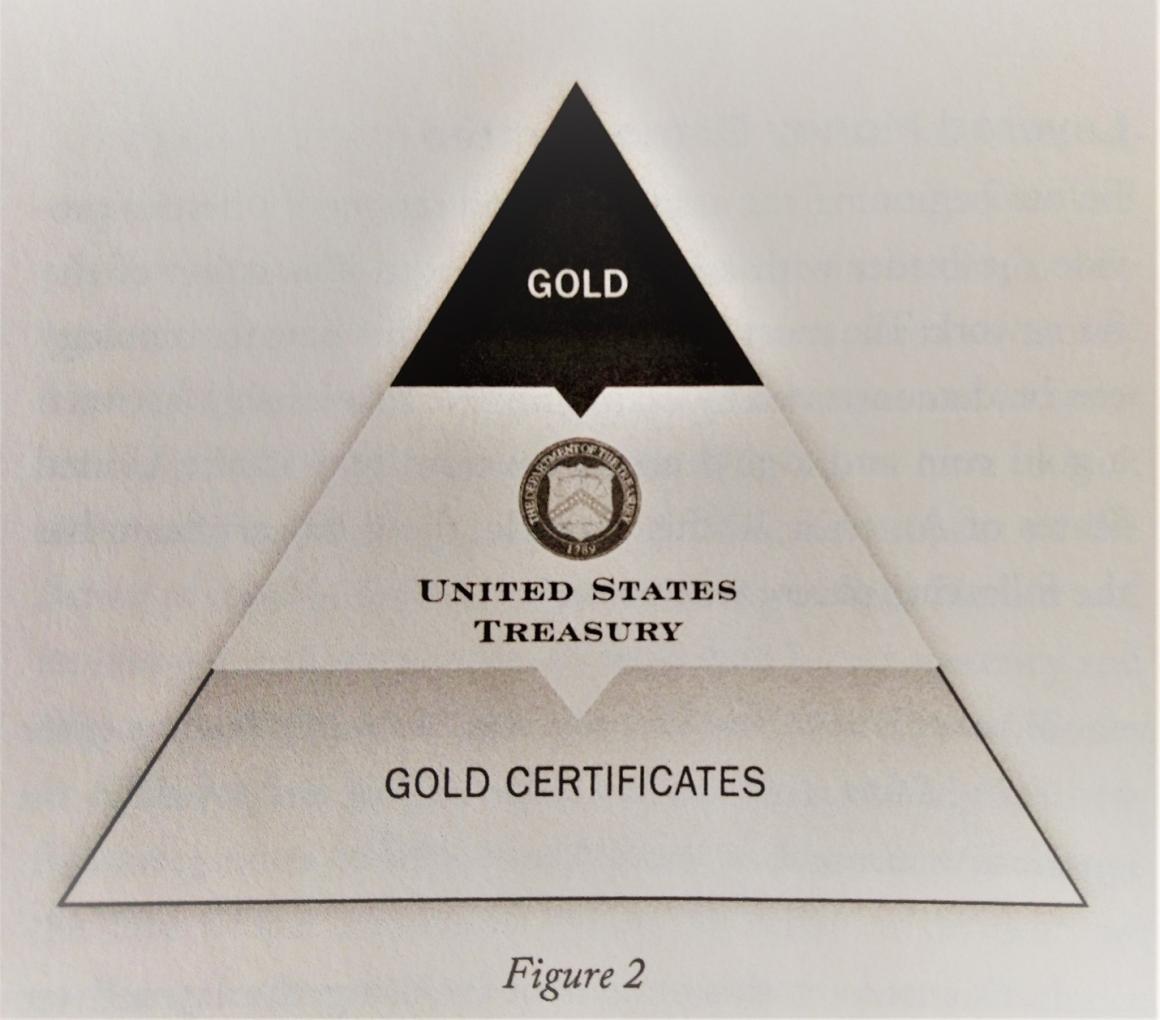

| In Layered Money, we get an actual pyramid, with the top of the pyramid constituting the economy’s base money. Right away, the terminology becomes odd, since the “base” sits at the top, and we don’t get the immediate impression of instability inherent in leveraged runnable banking deposits. So, under a simplified version of the interwar United States, we get a pyramid looking like figure 2 (and commercial banks would have pursued their business below the second layer): |

Gold is the highest money (first layer) with gold certificates issued by the Treasury (and in theory redeemable for the upper layer) forming the second layer. Bhatia draws a similar pyramid for the classical gold standard, with gold at the top, the Bank of England as the main custodian of gold, Bank of England notes as second-layer money, and commercial banks and their deposits as third-layer money.

Across the few centuries of monetary history that Bhatia briefly recounts, different objects took the place of the economy’s highest form of money: gold and the Bank of England were the upper layers during the classical gold standard; gold coins intermediated into notes and bills of exchange by Antwerp bankers in the sixteenth century, and ghost money at the Bank of Amsterdam during the Dutch Golden Age. As a more recent system, the Bretton Woods system featured gold at the top, intermediated by the Federal Reserve into dollars, which in turn were hard money for other countries’ central banks, which only indirectly tied their currencies to gold.

The top of the pyramid is outside money—money that is a pure asset and therefore doesn’t have counterparty risk. The lower layers of money are all subject to redemption by some issuer: a central bank in the first round and commercial banks in the second, as they pyramid on top of central bank money.

What Bhatia loses in traditional terminology (“base money” no longer at the base) he gains by making explicit the hierarchy of money: “all second-layer monies are IOUs (I-owe-you) or promises to pay first-layer money”—“monetary instruments are ranked in order of superiority from top to bottom.” Bank runs are therefore runs up the hierarchy, a notion that makes more sense than the traditional inverted pyramid that somehow falls over or disintermediates itself in a crisis.

And he pulls no punches in denouncing today’s monetary regime:

Despite the dollar system’s fragility that has been exposed over the past dozen years, the dollar is more deeply entrenched as the international monetary system’s fulcrum than ever. The world is seemingly trapped inside a dollar denomination and is hankering for a monetary renaissance.

After gold was purged from the top layer, the Fed “never lost its position atop the dollar money pyramid.” In Bhatia’s rendition, gold was instead replaced by US Treasury bills and bonds (“USTs”). That makes sense from a financial-markets point of view, where USTs are prime collateral, but it’s a little suspicious from a monetary lens.

USTs have counterparty risk, in contrast to the other first-layer monies that Bhatia considers (gold, silver, bitcoin). More importantly, there’s no constraining connection between USTs and their supposedly second-layer inferior money, as dollar holders can’t redeem their bank balances or Fed deposits in U.S. Treasurys—a feature that is crucial for all the money pyramids previously surveyed. If USTs are first-layer money in today’s money pyramid, it no longer makes sense to consider panics and bank runs a scramble up the pyramid. Once you’ve acquired Fed deposits, how could you possibly scramble further upward?

In that case, why would the Fed, the creator and issuer in of lower-level money, purchase an upper-layer money? How can the transformation from a lower-level to an upper-level money be considered money creation? By Bhatia’s logic, Fed purchasing of Treasurys in its quantitative easing programs should be deleveraging; that is, contractionary.

If anything, USTs should be on the same level as government-issued, debt-carrying assets—which even Basel regulations (general international guidelines for bank regulations) posit: both Fed reserves and USTs are equally serviceable level 1 assets, according to those shared central bank–negotiated rules.

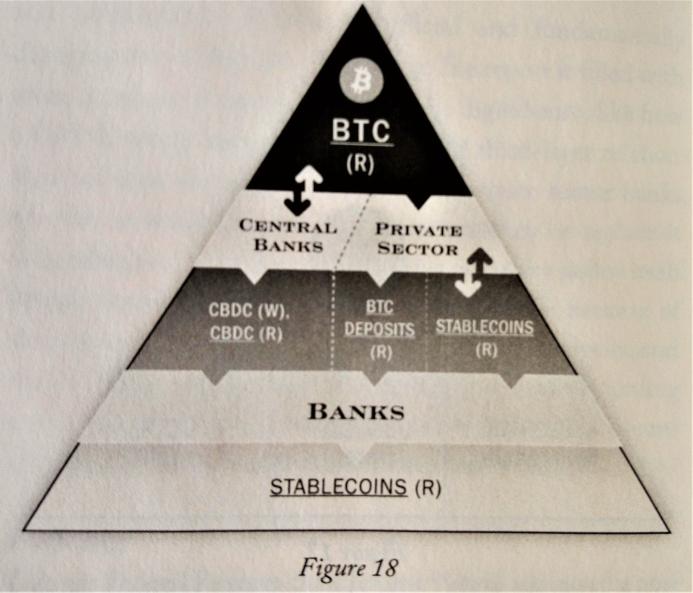

Hyperbitcoinization and a Layered Vision for the FutureAfter going through some monetary history, the issues with the current monetary regime, and discussing central bank digital currencies—the monstrosity that has monetary overlords from China to the eurozone to the Fed drooling—Bhatia presents his prediction for the future, where bitcoin takes its natural place at the top of the hierarchy. We have central banks and the private sector both competing for bitcoin deposits, and leveraging payment mechanisms on top of (under?) their bitcoin reserves. Banks issue lending certificates at yet a lower monetary layer: |

Even though Bhatia is busy writing a second book more exclusively on bitcoin, he could use his great talent for explaining difficult themes in the many nuances of monetary history that were overlooked in this book. Still, those are errors of omission, excusable in a short book with different aims in mind. The errors of commission I found in Layered Money are minor and don’t take away much from the story:

- Walter Bagehot didn’t found The Economist—James Wilson did, and Bagehot married his daughter, Eliza Wilson.

- Bhatia considers the cause of the Restriction Act of 1797 (where Britain went off gold for two decades during wartime) a banking bailout resulting from land value crashes in the US—rather than the more pressing monetary danger that was the Napoleonic Wars.

- It’s a bit misleading to call the Restriction period, 1797–1821, one of free-floating paper money, as the strong presumption that Britain would return to gold after the war kept overissuance in check.

- The straight line drawn from Amsterdam’s Wisselbank to the Bank of England to the Federal Reserve simplifies too much. The Wisselbank was a ledger-based exchange bank that, aside from some lending to the City of Amsterdam and the Dutch East India Company in later periods (that would ultimately be its downfall), held 100 percent metal reserves for most of the seventeenth century. The Bank of England, in contrast, was explicitly a vehicle for raising wartime funds, a scheme among many in the 1690s. For decades, the operations of the Bank of England centered around administering and improving the government’s debt management and acquiring valuable monopolies in exchange. The Fed, yet again, was neither of those things, established in 1913 ostensibly to improve upon the private clearinghouses that came before it, centralize bank reserves, and make the US currency more elastic.

For a quick introduction to the vast and bottomless topics of our monetary past and how money works in the present, Bhatia’s book is excellent. Some of his historical details are incorrect, and there’s a lot more nuance to cover, but those shortfalls don’t derail the overall achievement—especially in incorporating bitcoin into a traditional monetary lens.

Layered Money belongs on every goldbug’s or bitcoiner’s bookshelf, or better yet, desktop: to be read and returned to frequently.

Tags: Featured,newsletter