[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Monthly Macro Monitor – October 2018 Special Edition: Markets Under Pressure (VIDEO) Monthly Macro Monitor – September 2018 Monthly Macro Monitor – September Monthly Macro Monitor – August Monthly Macro Monitor – August 2018 Global Asset...

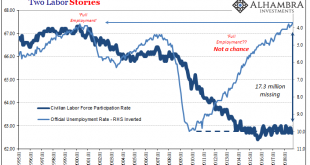

Read More »No Such Thing As An 80 percent Boom

Many attribute the saying “a rising tide lifts all boats” to President John Kennedy. He may have been the man who brought it into the mainstream but as his former speechwriter Ted Sorenson long ago admitted it didn’t originate from his or the President’s imagination. Instead, according to Sorenson, it was a phrase borrowed from the New England Chamber of Commerce or some such. Before implying the benefits of broad...

Read More »Monthly Macro Monitor – October 2018

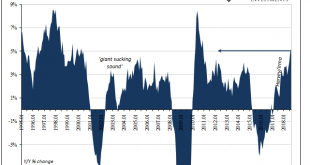

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly. The most common explanation for the pullback in stocks – 6% doesn’t even qualify as a correction – is rising interest rates but I think it is a...

Read More »The Coming Inflation Threat

Falling asset inflation plus rising cost inflation equals stagflation. Inflation is a funny thing: we feel it virtually every day, but we’re told it doesn’t exist—the official inflation rate is around 2.5% over the past few years, a little higher when energy prices are going up and a little lower when energy prices are going down. Historically, 2.5% is about as low as inflation gets in a mass-consumption economy like...

Read More »Mutiny, Class, Authority and Respect

Humiliation and fear of a catastrophic decline in status foment mutiny and rebellion. I recently finished The Bounty: The True Story of the Mutiny on the Bounty, a painstakingly researched history of the mutiny, but with a focus on how the story was shaped by influential families after the fact to save the life of one mutineer, Peter Haywood, and salvage the reputation of the leader, Fletcher Christian, via a carefully...

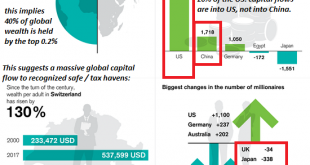

Read More »Is the Greatest Bull Market Ever Finally Ending? (Hint: Follow the Money)

The key here is the gains generated by owning US-denominated assets as the USD appreciates. Is the Greatest Bull Market Ever finally ending? One straightforward approach to is to follow the money, i.e. global capital flows: assets that attract positive global capital flows will continue rising if demand for the assets exceeds supply, and assets that are being liquidated as capital flees the asset class (i.e. negative...

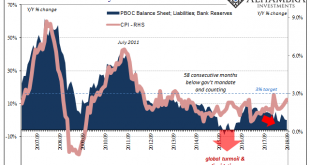

Read More »Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm. The Chinese had a pork problem in...

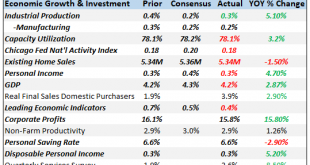

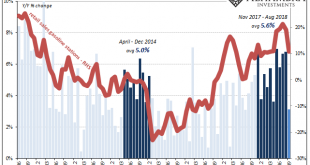

Read More »Just The One More Boom Month For IP

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010. While that may be, over the last five months American...

Read More »Now Back To Our Regularly Scheduled Economy

The clock really was ticking on this so-called economic boom. A product in many economic accounts of Keynesian-type fantasy, the destructive effects of last year’s hurricanes in sharp contrast to this year’s (which haven’t yet registered a direct hit on a major metropolitan area or areas, as was the case with Harvey and Irma) meant both a temporary rebound birthed by rebuilding as well as an expiration date for those...

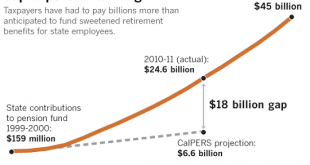

Read More »Here’s Why the Next Recession Will Spiral Into a Depression

Here’s the difference between a recession and a depression: you can’t get blood from a stone, or make an insolvent entity solvent with more debt. There are two basic differences between a recession and a depression: 1. Duration: a recession typically lasts between 6 and 18 months, while a depression drags on for years or even decades, often masked by official propaganda as “slow growth” or “stagnation.” 2. The basic...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org