While a December rate hike is on the cards, comments from the central bank are raising questions about when the Fed will pause its rate-hiking cycle.The Federal Reserve (Fed) has been sending dovish signals in recent days: The previous exuberantly optimistic tone about the US growth has been pared down, as some pockets of data have softened, notably housing.Meanwhile, there is renewed debate about the landing zone of the current monetary tightening. Some Fed members want to change the current ‘auto pilot’ trajectory of one increase per quarter, as short-term rates will soon approach the Fed’s nominal neutral rate level of 3.0%.An increasing number of Fed officials, and perhaps Chairman Powell himself in a recent U-turn, resist going above this 3% threshold.Also playing into this anxiety

Topics:

Thomas Costerg considers the following as important: Macroview, Uncategorized, US Fed hike, US Federal Reserve

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

While a December rate hike is on the cards, comments from the central bank are raising questions about when the Fed will pause its rate-hiking cycle.

The Federal Reserve (Fed) has been sending dovish signals in recent days: The previous exuberantly optimistic tone about the US growth has been pared down, as some pockets of data have softened, notably housing.

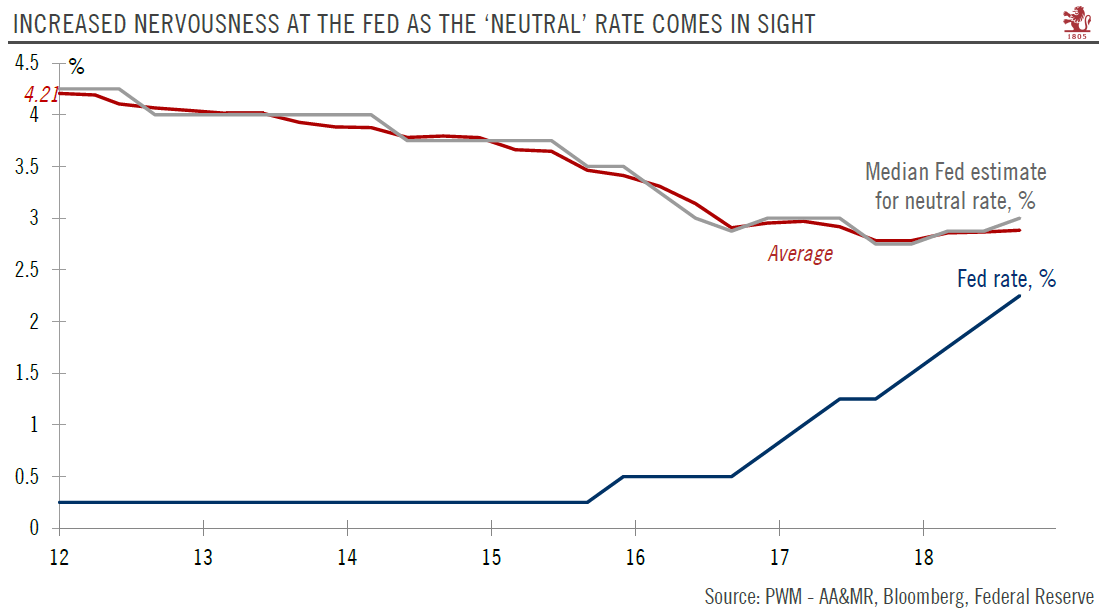

Meanwhile, there is renewed debate about the landing zone of the current monetary tightening. Some Fed members want to change the current ‘auto pilot’ trajectory of one increase per quarter, as short-term rates will soon approach the Fed’s nominal neutral rate level of 3.0%.

An increasing number of Fed officials, and perhaps Chairman Powell himself in a recent U-turn, resist going above this 3% threshold.

Also playing into this anxiety of managing the landing of US monetary policy, and therefore explaining the more cautious tone, are recent equity market jitters and the uneven growth picture globally, particularly in Europe and in China.

We have long been of the view that the US interest-rate cycle, which kicked off in December 2015, would end in 2019. This view still holds. Our scenario calls for three rate hikes next year, although with risks skewed to two rate hikes if recent oil-price weakness continues. This downside risk of two rather than three hikes is now more pronounced given recent dovish Fed signals.

While not our scenario, it is possible that the Fed may change the ‘auto pilot’, and space out the rate hikes to once every three meetings in 2019, in an attempt to engineer a smooth convergence towards the neutral rate. The exact timing of the ‘stop’ may be dictated by financial markets’ behaviour and the economy.

In the short term, a rate hike on 19 December still looks very likely as the economy remains strong.