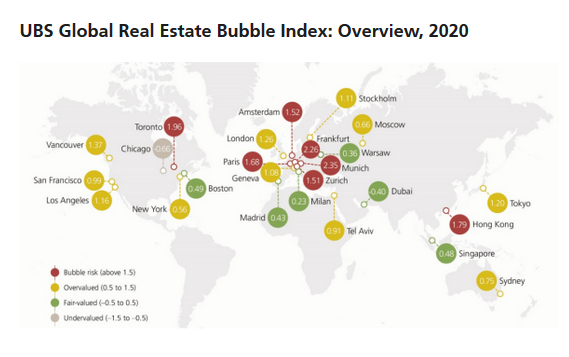

Zurich, 30 September 2020 – The UBS Global Real Estate Bubble Index, a yearly study by UBS Global Wealth Management’s Chief Investment Office, indicates bubble risk or a significant overvaluation of housing markets in half of all evaluated cities. Prices increased on average, with Europe showing most cities at risk The Eurozone stands out as the region with the most overheated housing markets. Munich and Frankfurt top the ranking. Paris and Amsterdam closely follow suit, treading on bubble risk territory alongside the two German cities. Similarly, Zurich, Toronto, and Hong Kong also display high imbalances. In contrast to last year, Vancouver’s housing market is now on the overvalued range of the spectrum, sharing the same territory with London, San

Topics:

UBS Switzerland AG considers the following as important: 3) Swiss Markets and News, 3.) Swiss Banks, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Zurich, 30 September 2020 – The UBS Global Real Estate Bubble Index, a yearly study by UBS Global Wealth Management’s Chief Investment Office, indicates bubble risk or a significant overvaluation of housing markets in half of all evaluated cities.

Prices increased on average, with Europe showing most cities at riskThe Eurozone stands out as the region with the most overheated housing markets. Munich and Frankfurt top the ranking. Paris and Amsterdam closely follow suit, treading on bubble risk territory alongside the two German cities. Similarly, Zurich, Toronto, and Hong Kong also display high imbalances. In contrast to last year, Vancouver’s housing market is now on the overvalued range of the spectrum, sharing the same territory with London, San Francisco, Los Angeles, and, to a lesser extent, New York. Boston, Singapore, and Dubai remain fairly valued. The same is true for Warsaw, which has been included in the study for the first time. Chicago remains undervalued and is the only market on that end of the scale. On average, inflation-adjusted annual price growth rates in the cities analyzed have accelerated in the last four quarters. In many European metropolitan areas, prices soared by more than 5%, with Munich, Frankfurt, and Warsaw leading the way. Price growth in the Asian and American cities, with the exception of Sydney, remained in a low-to-mid single-digit range. Madrid, San Francisco, Dubai, and Hong Kong are the only cities that saw a decline in prices. The last time there were fewer cities with negative price growth was in 2006. |

UBS Global Real Estate Bubble Index: Overview, 2020 |

Governments supported market resilience, but uncertainty looms

Despite the pandemic, housing markets have remained resilient in the first half of 2020. The study discerns three main reasons for this outcome. First, home prices are a backward-looking economic indicator and are only able to reflect an economic downturn with a certain delay. Second, the majority of potential home buyers did not suffer direct income losses in the first half of 2020. Credit facilities for companies and short-time work schemes mitigated the fallout from the crisis. Third, governments supported homeowners in many cities during the lockdown periods. Housing subsidies were increased, taxes lowered, and foreclosure procedures suspended.

Mark Haefele, Chief Investment Officer at UBS Global Wealth Management, said: “It is uncertain to what extent higher unemployment and the gloomy outlook for household incomes will affect home prices. However, it’s clear that the acceleration over the past four quarters is not sustainable in the short run. Rents have been falling already in most cities, indicating that a correction phase will likely emerge when subsidies fade out and pressure on incomes increase.”

High market valuations and an uncertain short-term outlook are bringing the longer-term trajectory of city housing into focus. On the one hand, the key appreciation drivers of urban housing – superior employment opportunities and amenities, low financing costs, and limited supply growth – remain in place. On the other hand, the pandemic seems to be accelerating a shift of population growth from cities to the wider metropolitan areas.

Claudio Saputelli, Head of Real Estate at UBS Global Wealth Management’s Chief Investment Office, explained: “The rise of the home office calls into question the need to live close to city centers. Pressure on household incomes cause many people to move to more affordable suburban areas. Moreover, already debt-ridden or economically weaker cities will have to respond to this economic crisis with tax increases or public spending cuts, neither of which bode well for property prices. Taken together, these factors amplify some longer-term uncertainties surrounding urban housing demand.”

Matthias Holzhey, lead author of the study and Head of Swiss Real Estate Investments at UBS Global Wealth Management, added: “The current cities at bubble risk seem to be weathering the coronavirus crisis relatively well. The local economies in Munich, Toronto, and Hong Kong will likely recover quickly. But even in the absence of a broad market correction, the potential for further capital gains seems depleted. In particular, the prospects for buy-to-let investments are poor given the record-high price-to-rent ratios.”

Regional perspectives

Switzerland

Zurich recorded the strongest price growth rate of all Swiss economic regions in the last decade. Its housing market has been characterized by a relatively fast supply expansion, with the vast majority of buildings ultimately being rented out. The owner-occupied market has dried up, while the coronavirus crisis has hardly left any traces on it. In fact, housing located near Zurich’s city center benefited from increasing demand. The high willingness to pay reflects both expectations that prices will further increase and sustained investment demand. In line with these developments, the city now joins the bubble risk ranks.

Zurich also continues to top Geneva both on the price and index score. After the recent price increase, however, Geneva’s housing market has recovered from losses incurred during the period between 2013 and 2016. Adding to this, low mortgage rates keep home-ownership appealing in light of inflated market rents and the city benefits from its international standing, while continuing to attract foreign nationals despite affordability constraints.

Europe

The index scores of all analyzed Eurozone cities increased in the last four quarters, with valuations already the highest worldwide. Imbalances are increasing further in the wake of record low financing costs that are not in line with the strength of the local economies. Most notably, prices in Frankfurt and Munich have more than doubled over the last decade.

On the contrary, London had the second-weakest price development of all analyzed cities since 2016. Despite this, the city remains in overvalued territory but affordability issues, political uncertainty, and a tighter tax and regulatory environment are putting further pressure on house prices. We expect foreign buyers to take advantage of the weaker pound and lower prices thus supporting the price level in the medium term.

US

The index scores have been relatively stable over the last five years in the East Coast cities. In contrast, the West Coast markets have developed less consistently. In Los Angeles the index scores have continued to increase, while in San Francisco valuations have declined due to falling home prices. Overall, the drop of mortgage rates to historically low levels supports house prices in the US. But price changes in the analyzed cities trail the nationwide average. Inner-city demand growth has slowed down as citizens move out to the suburbs as a result of affordability issues and the impacts of COVID-19. Continued migration to lower-cost and more tax-, business-, and regulatory-friendly states has accelerated this trend.

Middle East

Over the last 30 years, Tel Aviv has seen some of the highest price growth among the cities covered in this report. Currently, house prices are on the rise again due to easier financing conditions and scarce housing supply. The government has lowered the purchase tax for second homes, encouraging housing market investments. By contrast, Dubai’s property market has reached a new cyclical low. Since the last peak in 2014, prices have fallen by over 35%, and the valuation score is close to depressed levels. Positive price effects of high population growth and easier mortgage regulations are being offset by ongoing high supply growth and weak oil prices.

APAC

Home prices both in Hong Kong and in Singapore were fairly stable during the first half of the year. But while real home prices in Hong Kong are over 50% higher than they were 10 years ago, prices in Singapore have remained virtually unchanged over this period. Regulatory tightening has proven very effective in curbing price growth in the Lion City over the last decade. The uncertain economic outlook is weighing on the market prospects in both cities, but in the medium term demand is likely to remain high given their respective key roles in the region. Tokyo has evolved into one of the most dynamic housing markets in the region, bolstered by its strong population growth and attractive financing conditions. In Sydney, easier lending standards and the RBA’s rate cuts have kindled a modest but likely fleeting price recovery.

Tags: Featured,newsletter