Swiss Franc The Euro has fallen by 0.10% to 1.0779 EUR/CHF and USD/CHF, October 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Speculation that a new round of fiscal stimulus from the US is possible is encouraging risk-taking today. Many large Asian centers were closed for holidays today, and a technical problem prevented the Tokyo Stock Exchange from opening. Nevertheless, the markets that were open rose by 1% or more, including Australia and India. Europe’s Dow Jones Stoxx 600 firmed to new nine-day highs, and US shares are trading with an upside bias as well. Benchmark 10-year yields are firmer with the US yield near 69 bp. The dollar is mostly softer, though the yen and sterling are struggling. The

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, EMU, Featured, Japan, Mexico, newsletter, South Korea, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.10% to 1.0779 |

EUR/CHF and USD/CHF, October 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

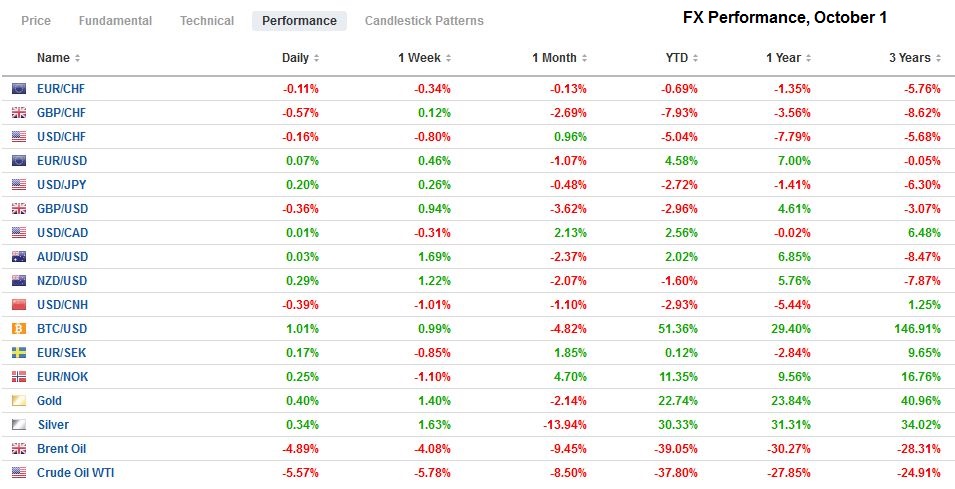

FX RatesOverview: Speculation that a new round of fiscal stimulus from the US is possible is encouraging risk-taking today. Many large Asian centers were closed for holidays today, and a technical problem prevented the Tokyo Stock Exchange from opening. Nevertheless, the markets that were open rose by 1% or more, including Australia and India. Europe’s Dow Jones Stoxx 600 firmed to new nine-day highs, and US shares are trading with an upside bias as well. Benchmark 10-year yields are firmer with the US yield near 69 bp. The dollar is mostly softer, though the yen and sterling are struggling. The Norwegian krone and Australian dollar are leading the majors. Emerging market currencies are steady to higher, and the JP Morgan Emerging Market Index is trying to extend its gains for a third session. Gold is testing $1900, and November WTI continues to straddle the $40 a barrel level. |

FX Performance, October 1 |

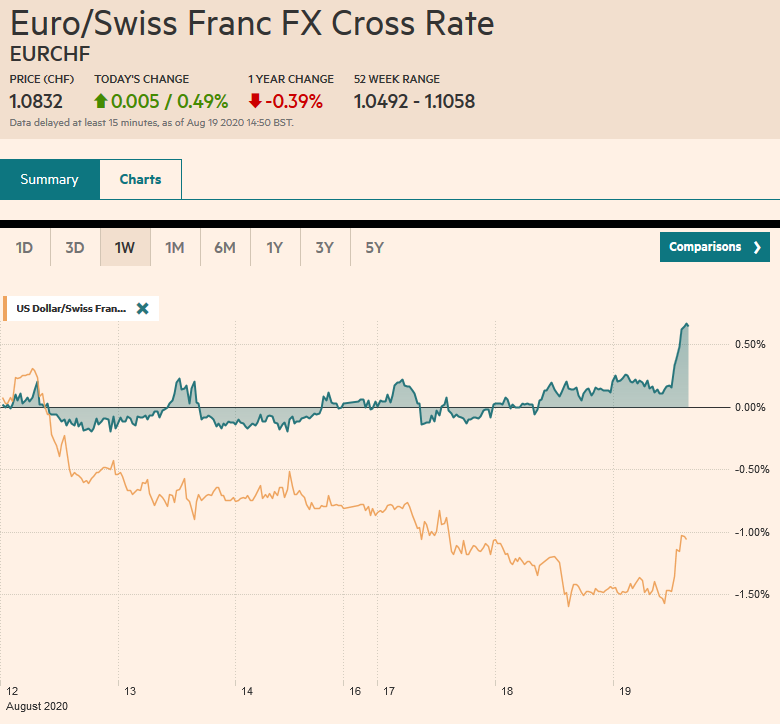

Asia PacificAn announcement is expected shortly from Japanese officials about equity trading tomorrow. The Tankan Survey showed a little improvement for the first time in six quarters, though the improvement lagged expectations. The large manufacturers and non-manufacturers showed the most improvement (-27 from -34 and -12 from -17). The results from the small business show even less of a recovery. A modest bright spot was that capex plans were a little stronger than expected at 1.4%. Underscoring that the recovery in the world’s third-largest economy remains precarious was the upward revision in the September manufacturing PMI to 47.7 from 47.3. The Japanese economy is expected to have snapped a three-quarter contraction, continues to struggle. |

Japan Manufacturing Purchasing Managers Index (PMI), September 2020(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

South Korean September trade figures point to a continued recovery. Exports rose more than twice the 3.5% that economists expected. The 7.7% increase year-over-year is the strongest in two years and ends a six-month contraction. Imports unexpectedly rose by 1.1%. The median forecast in the Bloomberg survey was for a 5.1% contraction. The net result was an $8.88 bln trade surplus larger than the previous two months put together.

Reports suggest the US will initiate a 301 trade investigation into Vietnam. Vietnam is accused of preventing its currency from appreciating, giving it an unfair trade advantage. The specific issue is over tires. Vietnam’s own modernization drive has been aided by producers seeking to shift some production out of China and US crosshairs. Vietnam has emerged as one of the largest US trading partners with a growing trade surplus. Vietnam is a poor country, and its per capita GDP is less than a tenth of the US. Past US administrations tended to cut small and poor countries extra slack.

The dollar is firm against the yen but in less than a 25- tick range above JPY105.40. There are about $1.8 bln in expiring options in the JPY105.70-JPY105.90 band. Another option for around $760 mln is struck at JPY105.30 and also expires today. The Australian dollar has ended a six-day skid with a four-day advance this week. It stalled near $0.7200, but the intraday technicals suggest the session’s high may not be in place. Note that the $0.7210 area corresponds to a (50%) retracement of Aussie’s slide in September. The next retracement target (61.8%) is found closer to $0.7260.

EuropeThe high-frequency data focus has been on the disappointing CPI readings ahead of the aggregate report tomorrow. Overlooked is the strength of German and French consumption last month. German retails jumped 3.1% in August. The median forecast in the Bloomberg survey was for a 0.4% gain. |

Eurozone Producer Price Index (PPI) YoY, August 2020(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

| And adding to the picture was the upward revision in the July series to show a 0.2% decline instead of a -0.9%. Over in France, household consumption rose by 2.3% instead of fall by 0.2% as projected. July’s 0.5% gain was revised to show a 0.9% decline, which dented but did not negate the upside surprise. |

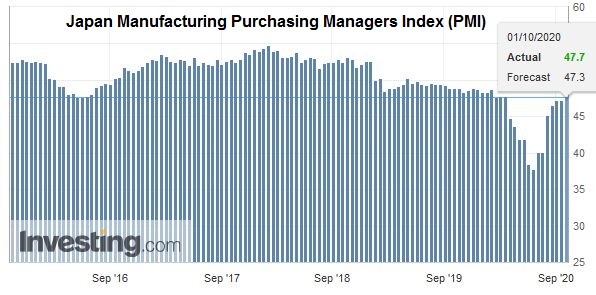

Eurozone Unemployment Rate, August 2020(see more posts on Eurozone Unemployment Rate, ) Source: investing.com - Click to enlarge |

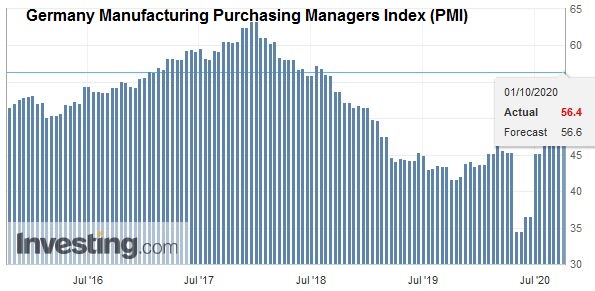

| The final manufacturing September PMI is featured today. The Germany flash reading of 56.6 was revised to 56.4, which is still a healthy improvement from August’s 52.2. France, on the other hand, revised its preliminary manufacturing PMI of 50.9 to 51.2. In August, it had dipped to 49.8. Italy saw a small gain to 53.2 from 53.1, while Spain rose to 50.8 from 49.9. |

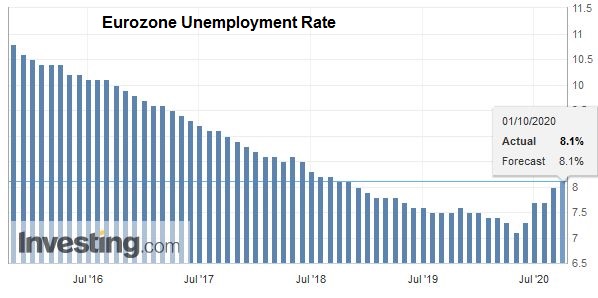

Germany Manufacturing Purchasing Managers Index (PMI), September 2020(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

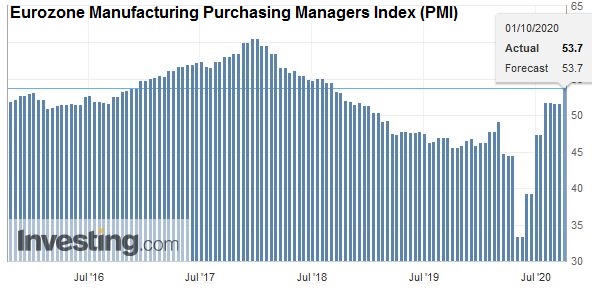

| The net effect was the preliminary aggregate manufacturing PMI was unchanged at 53.7. New orders and export orders showed improvement while the labor market remains stressed. Separately, the aggregate unemployment rate ticked up to 8.1% from a revised 8.0% (initially 7.9%). What struck us more than the data was that due to the excess liquidity in the Eurosystem, the key ESTR (euro’s short-term rate, interbank) fell to a record low of minus 57 bp, which is through the ostensible floor of the ECB’s deposit rate (minus 50 bp). |

Eurozone Manufacturing Purchasing Managers Index (PMI), September 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

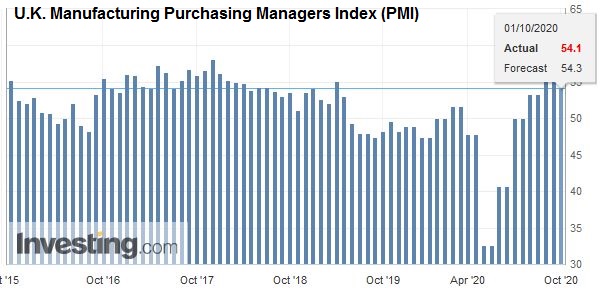

| The UK had a double dose of negative news. First, the pullback in the manufacturing PMI from August’s 55.2 was sharper than expected. It stands at 54.1 rather than 54.3 of the preliminary estimate. Second, it appears that the EU will bring forward legal action against the UK’s internal markets bill that passed the House of Commons and is to be debated in the House of Lords. Although officials have continued to negotiate the trade agreement in recent days, progress is far from sufficient to begin the next step of crafting a text. |

U.K. Manufacturing Purchasing Managers Index (PMI), September 2020(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The euro is firm, but it is holding below the $1.1765 area, which we note is the (38.2%) retracement of the losses since the September 1 high a little above $1.20. An option for 525 mln euros at $1.1750 expires today, and another one for 1.7 bln euros expires tomorrow. Initial support today is seen near $1.0720. Sterling traded on both sides of Tuesday’s range yesterday and closed above it high. The bullish outside day saw little follow-through today ($1.2950), before reversing lower. It has held a little above yesterday’s low (~$1.2800). It is overextended, but the $1.2880 area may cap corrective upticks.

AmericaThere are two developments to note. First, the markets seem to be the most optimistic in weeks that fiscal support can be agreed upon by the White House and House of Representatives. Talks between Mnuchin and Pelosi are set to continue today. Disappointing headlines would likely see risks trades unwind. Second, the Federal Reserve has extended its constraints on large bank dividend payouts and the ban on share buybacks through Q4. The measures were first announced in June. Of note, Governor Brainard dissented in favor of banning rather than capping dividend payouts. Brainard is seen as a likely candidate for Treasury Secretary in a possible Biden administration. |

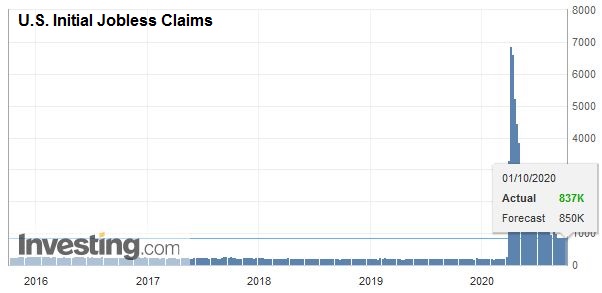

U.S. Initial Jobless Claims, October 1, 2020 Source: investing.com - Click to enlarge |

| The US economic calendar is full today, ahead of tomorrow’s employment report. On tap today ae weekly initial jobless claims, which have unexpectedly increased in two of the past three weeks. The median forecast in the Bloomberg survey expects a decline to 850k from 870k. The US also reports personal income and consumption figures for August. Income is expected to have fallen(-2.5%) as government transfers slowed. The pent-up consumption has been released and is expected to have risen by 0.8% after the heady 1.9% surge in July. |

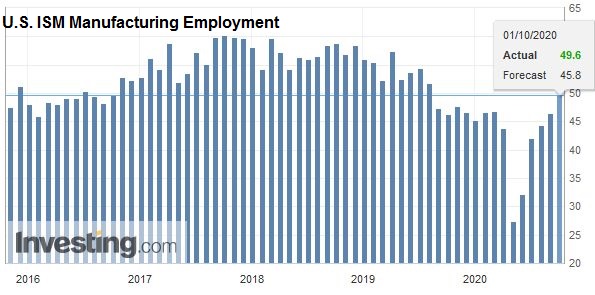

U.S. ISM Manufacturing Employment, September 2020(see more posts on U.S. ISM Manufacturing Employment, ) Source: investing.com - Click to enlarge |

| The PCE deflator that the Fed target is expected to firm to 1.2% from 1.0%, while the core rate, which it talks about, is expected to have edged up to 1.4% from 1.3%. The September ISM will likely draw more attention than the final manufacturing PMI. The details may not be as strong as the headline. Lastly, auto sales are expected to have continued to recover in September. |

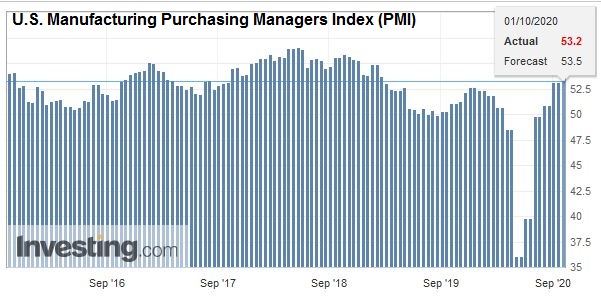

U.S. Manufacturing Purchasing Managers Index (PMI), September 2020(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Canada reports its manufacturing PMI. It stood at 55.1 in August, a two-year high. Mexico reports its manufacturing PMI, which in August was at 41.3. It bottomed in April at 35 and finished last year a little above 47. Separately, Mexico reports its August worker remittances. These have fared better than expected and are an important source of hard currency inflows. Worker remittances have been running around $3.5 bln a month. Note too that Mexico reported record trade surpluses in July and August.

Blocked near CAD1.3420, the US dollar broke down yesterday with a potential key reversal. Follow-through selling today has seen CAD1.3280. The CAD1.3260 is the (38.2%) retracement of the greenback’s gains since the dip below CAD1.30 on September 1. A break would target CAD1.3200 initially. The greenback is also retracing its recent gains against the Mexican peso. The MXN21.76-MXN21.77 area houses the (50%) retracement target of the bounce since the middle of September’s low near MXN20.84 and the 200-day moving average. The next target is closer to MXN20.55.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,Currency Movement,EMU,Featured,Japan,Mexico,newsletter,South Korea,U.K.