Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWhile the recent sell-off might have been overdone in view of fundamentals that remain basically sound, market gyrations and our expectation of further volatility mean we remain neutral equities overall. The current environment favours active management and a tactical allocation approach, exemplified by the partial sale of equity options we acquired to protect portfolios in early October.While markets attempt to find their footing, we are keeping plenty of dry powder to exploit opportunities as they arise. Tactically, we have moved from an overweight to neutral position in sterling and from neutral to undeweight on euro high yield.While we are still underweight core government bonds,

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy, Uncategorized

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationWhile the recent sell-off might have been overdone in view of fundamentals that remain basically sound, market gyrations and our expectation of further volatility mean we remain neutral equities overall. The current environment favours active management and a tactical allocation approach, exemplified by the partial sale of equity options we acquired to protect portfolios in early October.While markets attempt to find their footing, we are keeping plenty of dry powder to exploit opportunities as they arise. Tactically, we have moved from an overweight to neutral position in sterling and from neutral to undeweight on euro high yield.While we are still underweight core government bonds,

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Pictet Wealth Management's latest positioning across asset classes and investment themes.

- While the recent sell-off might have been overdone in view of fundamentals that remain basically sound, market gyrations and our expectation of further volatility mean we remain neutral equities overall. The current environment favours active management and a tactical allocation approach, exemplified by the partial sale of equity options we acquired to protect portfolios in early October.

- While markets attempt to find their footing, we are keeping plenty of dry powder to exploit opportunities as they arise. Tactically, we have moved from an overweight to neutral position in sterling and from neutral to undeweight on euro high yield.

- While we are still underweight core government bonds, in which we favour short duration, we remain positive on alternatives in general, including private equity and real estate vehicles. We have become tactically neutral on REITs instead of underweight.

Commodities, precious metals

- In spite of the recent fallback in prices, a further spike in oil prices during the winter cannot be excluded. However, oil supplyshould prove abundant as time progresses and we believe prices could revert to their long-term equilibrium price of USD72 per barrel for Brent by end-2019.

- The stock market decline revived interest in gold during October. A strong dollar and the rise in real US rates remain a drag on gold in US dollar terms, but continued volatility on financial markets could prove a boon, especially if dollar strength abates, as we think it will.

Equities

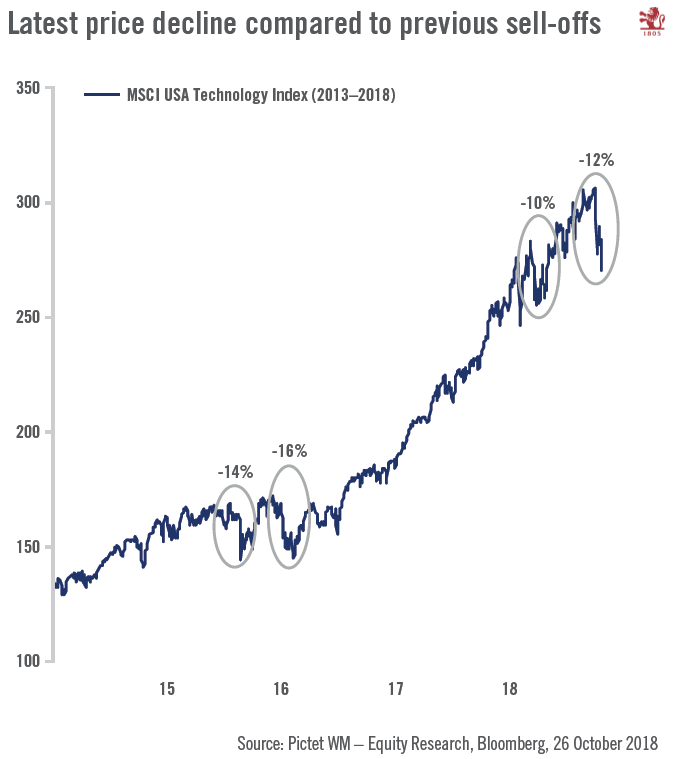

- The sell-off in October brought equity valuations back to levels last seen in 2015-2016. But earnings momentum has deteriorated, making us cautious and equity portfolio protections remain in place.

- Tech-related stocks suffered more than the overall market in the recent sell-off. Some Q3 earnings reports were disappointing and a number of high-profile names provided lacklustre guidance. We ourselves do not believe the tech sector’s fundamentals have changed much, but its attractiveness relative to the risk-free rate of return is declining.

- The European capital goods sector fared poorly in October. Trends in new orders give grounds for concerns.

- We expect volatility around Italian bonds to continue amid tense government budget negotiations. Although contagion has been noticeable by its absence, we remain underweight euro area peripheral debt in general.

- The sell-off in equities in October put high-yield credit spreads under pressure—but US high yield has proved more resilient than its European counterpart, explaining why we are neutral on the former but have turned underweight on the latter.

Alternatives

- Some hedge fund strategies have started to perk up as market volatility has increased. The previous dichotomy between managers long in equities and those with a bearish equity view is currently being resolved in favour of the latter. Managers of Arbitrage and Global Macro strategies continue to position accordingly.