A big part of Swiss consumption is imported from Germany. Therefore Swiss inflation is often correlated to German inflation. Capital flows often move to Switzerland and Germany at the same time. Correlations between CHF and the German economy The relationship between CHF and the German economy is very close for the following reasons: A big part of Swiss consumption is imported from Germany. Therefore, Swiss inflation...

Read More »FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

Swiss Franc The euro Swiss remains at relatively low levels, compared to the ones achieved in the recent risk-on enviornment. Click to enlarge. It is a bizarre turn of events. Just like the Game of Throne’s Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered...

Read More »SIBOR Forex Banking Fraud – another FX rate rigging scandal

Forex has been the big banks secret gold mine, supporting their other losing operations (like normal banking business, lending, etc.). To a large extent this has been unraveling, and this SIBOR lawsuit is another attack on their risk free profit center (FX). Read the entire lawsuit released by Elite E Services here in full. More than 50 unknown defendants and about 20 known FX banks are named in the case, submitted...

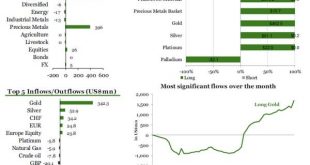

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

Read More »Purchasing Power Parity, REER: Swiss Franc Overvalued?

After the strong revaluation of the Swiss franc in recent years, some economists, like the ones at the Swiss National Bank (SNB), claim that the franc were overvalued. Finally this claim is propaganda, because it is based on a not usable models (the REER and purchasing power parity) and wrong assumptions. The mistakes Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or...

Read More »In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal. Jeff Gundlach confirmed as...

Read More »As Of This Moment, Barclays Is Not Accepting FX Stop Loss Orders

Anyone wondering why gaps and volatility in FX, and especially cable is reaching on the absured today, with 100 pips swings in minutes the norm, the reason is that there is virtually no liquidity, and a main catalyst for this is that as HFTs conduct their usual stop hunts to stop out proximal limit orders, they simply find no such stops. They can blame banks such as Barclays for this development: as of 600 GMT...

Read More »FX Daily, June 21: CHF Strongest Currency Again

Swiss Franc The Swiss Franc was the strongest currency. The euro fell from 1.0877 to 1.0808. Two fundamental reasons: Speculator anticipate that German investors buy Swiss francs in response to the court decision in favor of the OMT (see below) The German ZEW (see below) that was better than expected. We know that CHF acts as a proxy for the German economy via strong trade ties and the tradition that German...

Read More »Swiss National Bank─Reactive rather than proactive

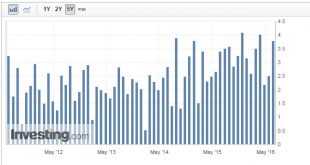

Macroview No change in base rates, but currency intervention on the cards as franc continues to strengthen Read full report hereThe Swiss National Bank (SNB) decided to leave its monetary policy unchanged at its quarterly meeting on 16 June. The main messages were unchanged from its March meeting. The target range for the three-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75% and the SNB reiterated its...

Read More »“Dirk Niepelt über die Folgen eines Brexit für die Schweiz (What Brexit Means for Switzerland),” SRF, 2016

SRF, Tagesgespräch, June 16, 2016. HTML with link to MP3. Half-hour-long interview on the Swiss news channel. Topics include monetary policy, exchange rates, financial stability, Brexit.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org