Investment and consumption remain the twin engines of US growth.The first estimate for Q3 GDP (3.5% quarter-on-quarter annualised) confirmed that the US business cycle remains solid. Whereas consumption was stronger than in previous quarters, investment was softer than in Q3—but the underlying story is that solid investment continues to support US growth.This data confirms our annual GDP forecast of 3.0%. This remains above the post-financial crisis average growth rate of 2.3%, and above the US’s “potential” growth rate that the Federal Reserve currently sees at 1.8%. Consumption was a particularly strong spot in Q3, rising 4% quarter on quarter (q-o-q), while investment growth (which had grown robustly in the first half of the year) moderated to 0.8%.Housing was a point of weakness

Topics:

Thomas Costerg considers the following as important: Macroview, Uncategorized, US growth, us job creation, US job market

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Investment and consumption remain the twin engines of US growth.

The first estimate for Q3 GDP (3.5% quarter-on-quarter annualised) confirmed that the US business cycle remains solid. Whereas consumption was stronger than in previous quarters, investment was softer than in Q3—but the underlying story is that solid investment continues to support US growth.

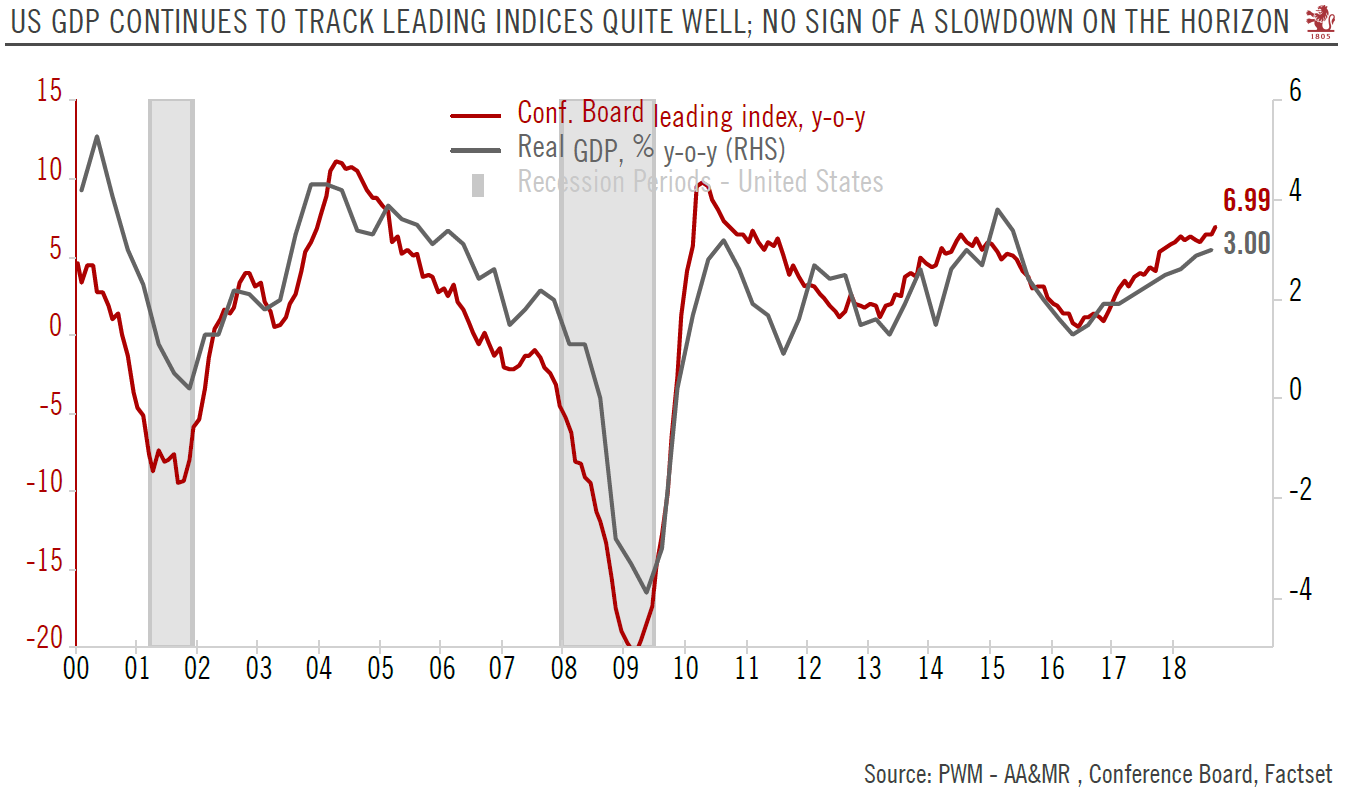

This data confirms our annual GDP forecast of 3.0%. This remains above the post-financial crisis average growth rate of 2.3%, and above the US’s “potential” growth rate that the Federal Reserve currently sees at 1.8%. Consumption was a particularly strong spot in Q3, rising 4% quarter on quarter (q-o-q), while investment growth (which had grown robustly in the first half of the year) moderated to 0.8%.

Housing was a point of weakness (-4%q-o-q), reflecting the recent rise in mortgage rates, but we think this simply reflects digestion of higher mortgage rates and is unlikely to put the US business cycle in danger. At this stage, we think Q4 growth could exceed 3.5%, a view underpinned by recent solid business surveys, such as the Conference Board Leading Economic Index. Most other economic indicators continue to flash green for growth in the coming months. Labour market data particularly validates this view, as job openings rose to a record high in August, suggesting employment growth should remain firm in Q4.

The Fed is likely to welcome the initial 3Q GDP reading, and could well announce an additional rate hike in December, providing payrolls remain as strong as anticipated in our core scenario. We still expect three further quarter-point rate hikes in 2019, in line with the Fed’s “dot plot”.