One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal. Jeff Gundlach confirmed as much last week when he said that “when you go to negative interest rates, you do not stimulate consumption, you necessitate saving. You cannot fight deflation with deflation. Negative interest rates are the definition of deflation. You cannot put out a fire by pouring gasoline on it.” However, just as NIRP was becoming the most hated central bank policy ever implemented and even the Fed was admitting that there are “concerns” with negative rates, something unexpected happened. It may have started to work. According to a report by Capgemini, wealthy bank clients and other high net worth individuals (with a net worth > million) are diverting more of their cash to investments such as hedge funds and private equity to counter negative interest rates. Capgemini’s annual World Wealth Report found that high-net-worth individuals in Switzerland kept 21.

Topics:

Tyler Durden considers the following as important: Central Banks, CHF, Deutsche Bank, Featured, Gundlach, Jeff Gundlach, newsletter, None, Private Equity, Reuters, Swiss Franc, Swiss National Bank, Switzerland

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes DWS mit neuem Vertriebsleiter für Institutionelle

investrends.ch writes Deutsche Bank mit Gewinnsprung – Aktie steigt

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal.

Jeff Gundlach confirmed as much last week when he said that “when you go to negative interest rates, you do not stimulate consumption, you necessitate saving. You cannot fight deflation with deflation. Negative interest rates are the definition of deflation. You cannot put out a fire by pouring gasoline on it.”

However, just as NIRP was becoming the most hated central bank policy ever implemented and even the Fed was admitting that there are “concerns” with negative rates, something unexpected happened. It may have started to work. According to a report by Capgemini, wealthy bank clients and other high net worth individuals (with a net worth >$1 million) are diverting more of their cash to investments such as hedge funds and private equity to counter negative interest rates.

Capgemini’s annual World Wealth Report found that high-net-worth individuals in Switzerland kept 21.4% of their assets in cash and cash equivalents in the first quarter of 2016, down a substantial 25% from 28.2% a year earlier, Reuters reported. “Because clients are not receiving any interest, they’re looking for alternative investment opportunities,” said Tobias Wolf, senior manager at Capgemini Consulting.

Which, of course, was the central bankers’ plan all along. However, what makes this more interesting, is that virtually none of the negative rates were actually passed on to savers.

As a reminder, following the ECB, the SNB The Swiss National Bank pushed interest rates to record lows since January 2015 in an effort to weaken the Swiss franc. It now charges banks 0.75% on some deposits. However, with the exception of Alternative Bank Switzerland, Swiss lenders have not yet passed on negative rates to retail customers, but some have introduced deposit charges for cash-heavy corporate, private and institutional clients.

Perhaps it is the threat that negative rates are coming: Switzerland’s biggest bank, UBS warned last month that it could pass on negative rates to wealthy private customers or add new service fees to safeguard profitability and capital returns.

Whatever the reason, the fact that NIRP has finally succeeded in forcing savers – even if it is a very selected subset – out of cash and into risky assets, just as it was meant to, may breathe new life into this policy which has, ironically, been panned by virtually the entire economist cadre. What would be truly embarrassing for central bankers is if two years after it was first implemented, NIRP was indeed starting to force savers to swap their savings for risky assets, just as NIRP is widely seen as a failure. And if so, would it breathe renewed life into NIRP just as central bankers, scrambling to stimulate inflation and even considering helicopter money, have given up on negative rates, much to the fury of Deutsche Bank which has been raging against this for the past few months.

* * *

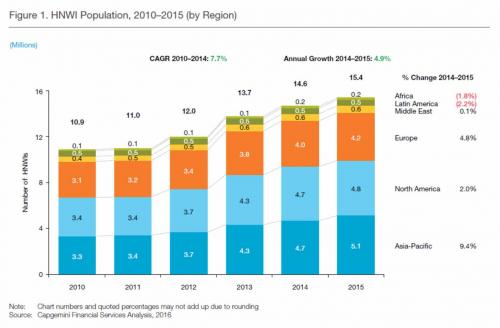

HNWI Population, 2010-2015Additionally, the Capgemini study also found that, for the first time, the Asia Pacific region had more high-net-worth individuals than North America. Asia Pacific, which many private banks are counting on to drive growth, had 5.1 million such individuals in 2015, compared with 4.8 million in North America. And in the most disturbing news for the world’s wealthiest, Capgemini also found that the growth in the number of high-net-worth individuals and their wealth slowed to 4.9 percent and 4 percent respectively, well off the pace of previous years. Perhaps central banks should be made aware and fix this inequity asap. |