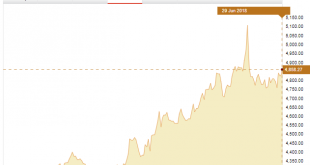

With the first half of 2018 now drawn to a close, much of the financial medias’ headlines and commentary relating to the gold market has been focusing on the fact that the US dollar gold price has moved lower year-to-date. Specifically, from a US dollar price of $1302.50 at close on 31 December 2017, the price of gold in US dollar terms has slipped by approximately 3.8% over the last six months to around $1252.50, a...

Read More »Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘. The Sovereign Money referendum...

Read More »Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey....

Read More »Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

On 29 January 2018, the Commodity Futures Trading Commission (CFTC) Division of Enforcement together with the Criminal Division of the US Department of Justice and the FBI announced criminal and civil enforcement actions against 3 global investment banks and 5 traders for involvement in trade spoofing in precious metals futures contracts on the US-based Commodity Exchange (COMEX). COMEX is by far the largest and most...

Read More »US Gold & Silver Futures Markets: “Easy” Targets

Following news coverage of the charging of five precious metals traders and three banks in January, Commodities Futures Trading Commission and Department of Justice documents reveal a global criminal cabal of 16 traders operating in at least four major financial institutions between 2008 and 2015 to defraud COMEX gold and silver futures markets. Of the many examples published, one reveals a UBS AG precious metals...

Read More »China’s Secret Gold Supplier Is Singapore

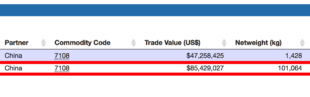

Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future. Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking...

Read More »Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here...

Read More »Why the World’s Central Banks hold Gold – In their Own Words

Collectively, the central bank sector claims to hold the world’s largest above ground gold bar stockpile, some 33,800 tonnes of gold bars. Individually within this group, some central banks claim to be the top holders of gold bullion in the world, with individual holdings in the thousands of tonnes range. This worldwide central bank group, also known as the official sector, spans central banks (such as the Deutsche...

Read More »Fed update-Jerome Powell’s testimony to Congress

The Fed remains upbeat on growth and its members may be tempted to raise their rate expectations.Fed Chair Jerome Powell highlighted continuity with Janet Yellen’s monetary policy in his testimony before Congress today.He highlighted “positive developments” since the December meeting. This could be a hint that an additional rate hike could be in the pipeline (The Fed indicated three rate hikes in the December dot plot).Reading between the lines, it remains clear that the Powell Fed will not...

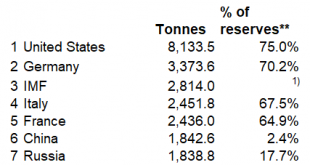

Read More »US Gold Reserves, Of Immense Interest to Russia and China

Recently, Russian television network RT extensively quoted me in a series of articles about the US Government’s gold reserves. The RT articles, published on the RT.com website, were based on a series of questions RT put to me about various aspects of the official US gold reserves. These gold reserves are held by the US Treasury, mostly in the custody of the US Mint. The US Mint is a branch of the US Treasury. The first...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org