Investec Switzerland. The SMI is set to finish flat this week (-0.12%), outperforming global equity market (MSCI World -0.68% ) with European stocks losing value after the long awaited ECB policy meeting. Stock markets around the world were mixed with risk appetite increasing ahead of Thursday’s European Central Bank (ECB) policy meeting and falling thereafter. The ECB lowered all its main interest rates and expanded its quantitative-easing purchase plan quantity (by €20...

Read More »Swiss franc rises on ‘Brexit’ angst

Brought to you by Investec Switzerland. Once again, Switzerland is getting saddled with unwanted currency appreciation due to other nations’ struggles. The franc posted its biggest gain since August against the euro as concern that the U.K. may exit the European Union dragged down the pound and with it the 19-nation shared currency. China’s decision to cut its daily yuan fixing by the most in six weeks also spurred demand for the safest assets. The franc jumped against all of its Group-of-10...

Read More »Are Central Banks Setting Each Other Up?

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s venture down some roads...

Read More »Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr, There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those times. And if correct? What at first might appear apocryphal, may in fact, be down right apocalyptic. And besides, what good is a tin-foil capped conspiracy theory anyhow if it doesn’t have the potential for doom, correct? So, with that in mind, let’s...

Read More »Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thing has to be abolished: cash. This explains the recent flurry of articles in outlets such as BBG and the FT, and op-eds by such "established" economists as Larry Summers, all advocating the death of cash, a process which would begin by...

Read More »Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thing has to be abolished: cash. This explains the recent flurry of articles in outlets such as BBG and the FT, and op-eds by such "established" economists as Larry Summers, all advocating the death of cash, a process which would begin by...

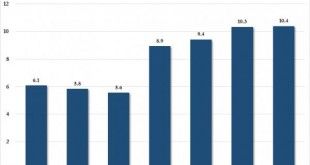

Read More »The Swiss National Bank Doubled Its Apple Holdings in 2015

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled – in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions in losses – largest hedge fund in Switzerland, its central bank, the Swiss National Bank. What is curious is that unlike the Fed, the hedge fund also known as the Swiss National Bank not only proudly admits it purchases stocks, ETFs and...

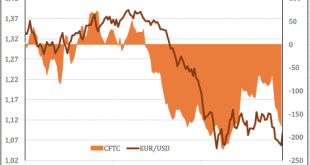

Read More »Will The Franc Follow In The Euro’s Footsteps?

The SNB’s expected December 10 rate cuts have already been priced in to the Swiss Franc. The central bank’s failure to do more than the market expected resulted in a stronger CHF. Growing uncertainty over the Fed’s 2016 monetary policy is a bullish factor for the franc. As they watched the euro strengthen following the ECB’s meeting, SNB representatives rubbed their hands in glee. However, by the start of the Asian FOREX session, the franc was already recovering from its wounds. Now, Bern...

Read More »SNB & CHF, the blog on a beleaguered central bank, its currency, on gold and astute investments

Over four years our association of supporters of Austrian Economics from Switzerland, Germany and Austria and helpful hands from all over the world expressed opposition against the CHF cap in in-numerous pages. Finally the SNB agreed to the wishes of Swiss consumers and gave up the cap that effectively represented a tax on consumption and extra-profits for companies and close friends of the central bank. Swiss Inflation Watch: Swiss inflation As monetarists & Austrians we expect Swiss...

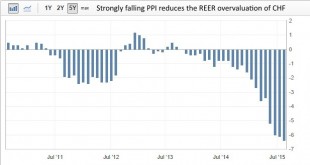

Read More »Purchasing Power Parity, REER: Is CHF Overvalued? (August 2015 update)

After the strong revaluation of the Swiss franc in recent years, some economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values. The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong “base year”, i.e. to assume that in 1999 the CHF was correctly valued. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org