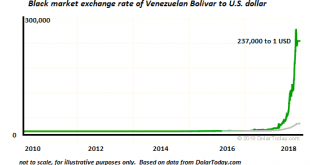

If a currency can’t be converted on demand into the underlying commodity, it’s not “backed by oil,” it’s just another form of control fraud. The broke and broken country of Venezuela appears to be the first nation-state to issue a cryptocurrency token (the petro) as a means of escaping the financial black hole that’s consuming its economy: Maduro Launches Oil-Backed Crypto “For The Welfare Of Venezuela”. For context,...

Read More »The End of (Artificial) Stability

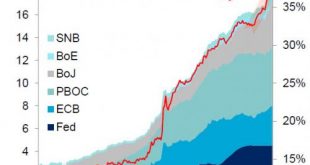

The central banks’/states’ power to maintain a permanent bull market in stocks and bonds is eroding. There is nothing natural about the stability of the past 9 years. The bullish trends in risk assets are artificial constructs of central bank/state policies. As these policies are reduced or lose their effectiveness, the era of artificial stability is coming to a close. The 9-year run of Bull-trend stability is ending as...

Read More »Our Approaching Winter of Discontent

The tragedy is so few act when the collapse is predictably inevitable, but not yet manifesting in daily life. That chill you feel in the financial weather presages an unprecedented–and for most people, unexpectedly severe–winter of discontent. Rather than sugarcoat what’s coming, let’s speak plainly for a change: none of the promises that have been made to you will be kept. This includes explicit promises to provide...

Read More »US IP On The Other Side of Harvey and Irma

Industrial Production in the US was revised to a lower level for December 2017, and then was slightly lower still in the first estimates for January 2018. Year-over-year, IP was up 3.7%. However, more than two-thirds of the gain was registered in September, October, and November (and nearly all the rest in just the single month of April 2017). US Industrial Production, Jan 1995 - 2018(see more posts on U.S. Industrial...

Read More »What Just Changed?

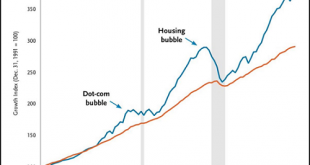

The illusion that risk can be limited delivered three asset bubbles in less than 20 years. Has anything actually changed in the past two weeks? The conventional bullish answer is no, nothing’s changed; the global economy is growing virtually everywhere, inflation is near-zero, credit is abundant, commodities will remain cheap for the foreseeable future, assets are not in bubbles, and the global financial system is in a...

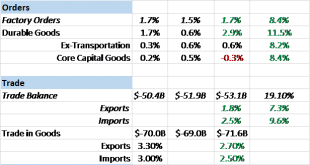

Read More »Bi-Weekly Economic Review

Economic Reports Economic Growth & Income Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion. Two items in this...

Read More »Three Crazy Things We Now Accept as “Normal”

How can central banks “retrain” participants while maintaining their extreme policies of stimulus? Human habituate very easily to new circumstances, even extreme ones. What we accept as “normal” now may have been considered bizarre, extreme or unstable a few short years ago. Three economic examples come to mind: 1. Near-zero interest rates. If someone had announced to a room of economists and financial journalists in...

Read More »Before You “Buy the Dip,” Look at This One Chart

Hello reverse wealth effect. There’s a place for fancy technical interpretations, but sometimes a basic chart tells us quite a lot. Here is a basic chart of the Dow Jones Industrial Average, the DJIA. It displays basic information: price candlesticks, volume, the 50-week and 200-week moving averages, RSI (relative strength), MACD (moving average convergence-divergence), stochastics and the MACD histogram. These kinds...

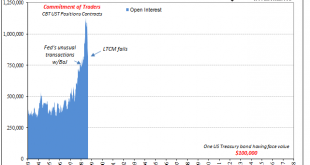

Read More »COT Blue: Interest In Open Interest

For me, the defining characteristic of the late nineties wasn’t the dot-coms. Most people were exposed to the NASDAQ because, frankly, at the time there was no getting away from it. It had seeped into everything, transforming from a financial niche bleeding eventually into the entire worldwide culture. We all remember the grocery clerks who became day traders. Behind all that was some darker evolutions. It was a period...

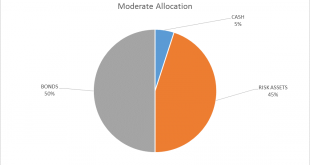

Read More »Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org