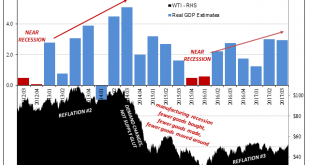

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have...

Read More »Four Point One

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k. For those two months combined, the headline advanced at an...

Read More »US Retail Sales: Retail Storms

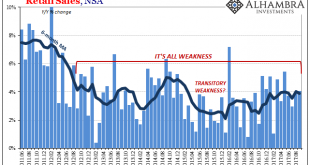

Retail sales were added in September 2017 due to the hurricanes in Texas and Florida (and the other states less directly impacted). On a monthly, seasonally-adjusted basis, retail sales were up a sharp 1.7% from August. US Retail Sales, Jun 2011 - Aug 2017(see more posts on U.S. Retail Sales, ) - Click to enlarge The vast majority of the gain, however, was in the shock jump in gasoline prices. Retail sales at...

Read More »The Damage Started Months Before Harvey And Irma

Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe. That said, we can’t pretend as if...

Read More »Expectations and Acceptance of Potential

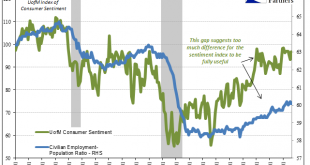

The University of Michigan reports that consumer confidence in September slipped a little from August. Their Index of Consumer Sentiment registered 95.3 in the latest month, down from 96.8 in the prior one. Both of those readings are in line with confidence estimates going back to early 2014 when consumer sentiment supposedly surged. University of Michigan Consumer Confidence, Jan 1997 - 2017(see more posts on...

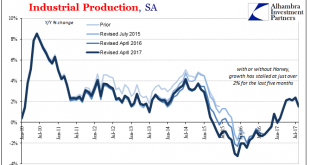

Read More »IP Weathers Storms But Not Cars

In late August 2006, ABC News asked more than a dozen prominent economists to evaluate the impacts of hurricane Katrina on the US economy. The cataclysmic storm made landfall on August 29, 2005, devastating the city of New Orleans and the surrounding Gulf coast. The cost in human terms was unthinkable, and many were concerned, as people always are, that in economic terms the country might end up in similar...

Read More »Retail Sales and the End of ‘Reflation’

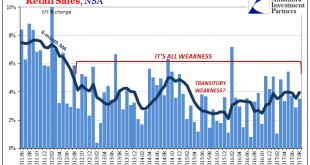

There will be an irresistible urge to the make this about the weather, but more and more data shows it’s not any singular instance. Nor is it transitory. What does prove to be temporary time and again is the upside. The economy gets hit (by “dollar” events), bounces back a little, and then goes right back into the dumps. This, it seems, is the limited extent of cyclicality in these times. Retail sales were again very...

Read More »A Clear Anchor

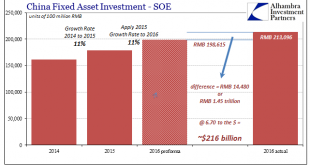

All the way back in January I calculated the total size of China’s 2016 fiscal “stimulus.” Starting in January 2016, authorities conducted what was an enormous spending program. As it had twice before, the government directed increased “investment” from State-owned Enterprises (SOE).By my back-of-the-envelope numbers, the scale of this fiscal side program was about RMB 1.45 trillion, or nearly 2% of GDP. It was about...

Read More »Bi-Weekly Economic Review: Don’t Underestimate Gridlock

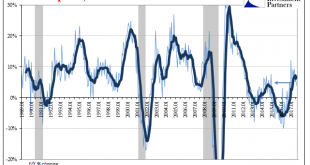

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index...

Read More »United States: Still No Up

The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general. But even in our domestic...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org