The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general. But even in our domestic economy, the Asian dollar flu registered. Industry was scaled back as global liquidity experienced often acutely dangerous levels. The export sector was hit, as was global trade particularly hard. US exports to the rest of the world contracted by 6.1% in July 1998, with a low 6-month average a few months

Topics:

Jeffrey P. Snider considers the following as important: Alan Greenspan, asian dollar, asian flu, bonds, Business cycle, consume spending, consumer spending, currencies, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, FOMC, Markets, Monetary Policy, Money, newsletter, Retail sales, The United States, U.S. Retail Sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general.

But even in our domestic economy, the Asian dollar flu registered. Industry was scaled back as global liquidity experienced often acutely dangerous levels. The export sector was hit, as was global trade particularly hard. US exports to the rest of the world contracted by 6.1% in July 1998, with a low 6-month average a few months later of -3.8%. |

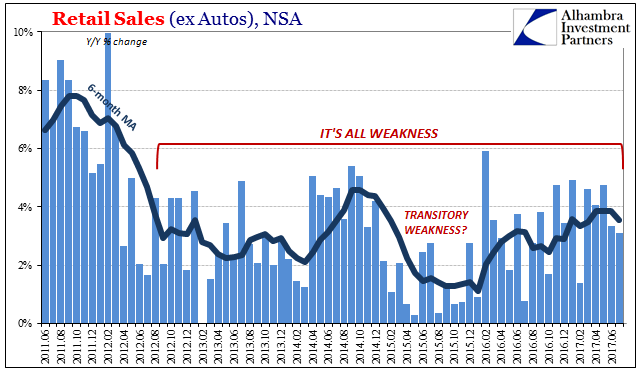

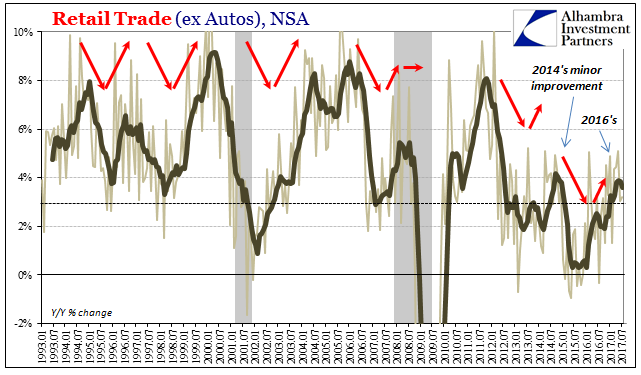

U.S. Retail Sales, Jun 2011-2017(see more posts on U.S. Retail Sales, ) - Click to enlarge |

It wasn’t just a trade matter, though, and it certainly wasn’t the export sector that had grabbed Alan Greenspan’s attention. In September 1998 as everything was starting to come together for all the wrong reasons, the Fed Chairman convened an impromptu conference call with the other members of the FOMC and staff. Markets were becoming shaky, and he wanted permission of sorts, or to at least hear no objections, to hint and wink at a rate cut ahead of time that might (read: would) be forthcoming.

This “major problem” was economy more than just markets, for the former often follows the latter especially when the latter is in distress. Not only was US industry softening, even contracting, there were by summer 1998 indications of a consumer pullback, too. |

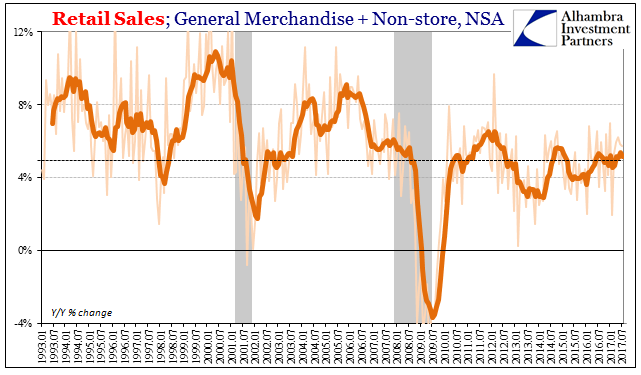

U.S. Retail Sales, Jan 1993-2017(see more posts on U.S. Retail Sales, ) - Click to enlarge |

| Retail sales growth that August was just 2.21% (current estimates) which is recession territory. Less than 6% is concerning, but around and below 3% is indicative of the serious stuff on Greenspan’s mind so much as he sought to bend the rules.

Sales growth never did get that low on an average basis, which is what matters. Month to month variation being a persistent feature of high frequency data, the 6-month average for retail sales did drop uncomfortably close to possible recession, falling to a low of 3.41% earlier in 1998. It did not get worse than that by the end, though. |

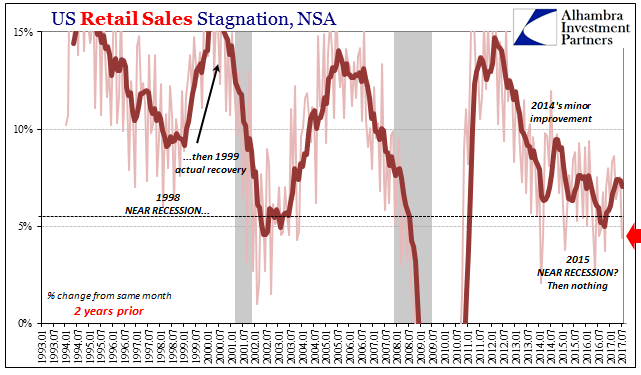

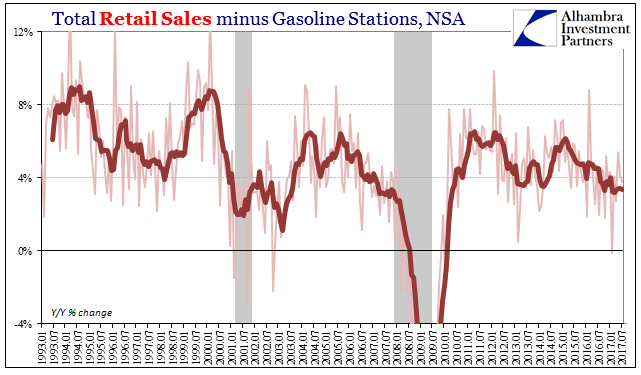

U.S. Retail Sales, Jan 1993-2017(see more posts on U.S. Retail Sales, ) - Click to enlarge |

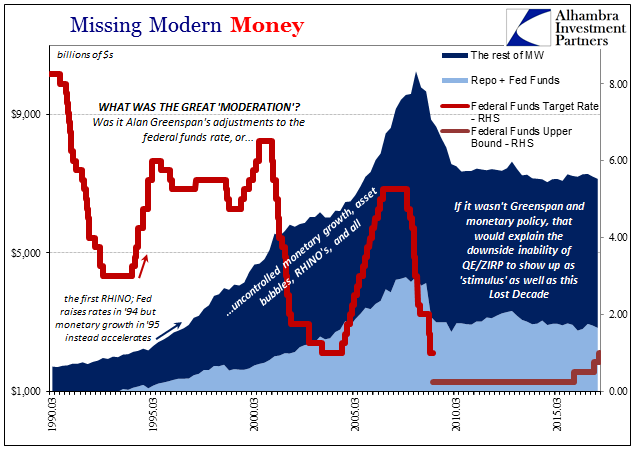

| Again, all these worries were soon forgotten, the Asian (dollar) flu left as some minor issue about LTCM and interest rate swaps or something. The FOMC did officially vote for a rate cut in September as well as two more later that year, a total of 75 bps “stimulus” that many if not most attribute the economic rebound and subsequent stock bubble mania to.

By July 1999, retail sales were up 8.54%, and the 6-month average growth rate was just shy of 8% itself. It was the typical sort of cyclical upswing that follows a cyclical sort of significant downturn. The near-recession in 1998 as a result of all that overseas monetary turmoil certainly qualified, even if downplayed in imagination by the as-yet unbroken promise of the looming “new economy.” |

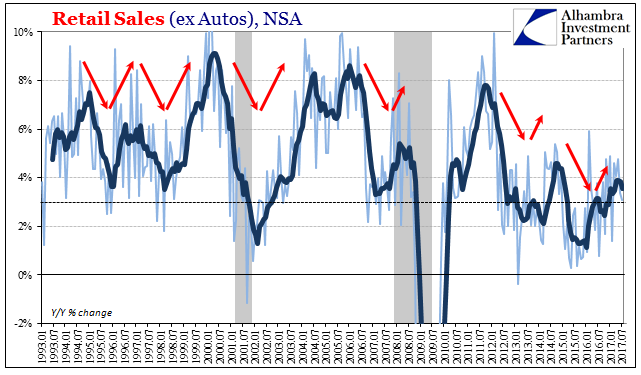

U.S. Retail Sales, Jan 1993-2017(see more posts on U.S. Retail Sales, ) - Click to enlarge |

| The “rising dollar” period of 2014-16 was in many ways comparable to the Asian flu, particularly in the context of it as an Asian dollar flu. The results were similar in that toward the end was a near-recession both times; though this time people in America were forced to pay a little more attention to it. Importantly as a difference, there is no “new economy” beckoning, merely a so far unfounded idea that the world just can’t be stuck so bad for so long.

Having gone through it, the economy this year like 1999 is on the upswing. What isn’t quite settled is by how much (though we are rapidly approaching that point). In July 2017, retail sales are again up by more than 8%, though as a three-year comparison rather than as in 1999 the normal one. Despite being on the upswing, there is very little “up” to it. The Commerce Department reports this morning that total retail sales last month were $479.9 billion, compared to $443.3 billion in July 2014, or $459.6 billion in July 2015 (for a pitiful 2-year growth rate of just 4.4%). Again, retail sales growth is concerning at less than 6% for a single year, so at barely more than 4% for two years indicates a special kind of stubborn stagnation that doesn’t fit the normal accounting of cyclical upturns and downturns. |

U.S. Retail Sales Trade, Jan 1993-2017(see more posts on U.S. Retail Sales, ) - Click to enlarge |

| Seasonally-adjusted, retail sales were up on the month, which is all the mainstream will focus on (as well as upward revisions to last month, almost entirely in auto sales). Year-over-year unadjusted, retail sales increased by just 3.6%, the second straight month less than 4%. This is the same sort of weakness that was evident for US consumers in late 2014 and early 2015. To this point, retail sales have yet to even match the “upswing” in 2014.

And like then, such softness will be characterized as “strong” and “resilient” so as to match in the conventional characterization the economy that “should be” as described by the unemployment rate (or Job Openings, to a lesser extent). In July 1999, the 2-year change in retail sales was 13.2%, including the first year captured by the downturn. That is actually “strong” or “resilient”, though it ultimately had nothing to do with Alan Greenspan or the federal funds rate. |

Missing Modern Money, March 1990-2015 - Click to enlarge |

| Such lasting weakness overall should be instead very concerning, especially this far into 2017. There is outwardly every reason for the economy and US consumers to turn it up, yet nothing happens; at best, it is a repeat of 2014; at worst, not even 2014 as in retail sales to this point. The absence of momentum especially after several years of downturn to the point of near-recession (in GDP as well as extended retail sales signals) is striking. |

U.S. Retail Sales, Jan 1993-2017(see more posts on U.S. Retail Sales, ) - Click to enlarge |

| What it says is unequivocal – the drag on the US (global) economy remains. It may not be as intense or as intensely depressive as last year or the year before, nonetheless it is still there. January 2016 appears to have been the trough in both GDP as well as retail sales, meaning that a year and a half is more than enough time to reach reasonable and solid conclusions along these lines. |

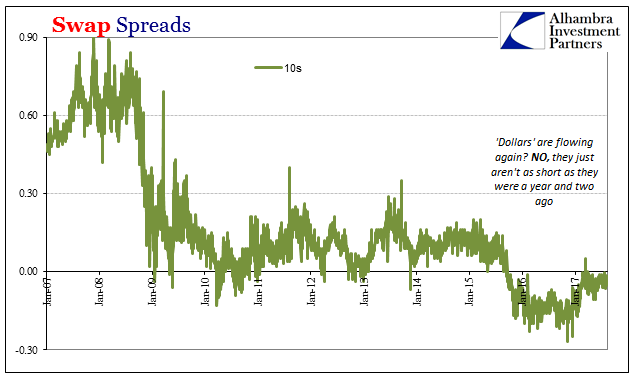

Swap Spread, Jan 2007-2017 - Click to enlarge |

| If it was just retail sales, it would still be concerning; obviously, it is much more than that. During the downswing there was actually great harmony in the economic accounts as to that condition, you just wouldn’t have known it in the media and its focus on the BLS figures. Now there is still great harmony in the data, showing improvement in global economic conditions but not even close to enough so as to be meaningful. This is not, however, unexpected. |

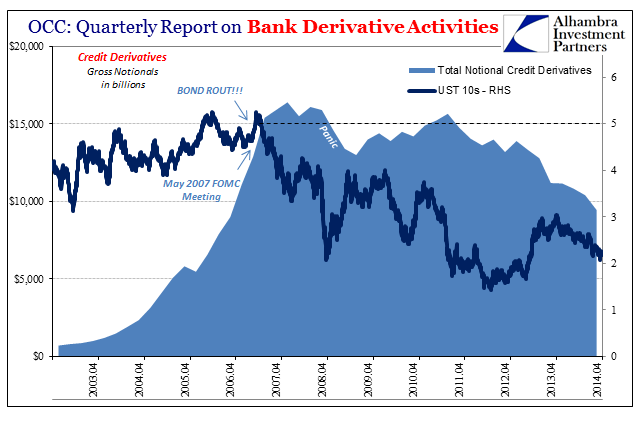

Bank Derivative Activities, Apr 2003-2014 - Click to enlarge |

Tags: Alan Greenspan,asian dollar,asian flu,Bonds,Business Cycle,consume spending,consumer spending,currencies,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,FOMC,Markets,Monetary Policy,money,newsletter,Retail sales,U.S. Retail Sales