ISM surveys are not very reliable at forecasting GDP growth in the short run. Nevertheless, the figures look reasonably good, at least compared to what the hard falling headline numbers for November might suggest. Both ISM indices dropped markedly m-o-m in November. However, while the Manufacturing index fell to a new cycle-low, its Non-Manufacturing counterpart remained pitched at a still relatively robust level by past standards. Taken together, they point towards economic growth running at around 3.2% in October-November. Nevertheless, we expect GDP growth to settle at ‘only’ 2.0% in Q4. ISM Manufacturing index fell heavily in November The ISM Manufacturing survey for November 2015 was published on Tuesday. The headline reading fell heavily from 50.1 in October to 48.6 in November, well below consensus expectations (50.5). This yardstick actually reached its lowest level since the recession ended in June 2009. As things stand, the Markit Manufacturing PMI (reflecting results from the other main survey on manufacturing activity) remains well above its ISM counterpart. However, it dropped as well m-o-m, from 54.1 in October to 52.8 in November. The details of the Manufacturing ISM report showed the Production sub-index fell by a large 3.7 points m-o-m to 49.2, while the New Orders sub-index declined by an even larger 4.0 points to reach 48.9.

Topics:

Bernard Lambert considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

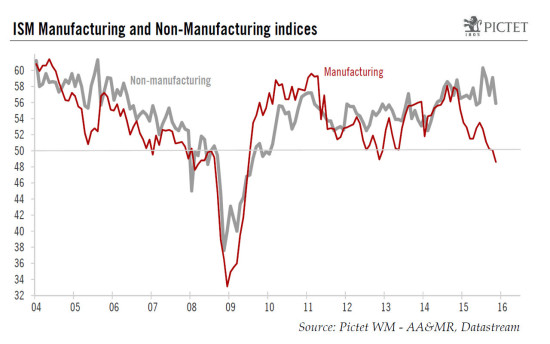

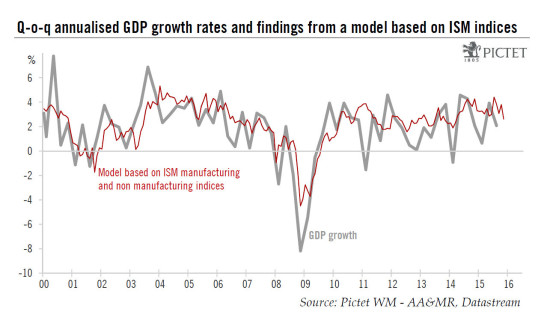

ISM surveys are not very reliable at forecasting GDP growth in the short run. Nevertheless, the figures look reasonably good, at least compared to what the hard falling headline numbers for November might suggest.

Both ISM indices dropped markedly m-o-m in November. However, while the Manufacturing index fell to a new cycle-low, its Non-Manufacturing counterpart remained pitched at a still relatively robust level by past standards. Taken together, they point towards economic growth running at around 3.2% in October-November. Nevertheless, we expect GDP growth to settle at ‘only’ 2.0% in Q4.

ISM Manufacturing index fell heavily in November

The ISM Manufacturing survey for November 2015 was published on Tuesday. The headline reading fell heavily from 50.1 in October to 48.6 in November, well below consensus expectations (50.5). This yardstick actually reached its lowest level since the recession ended in June 2009.

As things stand, the Markit Manufacturing PMI (reflecting results from the other main survey on manufacturing activity) remains well above its ISM counterpart. However, it dropped as well m-o-m, from 54.1 in October to 52.8 in November.

The details of the Manufacturing ISM report showed the Production sub-index fell by a large 3.7 points m-o-m to 49.2, while the New Orders sub-index declined by an even larger 4.0 points to reach 48.9. More encouragingly, the Employment sub-index bounced back markedly from 47.6 in October to 51.3 in November. However, the level reached in October was the lowest level in more than six years.

In any event, as we have noticed repeatedly, the combined effect of lower oil prices, soft foreign demand and a higher dollar was – and will over the coming months continue to be – a clear, sharp negative factor for the manufacturing sector, which is much more dependent on exports and the oil-extraction sector than the whole services-oriented economy. Moreover, the downward correction in inventories has probably amplified the downturn in manufacturing activity over the past few months. Fortunately, the manufacturing sector currently represents only some 12% of the overall US economy.

ISM Non-Manufacturing index dropped as well

The ISM Non-Manufacturing survey was published today. Unlike its Manufacturing counterpart, the composite Non-Manufacturing index remained at relatively elevated levels. Admittedly, it did drop back significantly from 59.1 in October to 55.9 in November, well below consensus expectations (58.0). However, November’s reading certainly remains pitched at still relatively robust levels by historical standards.

Last month’s sharp decline was broad-based. Most sub-indices printed marked monthly decreases. This was notably the case for the New Orders sub-index, which fell back from 62.0 in October to 57.5 in November, and for the employment sub-index, which dropped from 59.2 in October to 55.0 in November.

Nevertheless, taken together, the two ISM composite indices suggest that overall economic growth has remained solid so far in Q4. If we use historical correspondence to try to calibrate what the ISM indices are pointing towards in terms of GDP growth (see chart below), we arrive at 2.6% in November and an average of 3.2% for October-November, following an average reading of 3.8% in Q3 and 3.1% in Q2. The ISM surveys, therefore, suggest the economy has continued to expand robustly so far in Q4. Nevertheless, although ISM surveys are timely and useful indicators of the strength in the economy, they are not very reliable at forecasting GDP growth in the short run. Indeed, as we have seen above, ISM indices had been pointing to 3.8% GDP growth in Q3 2015 whereas the estimate published last week for this was 2.1% (see below).

Q3 GDP revised up, forecast for Q4 growth revised down

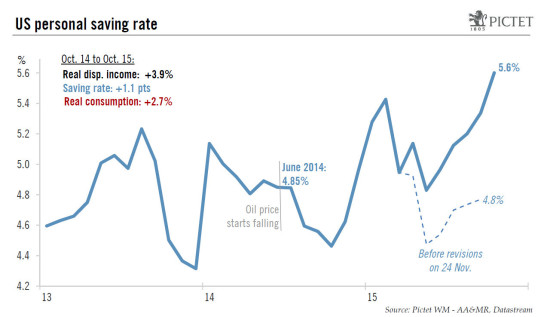

Last week, Q3 GDP growth was revised up from 1.5% q-o-q annualised to 2.1%, in line with expectations. However, the main reason behind this upward revision was a higher estimate of stockbuilding. As inventories currently remain at relatively high levels, this means that the pace of stockbuilding is likely to decline further by more than expected in Q4, dampening GDP growth. Moreover, October’s consumption numbers – although published last week – were disappointing. As a result, we are revising down our forecast for Q4 GDP growth by exactly the same as Q3 GDP growth was revised up, i.e. from 2.6% to 2.0%. These changes don’t alter the estimate for the 2015 average growth rate, which remains at 2.5%. However, our forecast for average growth in 2016 is ‘mechanically’ reduced from 2.4% to 2.3%.

It’s also worth noting that together with GDP data, estimates for Q2 and Q3 real disposable income were revised markedly up, but consumption not. The corollary is that the saving rate now appears significantly higher than estimated before (see chart above). It moved up from an upwardly revised 5.3% in September (previously 4.8%) to 5.6% in October. This suggests the windfall coming from the collapse in oil prices was actually only partly spent after all. This is encouraging for consumption growth in the future. As the saving rate is now relatively high, it has some potential to fall back over the coming months.