The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter. United States The Federal Reserve’s meeting on September 18 is the most important calendar event in the week ahead. There is no doubt in the collective wisdom of the market that it will deliver another 25 bp rate cut. There may be dissents in both directions, with one-to-three dissents to keep rates steady and a possible an objection by Bullard to deliver a 50 bp cut. The Federal Reserve will act appropriately, it

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Japan, Brexit, Featured, Federal Reserve, Labor market, newsletter, Norway, Swiss National Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter.

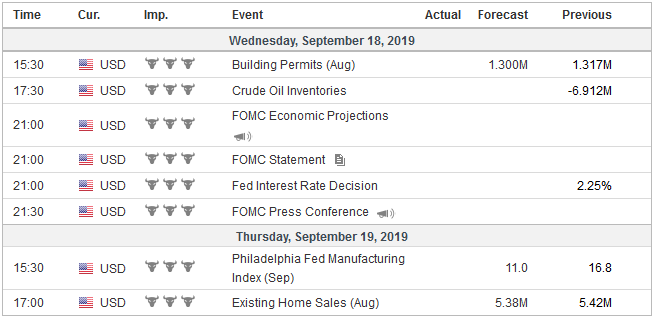

United StatesThe Federal Reserve’s meeting on September 18 is the most important calendar event in the week ahead. There is no doubt in the collective wisdom of the market that it will deliver another 25 bp rate cut. There may be dissents in both directions, with one-to-three dissents to keep rates steady and a possible an objection by Bullard to deliver a 50 bp cut. The Federal Reserve will act appropriately, it says and what is appropriate depends on how the economic impulses and trajectories are understood. Most Fed officials, including Bullard, seem comfortable in Powell’s characterization of a midcourse correction, which in the Fed’s parlance signals three rate cuts (harkening back to Greenspan and mid-1990s). The market had in what would be the third cut in the sequence, and the real debate was over a fourth one. The market waivers depending on various influences, including high-frequency data, and official comments, but probably now presidential tweets. In fact, the implied yield of the January 2020 fed funds futures contract rose to its highest level in a month (~1.67%) at the end of last week, suggesting the was beginning to be questions about the third cut now. The yield rose 14.5 bp last week, as the presidential tweet called US central bank officials “boneheads” for not cutting rates faster or into negative territory. The most important takeaway from the new forecasts will be how close officials are to morphing the rate cuts from midcourse correction to preempting a steeper downturn. The economy appears to be expanding around trend growth here in Q3 (a little below 2%). Job growth has slowed, but the consumer remains vibrant. Core CPI has accelerated, and at 2.4%, year-over-year is the highest in over a decade. That said, the US consumer typically cuts back after the start of a recession, and confidence is elevated before a downturn. An acceleration of inflation is often seen as a late-cycle phenomenon. |

Economic Events: United States, Week September 16 |

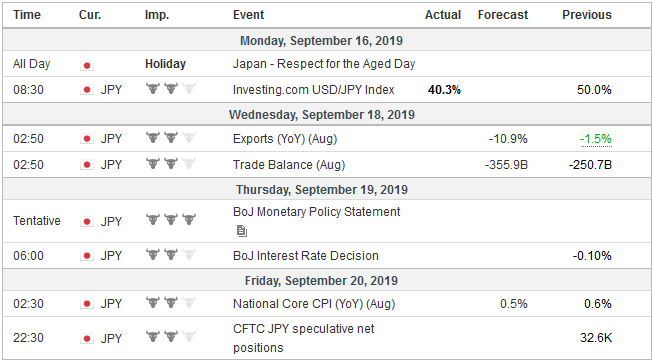

JapanThere are three other major central banks on September 19, the day after the FOMC meeting concludes: The Bank of Japan, the Swiss National Bank, and Norges Bank of Norway. The strength of the Japanese yen, which reached almost a three-year high in late August had put the Bank of Japan in a tough position. However, over the past three weeks, the yen has been the weakest currency in the world, losing 2.5% against the dollar. The yen’s setback, coupled with the higher bond yields may stay the BOJ’s hand until after the impact of the sales tax increase on October 1 is clear. Under yield curve control (YCC), the BOJ targets the 10-year yield in a 20 bp range around zero. There is some tolerance for variance, but it is thought that the BOJ’s pain threshold is around minus 30 bp that was tested in late August and early September. Although the BOJ has made its asset purchases dependent on economic data, i.e., open-ended rather than a calendar point, the yen has been the only major currency to rise against the US dollar since the end of 2017 (4.2%). Indeed, strong currencies usually have low-interest rates (think Japan and Switzerland) while weak currencies must offer higher interest rates to offset the currency risk. |

Economic Events: Japan, Week September 16 |

SwitzerlandThe SNB and the Norgesbank are interesting for different reasons. The issue for the former is about a rate, while the latter is one of the few central banks in a tightening mode. The Swiss National Bank has the lowest policy rate in the world of minus 75 bp, and it has intervened in the foreign exchange market. And still, the Swiss franc rose to two-year highs against the euro in early September. The franc has appreciated by around 2.5% against the euro this year. However, like the BOJ, the SNB will breathe a bit more comfortably as the upside momentum on the currency has been arrested. After bottoming a little above CHF1.08 earlier this month, it was approaching CHF1.10 before the weekend. The currency appears to have bought the SNB some time. |

Economic Events: Switzerland, Week September 16 |

Norway’s central bank raised rates in June for the third time within 12 months. The economy has been lifted by a surge in oil investment. It surged by 0.7% quarter-over-quarter in Q2 after 0.5% growth in Q1. The third quarter appears to have begun off on a strong note. Inflation continues to run above the 2% target (underlying rate), but August the pace was a little softer than expected at 2.1%.

Norway’s deposit rate is at 1.25%. It is in a tightening cycle, but the krone has depreciated by around 3.75% against the dollar this year, making it one of the weakest of the major currencies (behind the Swedish krone’s ~7.9% loss and the New Zealand dollar’s 5.0% decline). The krone’s softness and more looks likely may tilt a close decision to raising rates again.

In addition to these four central banks, a fifth meets, the Bank of England. However, with Brexit looming on the horizon, it is a non-event, and frankly, not particularly of interest to the market. Two other events won’t be on many calendars but still, are important. The first is the UK Supreme Court. It is expected to make a ruling Tuesday on an appeal from the High Court that allowed the suspension to stand. The issue is two-fold. The first is do the courts have the power/authority to rule on such a matter, and second, if it does, was the prorogation legitimate. Both the Scottish court that ruled against the suspension and the UK High Court that defended it acknowledged that there were no applicable legal standards.

It is not exactly clear what is at stake substantively. If the Supreme Court rules, as the Scottish Court did that the intent of the prorogue made its use illegitimate, what happens? The Parliament session will not begin until mid-October. So many politicians with time on their hands sounds like the makings of mischief. More seriously, it is tempting to make it into a constitutional issue about the power of Parliament to check the power of the Prime Minister, and plenty of gigabytes will be devoted to precisely that.

However, such battles, if that is what it is, are rarely decisive and it is that sustained tension that characterizes modern representative governments. The struggle for the Brexit is unlikely to be turned one way or the other by the Supreme Court’s decision. With Operation Yellowjacket, the government’s worst-case estimate of a no-deal Brexit, now in the public space, a new discussion is taking place. Sterling’s appreciation, in part, suggests that the risk of an October 31 exit as currently planned is unlikely. This is consistent with the positioning at PredictIt.Org, which now sees as likely (~75%) that the UK is still in the EU on November 1. It was less than 50% in late August.

The other event, to round out of half dozen of things to watch in the coming days, is a possible strike at General Motors. The current contract expires on September 14 at midnight. The issue is partly over pay. After the company reported record profits and record payouts to shareholders, employees want to have a greater share of the bounty. The issue is also about closing plants and laying off workers rather than assigning new products to under-utilized factories.

A vote by the rank-and-file members gave the union leaders a strong hand to strike (96%). The strike fund has recently been boosted. Some reports have suggested a strike would help rebuild unity after a bribery scandal among in the highest levels of the union of leadership. At the same time, GM seems to have prepared by boosting inventories to 11 weeks, which is more than the industry average of about 61 days, according to Cox Automotive. Digging deeper, GM has 80-days of supply of the high profit-margin trucks and SUVs and only 56 days of average sales of their lower-selling models.

A strike would be the first in the industry since 2007. That strike lasted two days. Some accounts suggest the employees have been emboldened by President Trump’s criticism of US companies offshoring in general and the auto sector in particular. That would seem to imply scope for greater labor-management tensions may lay ahead, with a potential new risk to the inflation outlook.

We are somewhat skeptical. But, it may be a useful reminder of the argument that inflation may not be “always and everywhere a monetary phenomenon,” as Milton Friedman said. Instead, previously, inflation was also a political solution to the distribution of the social product. The increasing pie through growth and/or inflation helped moderate the fight over the distribution.

In the meantime, the institution whose raison d’etre was to secure a greater share for employees has been weakened in the old industries and is not taking root in the new and emerging sectors. Even with the lowest level of unemployment in a generation, weekly initial jobless claims near cyclical lows, record-long expansion, wage growth has been miserly compared with past cycles. The breakdown of the economic abstraction called the Phillips Curve has many real-world consequences, and is not just an accident of history, but socially determined.

Tags: Bank of Japan,Brexit,Featured,federal-reserve,Labor Market,newsletter,Norway,Swiss National Bank