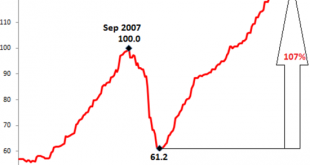

A funny thing happened on the way to a low-risk environment: loans in default (non-performing loans) didn’t suddenly become performing loans. If we had to summarize what’s happened in eight years of “recovery,” we could start with this: everyone’s been pushed into risky assets while being told risk has been transformed from something to avoid (by buying risk-off assets) to something you chase to score essentially...

Read More »Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them. At Janet...

Read More »Bi-Weekly Economic Review

Economic Reports Scorecard The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed. More...

Read More »Earnings Update – A Poor Sort of Memory

“I don’t understand you,’ said Alice. ‘It’s dreadfully confusing!’ ‘That’s the effect of living backwards,’ the Queen said kindly: ‘it always makes one a little giddy at first–‘ ‘Living backwards!’ Alice repeated in great astonishment. ‘I never heard of such a thing!’ ‘–but there’s one great advantage in it, that one’s memory works both ways.’ ‘I’m sure mine only works one way,’ Alice remarked. ‘I can’t remember things...

Read More »The Next Domino to Fall: Commercial Real Estate

Unless the Federal Reserve intends to buy up every dead and dying mall in America, this is one crisis that the Fed can’t bail out with a few digital keystrokes. Just as generals prepare to fight the last war, central banks prepare to battle the last financial crisis–which in the present context means a big-bank liquidity meltdown like the one that nearly toppled thr global financial system in 2008-09. Planning to win...

Read More »Do Record Debt And Loan Balances Matter? Not Even Slightly

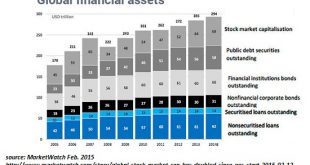

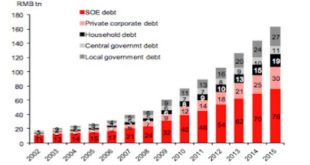

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated...

Read More »Payrolls Still Slowing Into A Third Year

Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued...

Read More »Time, The Biggest Risk

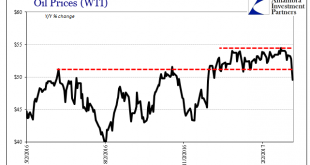

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the...

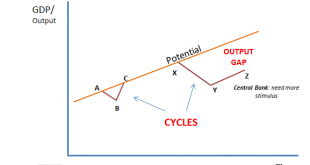

Read More »Are Central Banks Losing Control?

Eight years after the crisis of 2008-09, central banks are still injecting $200 billion a month into the global financial system to keep it from imploding. If you want a central banker to choke on his croissant, read him this quote from socio-historian Immanuel Wallerstein: “Countries (have lost the ability) to control what happens to them in the ongoing life of the modern world-system.” Stated another way, Wallerstein...

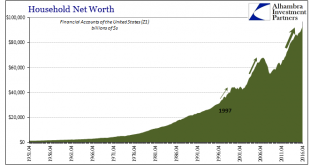

Read More »No Paradox, Economy to Debt to Assets

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression. Weakness might be more easily believed as some overseas problem, leading to only ideas of decoupling or the US as the “cleanest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org