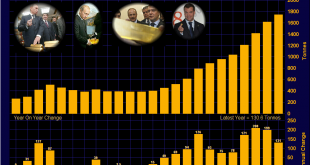

– Gold prices rise to $1,326/oz on concerns China may slow U.S. Treasury buying – Equities fell sharply on the report as did Treasurys and the U.S. dollar – Chinese officials think U.S. debt is becoming less attractive compared to other assets – Trade tensions could provide a reason to slow down or halt U.S. debt purchases – U.S. dollar vulnerable as China remains biggest buyer of U.S. sovereign debt – Currency wars to...

Read More »10 Reasons Why You Should Add To Your Gold Holdings

10 Reasons Why You Should Add To Your Gold Holdings – Gold currently undervalued– Since 2000, the gold price has beaten the S&P 500 Index– A ‘a once-in-a-decade opportunity’ as gold-to-S&P 500 ratio is at its lowest point in 10 years.– Reached ‘peak gold’ as exploration budgets continue to tighten– $80 trillion sits in global equities, a ‘ticking time bomb’ – Gold remains an appealing diversifier in the current...

Read More »Russia, China and BRICS: A New Gold Trading Network

One of the most notable events in Russia’s precious metals market calendar is the annual “Russian Bullion Market” conference. Formerly known as the Russian Bullion Awards, this conference, now in its 10th year, took place this year on Friday 24 November in Moscow. Among the speakers lined up, the most notable inclusion was probably Sergey Shvetsov, First Deputy Chairman of Russia’s central bank, the Bank of Russia. In...

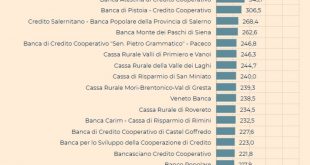

Read More »Bailins Coming In EU – 114 Italian Banks Have Non Performing Loans Exceeding Tangible Assets

Bailins Coming In EU – 114 Italian Banks Have NP Loans Exceeding Tangible Assets – Italy opposes ECB proposal that holds banks to firm deadlines for writing down bad loans – Italy’s banks weighed down under €318bn of bad loans – New ECB rules could ‘derail’ any recovery in Italy’s financial system – Draft proposal requires banks to provision fully for loans that turn sour from 2018 – ECB insists banks have better...

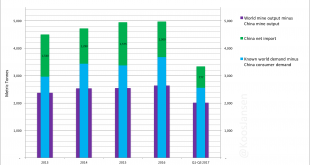

Read More »China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day. The Chinese appear to be price sensitive regarding gold, as was mentioned in the most recent World Gold Council Demand Trends report, and can also be...

Read More »ARD und ZDF könnten bald ganz anders aussehen

Von Carlos A. Gebauer, Rechtsanwalt und Fachanwalt für Medizinrecht. Man kann die Geschichte des öffentlich-rechtlichen Rundfunks in Deutschland auf zweierlei Art erzählen. Misanthropen sehen ihn als Fortsetzung der staatlichen Zensur, deren Zeilenschwärzer und Bücherbeschlagnahmer vor den Radiowellen kapitulierten und also das Medium selbst besetzten. Philanthropen beschreiben ihn als den Versuch, seriös und ausgewogen das Wahre, Gute...

Read More »Neck and Neck: Russian and Chinese Official Gold Reserves

Official gold reserve updates from the Russian and Chinese central banks are probably one of the more closely watched metrics in the gold world. After the US, Germany, Italy and France, the sovereign gold holdings of China and Russia are the world’s 5th and 6th largest. And with the gold reserves ‘official figures’ of the US, Germany, Italy and France being essentially static, the only numbers worth watching are those...

Read More »The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece...

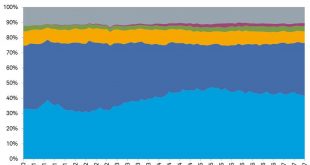

Read More »The West lost at least another 1000 tonnes of large gold bars in 2015

Over the last number of years, one of the most interesting trends in the physical gold world is the ongoing conversion of large 400 ounce gold bars into smaller high purity 1 kilogram gold bars to meet the insatiable demand of Asian gold markets such as China and India. This transformation of 400 ounce bars into 1 kilogram bars is an established fact and is irrefutable given the large amount of evidence which proves it...

Read More »Estimated Chinese Gold Reserves Surpass 20,000t

My best estimate as of June 2017 with respect to total above ground gold reserves within the Chinese domestic market is 20,193 tonnes. The majority of these reserves are held by the citizenry, an estimated 16,193 tonnes; the residual 4,000 tonnes, which is a speculative yet conservative estimate, is held by the Chinese central bank the People’s Bank of China. I’m aware I’ve been absent from writing about the Chinese...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org