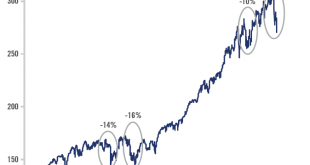

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWhile the recent sell-off might have been overdone in view of fundamentals that remain basically sound, market gyrations and our expectation of further volatility mean we remain neutral equities overall. The current environment favours active management and a tactical allocation approach, exemplified by the partial sale of equity options we acquired to protect portfolios in early...

Read More »US economy continues to chug along, with no slowdown in sight

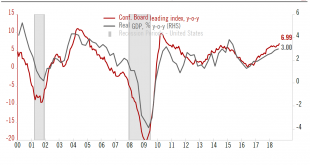

Investment and consumption remain the twin engines of US growth.The first estimate for Q3 GDP (3.5% quarter-on-quarter annualised) confirmed that the US business cycle remains solid. Whereas consumption was stronger than in previous quarters, investment was softer than in Q3—but the underlying story is that solid investment continues to support US growth.This data confirms our annual GDP forecast of 3.0%. This remains above the post-financial crisis average growth rate of 2.3%, and above the...

Read More »Rewarding excellence

IMD and Pictet join forces to celebrate and reward leading family enterprises.IMD Lausanne is a world-leading business school based in the Lausanne region. Its Global Family Business Centre, which has operated for more than 30 years, was the first institute to focus on family businesses, their values, the principles they champion and their particular characteristics.In October 2018, Pictet joined forces with IMD to the IMD Global Family Business Award, a prestigious annual prize presented to...

Read More »In surprise move, Central Bank of Hungary announces 10-fold jump in its gold reserves

In one of the most profound developments in the central bank gold market for a long time, the Hungarian National Bank, Hungary’s central bank, has just announced a 10 fold jump in its monetary gold holdings. The central bank, known as Magyar Nemzeti Bank (MNB) in Hungarian, made the announcement in Budapest, Hungary’s capital. The details of Hungary’s dramatic new gold purchase are as follows: Before this month,...

Read More »Hurricane aside, US job market is still very solid

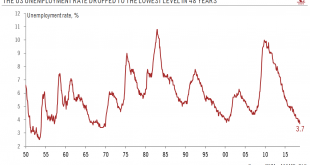

US unemployment rate drops to lowest level in 48 years.Setting aside the impact of the hurricane that hit the Carolinas (and also the headline payroll reading as a result), the US jobs market remains in very good shape. Today’s data showed the unemployment rate dropped to its lowest level in 48 years in September (3.7%).Importantly, the nonfarm payrolls reportshowed strong employment gains in September, consistent with the view that GDP growth is remaining firm in the second half of the...

Read More »LBMA Clearing and Vaulting data reveal the absurdity of the London ‘Gold’ Market

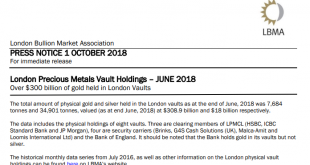

The first day of each month sees the reporting of a number of statistics about the London Gold Market by the bullion bank led London Bullion Market Association (LBMA). These statistics focus on clearing data and vault holdings data and are reported in a 1 month lag basis for clearing activity and a 3 month lag basis for vault holdings data. Therefore the latest clearing data just published is for the month of August,...

Read More »As Emerging Market Currencies Collapse, Gold is being Mobilized

In recent weeks, global financial markets have been increasingly spooked by an intensifying crisis in emerging market currencies including those of Turkey and Argentina. Add to this the ongoing currency crisis in Venezuela and the currency problems of Iran. While all of these countries have economy specific reasons that explain at least some of their currency weakness, there are some common themes such as a stronger US...

Read More »Annual Mine Supply of Gold: Does it Matter?

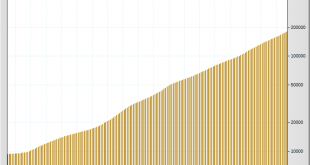

The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and...

Read More »Spotlight on the HUI and XAU Gold Stock Indexes

Probably the two best known gold mining stock indexes in the world’s financial markets are the HUI and the XAU. HUI is the ticker symbol for the NYSE Arca Gold BUGS Index. XAU is the ticker symbol for the Philadelphia Gold and Silver Index. Both of these monikers make an appearance on many gold related websites and many general financial market websites as well, so its worth knowing briefly what these indexes are and...

Read More »Chinese Gold Market: Still in the Driving Seat

With the first half of 2018 now behind us, it’s an opportune time to look at whats been happening in the Chinese Gold Market. As a reminder, China is the largest gold producer in the world, the largest gold importer in the world, and China’s Shanghai Gold Exchange is the largest physical gold exchange in the world. For various reasons such as cross-border trade rules, VAT rules and deep liquidity, nearly all physical...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org