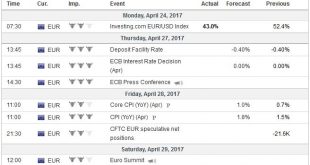

Summary: Provided Le Pen and Macron or Fillion make to the second round, the market response to the French election results may be short lived. BOJ, Riksbank and ECB meetings. Spending authorization and some announcement from the White House on tax policy are in focus as Trump’s 100th day in office approaches. The results of the French presidential election will be known prior to the open of the Asian...

Read More »Monetary Policy is Important, but US Fiscal Stance Moving Center Stage

Summary: Monetary policy is off the table for at least the next two months. Several fiscal issues are coming to a head. Despite the GOP majority in Congress and White House, brinkmanship cannot be ruled out. The Federal Reserve hiked rates in March. Whatever gradual hikes mean, it seems to preclude moves in back-to-back meetings. There are two chances of a May hike: Slim and none and Slim left town. June...

Read More »Trade Notes: China and Prospects for a New Executive Order

Summary: China’s trade concessions seem modest, but little discussion of US concessions. Reports suggest Trump is set to sign a new executive order to investigate trade practices in steel, aluminum, and maybe household appliances. Trade imbalances and floating currencies are not mutually exclusive. Last week’s meeting between the US and China’s Presidents did not produce much fireworks or headlines. The...

Read More »FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

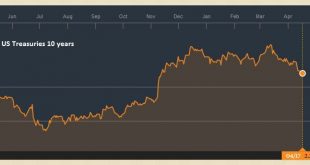

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it...

Read More »US Fed Hikes Rates, Sounds Less Hawkish Than Feared

The US Federal Reserve raised the policy rate by 25 basis points in mid-March, but left its outlook largely unchanged. We continue to expect two more rate hikes in 2017. After hawkish comments from Federal Reserve (Fed) officials in recent weeks, the 25 basis point hike in the target range for the...

Read More »China’s NPC Ends with New Initiatives

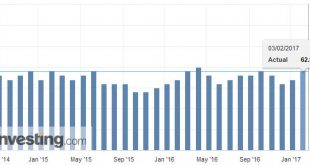

Summary: China will make its mainland bond market more accessible. As China’s portfolio of patents grows it will likely become more protective of others’ intellectual property rights. PRC President Xi will likely visit US President Trump early next month. The market’s immediate focus is on today’s FOMC meeting and Dutch elections. However, China’s annual legislative session (National People’s Congress) ended...

Read More »A Few Thoughts about the US Labor Market

Summary The 94 mln people POTUS claims are not working is true but terribly misleading. What happened to agriculture a century ago is happening to manufacturing. New industries are less labor intensive than smokestack industries. In a speech to the joint session of Congress that was widely recognized as “presidential,” US President Trump said twice that there are 94 mln Americans out of the labor market. It is...

Read More »Great Graphic: US and Japan Five-Year Credit Default Swaps

Summary: For the first time since the financial crisis, the 5-year CDS on JGBs is dipping below the 5-year US CDS. It appears to be more a function of a decline in Japan’s CDS than a rise in the US CDS. We are reluctant to read too much into the small price changes in the mostly illiquid instruments. This Great Graphic was created on Bloomberg and depicts Japan and US 5-year credit default swap indicative...

Read More »The Future of Globalization

(draft of monthly column for a Chinese paper) The cross-border movement of goods, services, and capital increased markedly for the thirty years up to the Great Financial Crisis. Although the recovery has given way to a new economic expansion in the major economies, global trade and capital flows remain well below pre-crisis levels. It had given rise to a sense globalization is ending. The election of Donald Trump as...

Read More »Donald Trump’s Trade Policy Options

So far, there has been little clarity as to which specific trade policies the new president will introduce, but given how high trade ranks on his agenda, this will likely change quickly. But what actual powers does a US president have in the area of trade, and what measures might Mr. Trump implement?...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org