The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and subsequently diminishes). The concern about remaining extractable gold is based on the fact that annual gold mining production is running at over 3200 tonnes per annum (e.g. 3247 tonnes in 2017 according to GFMS), while various metal and geological consultancy estimates put the amount of remaining extractable

Topics:

Ronan Manly considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, above ground gold, above-ground stocks, China, Featured, gold demand, gold flows, gold price, gold reserves, gold resources, gold supply, newsletter, portfolio diversification, reserves and resources, Ronan Manly (Bullionstar), Russia, Safe-haven, store of value, Uncategorized, United States Geological Survey, USGS, World Gold Council

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and subsequently diminishes).

| The concern about remaining extractable gold is based on the fact that annual gold mining production is running at over 3200 tonnes per annum (e.g. 3247 tonnes in 2017 according to GFMS), while various metal and geological consultancy estimates put the amount of remaining extractable gold reserves worldwide in the region of 55,000 tonnes. In other words, at current rates of extraction, according to these estimates, known gold reserves worldwide would be depleted in about 17 years.

For example, the USGS estimates that there are approximately 54,000 tonnes of economically extractable gold reserves in the world, while consultancy Metals Focus in its annual ‘Gold Focus‘ report estimated recently that there are about 57,000 tonnes of in-ground gold mineral reserves remaining worldwide. Given that about 192,000 tonnes of gold have been mined throughout history (according to the World Gold Council), with about half of that mined gold extracted in the last 50 years, the figures of remaining gold reserves could look quite low and potentially worrying. But should we be worried, and more fundamentally does annual gold supply really matter all that much? |

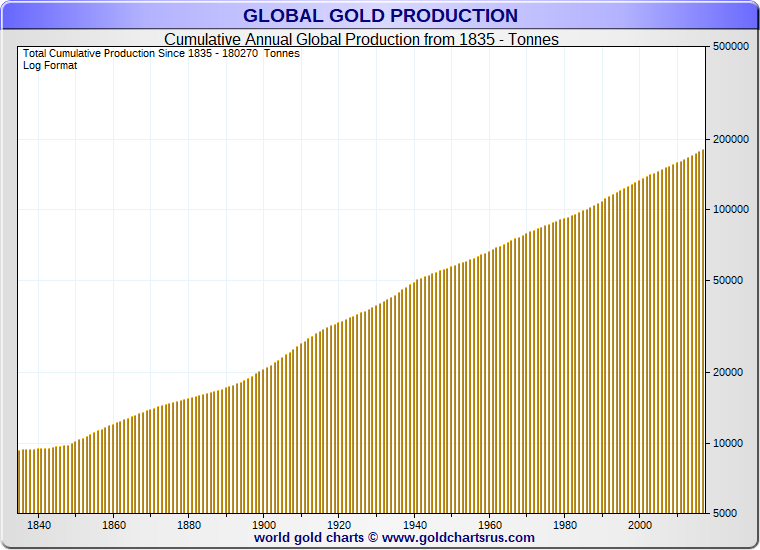

Cumulative Global Gold Production: 1835 to present day. Source: goldchartsrus.com - Click to enlarge |

Estimated Reserves are Not the Full Picture

While published estimates of remaining gold reserves are in the ballpark of 55,000 tonnes, reserves are not the full picture, and other factors indicate that there is a lot more mineable gold left in the world than reserves estimates would suggest. Firstly, the definitions of reserves and resources have to be taken into account.

As the USGS explains in its Reserves and Resources definitions:

“Reserves data are dynamic. They may be reduced as ore is mined and/or the feasibility of extraction diminishes, or more commonly, they may continue to increase as additional deposits (known or recently discovered) are developed, or currently exploited deposits are more thoroughly explored, and (or) new technology or economic variables improve their economic feasibility.”

Reserves, according to USGS, are the “working inventory of mining companies’ supplies of an economically extractable mineral commodity“. This inventory is limited by many factors including extraction and operating costs, as well as “the price of the mineral commodity being mined, and the demand for it.”

Future supplies, say USGS, “will come from reserves and other identified resources“ as well as from “currently undiscovered resources in deposits that will be discovered in the future“. This latter category, the undiscovered mineral deposits, “constitute an important consideration in assessing future supplies” says USGS. Therefore, the USGS reserves figure (economically extractable gold) can be augmented by identifiable resources (resources potentially feasible to extract) as well as undiscovered resources (postulated to be in mineral deposits).

The Metals Focus “Gold Focus 2017” report puts some numbers on these differences. While Metals Focus estimate that at the end of 2016 global gold mineral reserves totalled 57,300 tonnes, they think that there is “an additional 110,000 tonnes of gold in the resource category“.

And for example, while the largest 50 gold mines in the Metals Focus tracking database (responsible for over 25% of global mine supply) have on average just over 11 years of reserve mine life remaining, “these mines also have an additional 11 years of mineral resources (exclusive of reserves), which have the potential to be recategorised into reserves.”

But even in the published reserves data from USGS, reserve estimates appear to be underestimated and USGS gold reserves data at times looks more static than ‘dynamic’. Drilling down into the USGS estimate of 54,000 tonnes of gold reserves globally, only 2000 tonnes of this total is attributed to the world’s top gold producer China. However, China stated at the end of 2016 that it had a much larger 12,100 tonnes of identified in-ground gold reserves.

Likewise, the USGS estimates only attribute 5,500 tonnes of unmined gold reserves to the third largest gold producer Russia, whereas the Russian Federation says that it has 12,500 tonnes of identified gold reserves. So even within these two major gold producing countries, China and Russia, that’s another 17,000 tonnes of identified gold reserves that the USGS does not reflect in its gold reserves total. Different data methodologies perhaps for defining gold reserves and gold resources, but these deltas highlight an important point that when it comes to mineable gold, there is no one consensus figure.

Technological advances in gold mining and processing can also over time change identifiable resources (resources potentially feasible to extract) into reserves, and turn undiscovered resources (theroized to be in mineral deposits) into identifiable resources. These advances and discoveries therefore increase the pool of gold reserves over time. Likewise, some gold deposits which are uneconomic to mine at gold price X will become economically viable to mine at a higher gold price of Y.

Stock vs Flow: The Key to Above-Ground Stocks

Stock vs Flow: The Key to Above-Ground Stocks

But on a more fundamental level, do the short-term gyrations in annual gold supply really matter that much? Specialist gold consultancies such as GFMS and Metals Focus which regularly crunch annual gold mining figures would argue yes, but their fixation on annual gold supply downplays the fact that there are huge above-ground stocks of gold which have an influence on everything from gold’s investment characteristics (e.g. store of value, portfolio diversifier and safe haven) to movements in the gold price, and to the shifting direction of gold flows between east and west.

Almost all of the gold ever mined throughout history still exists in these above-ground gold stocks, be it in the form of gold jewelry, central bank gold holdings, gold held in private gold hoards within investment gold bars and coins, and gold that has been used within industrial medical and technological applications. This amounts to about 192,000 tonnes according to the World Gold Council (WGC), or significantly more according to those who dispute the WGC’s figures as being underestimated.

Using WGC figures, this would mean that the annual flow of new gold from mining (about 3100 tonnes), represents only about 1.6% of the total above-ground stocks of gold. Or in other words, the above-ground stocks of gold are about 62 times larger than the annual flow of new gold from gold mining. i.e. the stock-to-flow ratio is very high.

The majority of this above ground gold is held for saving purposes and as a store of wealth (including in the form of gold jewelry), and while much of the gold in above-ground stocks is not traded, it has the potential to be traded, and it can move into the highly liquid worldwide gold market depending on the gold price. Therefore, this far larger pool of gold held in above-ground gold stocks widens the definition of gold supply considerably.

Above-Ground Stocks – A Store of Value

Holding physical gold as a store of value works precisely because there are very large above ground stocks of gold in existence. Unlike other metals which are produced to be consumed (even including silver to some extent), physical gold is a monetary metal because it is rare, tangible, cannot be debased and has no counterparty or default risk. See here for details. Physical gold is also generally produced to be accumulated and to be used as a store of wealth and as an inflation hedge.

This accumulation of gold from the dawn of civilisations to the present day gives us the current very large above ground stocks of gold, a stock which constantly increases but increases at a slow and stable rate relative to the size of the overall stock. Therefore the value of this total above ground stock of gold is relatively stable, and over long periods of time, the purchasing power of this total stock of gold (which cannot be debased) is stable relative to the prices of other goods.

Gold’s purchasing power has also been found to be nearly constant over long periods. See for example the well-known study by Roy Jastram known as ‘The Golden Constant‘, in which he constructed gold price indexes and general price indexes and found that the purchasing power of gold, although it fluctuated, was broadly constant over long periods of time. Jastram’s study was then updated in 2009 by Jill Leyland. As Leyland wrote in an explanation of gold’s constant purchasing power which makes it an ideal store of value:

“the broad supply and demand fundamentals of gold help this stability. Gold is a scarce metal and the annual increase in supply is a small fraction of above-ground stocks. Most gold is held in a form that makes it easy to return to the market if economic circumstances dictate, thus helping to stabilise price fluctuations.”

Therefore, gold’s ability to act as store of value and as a form of wealth preservation is directly related to gold’s very large and stable above ground stocks. The presence of very large above-ground gold stocks also partially explains gold’s safe haven appeal. One aspect of why gold acts is a safe haven is that it does not have any counterparty or default risk. But there is also an understanding that in times of crisis the physical gold market will remain highly liquid, a liquidity which again is due to the ability of the extensive above ground stock of gold to be mobilised.

Gold is Less Affected by Economic Activity

The existence of very large above-ground gold stocks also drives gold’s ability to provide diversification benefits, for example, holding gold in a wider investment portfolio of other assets such as stocks and bonds is a proven way to reduce portfolio risk. This is so because of the low correlation of the gold price with the prices of these other assets which in turn is because the gold price is far less influenced by business and macro economic cycles than other assets. But why is the gold price less influenced by business and macro economic cycles than other assets?

The answer again lies in gold’s huge above ground stocks, and the highly liquid worldwide gold market that allows these gold stocks to move into the market should conditions merit it. Gold demand can therefore be met, not just from new mine supply which is correlated to business cycles, but from any of the gold that exists in gold’s extensive above-ground stocks.

As a World Gold Council paper from 2003 titled “Why is gold different from other assets?” states:

“The lack of correlation between returns on gold and those on financial assets such as equities has become widely established….the fundamental reason for this lack of correlation is that returns on gold are not correlated to economic activity whereas returns on mainstream financial assets are.

It is thought that the reasons which set gold apart from other commodities stem from three crucial attributes of gold: it is fungible, indestructible and, most importantly, the inventory of above-ground stocks of gold is enormous relative to the supply flow….The potential for gold to be highly liquid and responsive to price changes is seen as its critical difference from other commodities.”

A Wider Definition of Gold Supply

In practice, what do these above ground gold stocks constitute and can they be mobilised? According to the WGC, about 90,000 tonnes of above ground gold is held in the form of gold jewellery, another 33,000 tonnes of gold are (reportedly) held by central banks, about 40,000 tonnes are attributed to private gold holders, and the remainder sits within end uses where it has been applied in industrial / technological and other fabrication uses.

In theory, all above-gound gold can be mobilised into the gold market as forms of potential supply if the price is right. In practice, all the major categories of gold holdings are served by functioning markets which allows their mobilisation. For example in India, where between 20,000 and 25,000 tonnes of gold are held by private citizens, the gold market provides a mechanism for the accumulation or sale of investment gold jewelry depending on fluctuating incomes and economic conditions. In China, where at least 17,000 tonnes of gold is held by private citizens, the gold market is served by a central physical gold exchange (the Shanghai Gold Exchange) and large networks of gold jewelery and investment gold retail outlets.

The ability to mobilise gold from the central bank and official sector is served by a functioning gold lending and gold swapping market centred in London. Admittedly, that gold lending market is so opaque due to secrecy and lack of reporting that its impossible to know how much or how little gold is actually in the possession of central banks and how much has been lent out and not returned. But overall, there is gold lent out from central bank holdings that flows into the market and is very distinct from any supply categories tracked by the major precious metals consultancies.

Many national gold markets exist around the world also exist which provide their citizens with the ability to buy and sell physical gold and which provide the necessary liquidity with which private gold holdings can be mobilised into the market. For example, see BullionStar’s Gold University for profiles of over 20 of these gold markets. Due to gold’s high value, a well-functioning scrap gold and gold recycling sector also exists around the world, with numerous refineries and processors adept at extracting valuable gold content from every end use product which contains gold bearing material.

Gold from countries that would normally be net buyers on the international market can also be turn into net gold suppliers when the need arises, in other words flows of gold from West to East can and do sometimes switch to flows going the other way from East to West. This, for example happened in 2016 when non-monetary gold flowed westwards to Switzerland from countries such as UAE, Hong Kong and Thailand (markets that are normally considered large destinations for Swiss gold) and this gold was then exported from Switzerland to mainly the UK but also the US.

There is a relative fixation in the gold industry on new gold mining supply and the impact that this has on the gold market. But beyond annual gold mining output, its important to remember that the world’s above-ground gold stocks, some 190,000 tonnes based on official figures, can and do come into play as supply sources if and when conditions merit this.

Most importantly, these vast above-ground stocks underpin some of physical gold’s most important investment characteristics, such as gold’s ability to act as a stable store of value and gold’s ability to reduce risk in investment portfolios.

Tags: above ground gold,above-ground stocks,China,Featured,gold demand,gold flows,gold price,gold reserves,gold resources,gold supply,newsletter,portfolio diversification,reserves and resources,Russia,Safe-haven,store of value,Uncategorized,United States Geological Survey,USGS,World Gold Council