Within the world of central bank and government gold reserves, there is often an assumption that these gold holdings consist entirely of gold bullion bars. While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves. These...

Read More »Faber: “Switzerland is doing much better than any other country in Europe. So maybe Britain would do the same?”

The European Union is an “empire that is hugely bureaucratic,” warns Marc Faber, telling CNBC that he thinks that “a Brexit would be bullish for global economic growth,” because “it would give other countries incentive to leave the badly organized EU.” The Gloom, Boom & Doom-er explained that Brexit is a risk Britain should be willing to take, and that it would not be a disaster, “on the contrary, it would be the...

Read More »Swiss growth fails to ignite, SNB likely to remain on hold

Macroview Although there were positive components in the Q1 GDP report, we are reducing our full-year growth forecast for Switzerland to 0.9% this year Read full report hereGrowth estimates from SECO (the Swiss economic affairs secretariat) released on June 1 suggest that real GDP in Switzerland expanded by 0.1% q-o-q (0.3% q-o-q annualised, 0.7% y-o-y) in Q1, lower than consensus expectations of 0.3% and Q4 2015 growth of 0.4%.But the GDP components were more encouraging than what the...

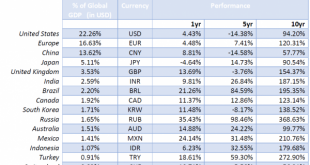

Read More »The Global Monetary System Has Devalued 47 percent Over The Last 10 Years

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most politically expedient avenues policy makers could take would be to inflate the debt away in real terms through coordinated currency devaluations against gold, the only monetize-able asset on most central bank balance sheets. To do so they would create new base money with which to purchase gold at...

Read More »Gold And Negative Interest Rates

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have...

Read More »In Switzerland, New Bank Notes Render Old Notes Invalid

In the NZZ, Thomas Fuster reports about a consequence of the introduction of new banknotes in Switzerland: Old notes become invalid after a transition period of 20 years. Nach der Emission des letzten Notenwerts einer neuen Serie kündigt die Schweizerische Nationalbank (SNB) jeweils den Rückruf der alten Serie an. Danach können die Banknoten zwar noch während zwanzig Jahren bei den Kassenstellen oder Agenturen der Nationalbank zum Nennwert umgetauscht werden. In der Folge sind die Noten...

Read More »The Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority don't understand how the Forex markets work. It's not insulting - it's a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions - but none against a central bank. Of...

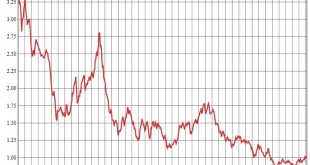

Read More »The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it’s economic data. That’s because the vast majority don’t understand how the Forex markets work. It’s not insulting – it’s a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions – but none against a central bank....

Read More »Swiss monetary policy and the central bank’s options with regards to the CHF

At its quarterly policy assessment, the Swiss National Bank (SNB) decided to leave its monetary policy unchanged. The SNB could afford not to cut its reference rate after last week’s ECB stimulus failed to have much impact on the Swiss franc versus the euro. The target range for the 3-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%; and the SNB reiterated its willingness to intervene on the foreign...

Read More »Central Bank Independence in Switzerland: A Farce

Each week we will publish the best articles by Marc Meyer, one of the most critical voices against the SNB.This post explains 3 points: That the SNB does not understand what assets and liabilities are – and due to this misunderstanding – it speculates with massive leverage. The difference between good and bad deflation, and that Switzerland has good deflation. That both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org