The dramatic declines in the costs of oil production will be boosting supply at the very moment that demand is falling. Over the past decade I’ve addressed what I call Head-Fakes in the cost of oil/fossil fuel: even though we know the cost of extracting and processing oil will rise over time as the easy-to-get oil is depleted, oil occasionally plummets to such low prices that we’re fooled into thinking it will remain...

Read More »U.S. Treasuries: Not Really Wrong On Bonds

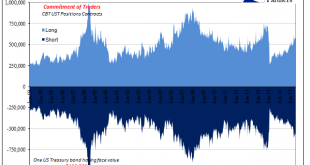

It is often said that the market for US Treasuries is the deepest and most liquid in the world. While that’s true, we have to be careful about what it is we are talking about. There is no single US Treasury market, and often differences can be striking. The most prominent example was, of course, October 15, 2014. In truth, the liquidity side of cash market UST’s has been diminished since around 2013. Largely as a...

Read More »Why We’re So Risk-Averse: “We Can’t Take That Chance”

If our faith in the future and our resilience is near-zero, then we can’t take any chances. You’ve probably noticed how risk-averse Hollywood has become: the big summer movies are all extensions of existing franchises–mixing up the superheroes in new combinations, or remaking hit films from the past–all safe bets. The trend to “playing it safe” is not limited to Hollywood:–we see risk aversion in every sphere of the...

Read More »Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook. On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his...

Read More »Bi-Weekly Economic Review: Extending The Cycle

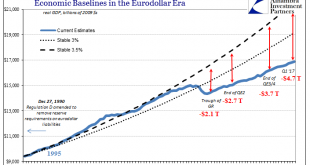

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

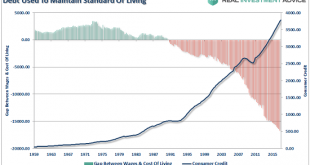

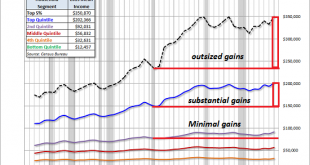

Read More »The Two Charts That Dictate the Future of the Economy

If you study these charts closely, you can only conclude that the US economy is doomed to secular stagnation and never-ending recession. The stock market, bond yields and statistical measures of the economy can be gamed, manipulated and massaged by authorities, but the real economy cannot. This is espcially true for the core drivers of the economy, real (adjusted for inflation) household income and real disposable...

Read More »U.S. Consumer Price Index, Oil Prices: Why It Will Continue, Again Continued

Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing...

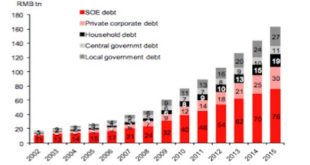

Read More »There Is Only One Empire: Finance

Any nation-state that meets these four requirements is fully exposed to a global loss of faith in its economy, debt, balance of payments and currency. There’s an entire sub-industry in journalism devoted to the idea that China is poised to replace the U.S. as the “global empire” / hegemon. This notion of global empire being something like a baton that gets passed from nation-state to nation-state is seriously...

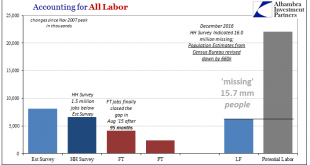

Read More »Reports on a Quarterly Survey Conducted: Qualifying Shortage (Labor)

There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is...

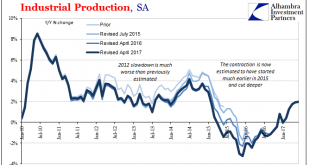

Read More »U.S. Industrial Production: Industrial Drag

Completing a busy day of US economic data, Industrial Production was, like retail sales and inflation data, highly disappointing. Prior months were revised slightly lower, leaving IP year-over-year up just 2% in June 2017 (estimates for May were initially 2.2%). Revisions included, the annual growth rate has been stuck around 2% now for three months in a row, suggesting like those other accounts a pause or even...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org