Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe. That said, we can’t pretend as if the economy was cooking before Mother Nature interfered. It wasn’t. If one thing has become absolutely clear about the economy in 2017, it is that it has fallen off dramatically when compared to the last half of 2016. US Imports, Jan 1989 - 2017 - Click to enlarge That said, we can’t pretend as

Topics:

Jeffrey P. Snider considers the following as important: consumer spending, currencies, economy, exports, Featured, Federal Reserve/Monetary Policy, global trade, imports, incomes, Labor market, Markets, newslettersent, Retail sales, The United States, Trade Balance, U.S. Disposable Personal Income, U.S. Retail Sales, U.S. Savings Rate, us demand, wholesale sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe.

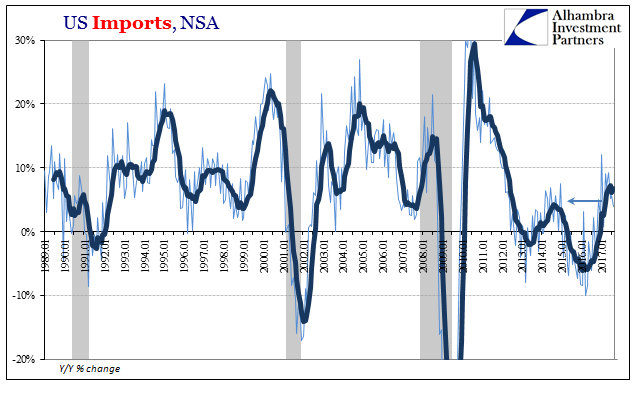

That said, we can’t pretend as if the economy was cooking before Mother Nature interfered. It wasn’t. If one thing has become absolutely clear about the economy in 2017, it is that it has fallen off dramatically when compared to the last half of 2016. |

US Imports, Jan 1989 - 2017 |

| That said, we can’t pretend as if the economy was cooking before Mother Nature interfered. It wasn’t. If one thing has become absolutely clear about the economy in 2017, it is that it has fallen off dramatically when compared to the last half of 2016. |

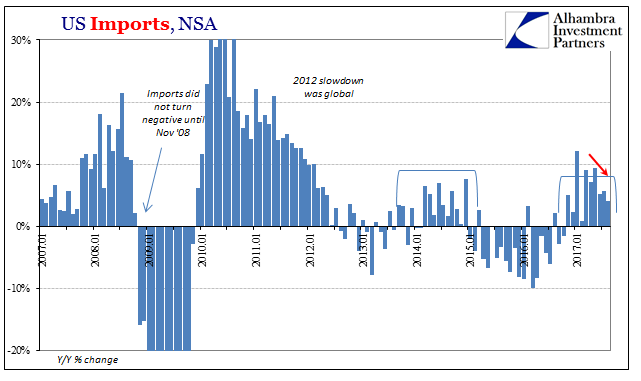

US Imports, Jan 2007 - 2017 |

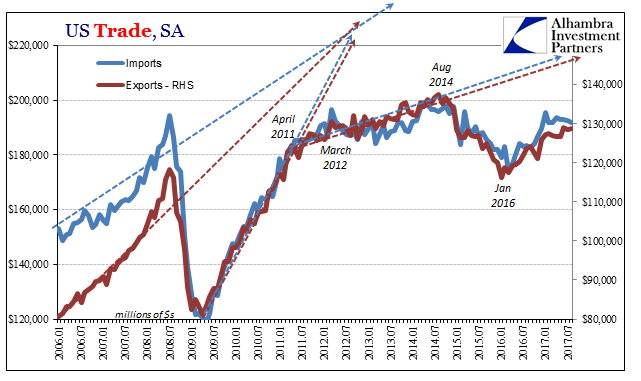

| This is the opposite of what was supposed to happen, what most people and all Economists were expecting. The rebound off the early 2016 trough was only the first part of bigger things, or so it may have seemed. For reasons beyond the mainstream grasp, however, the farther into 2017 we go the farther away that dream seems to get. |

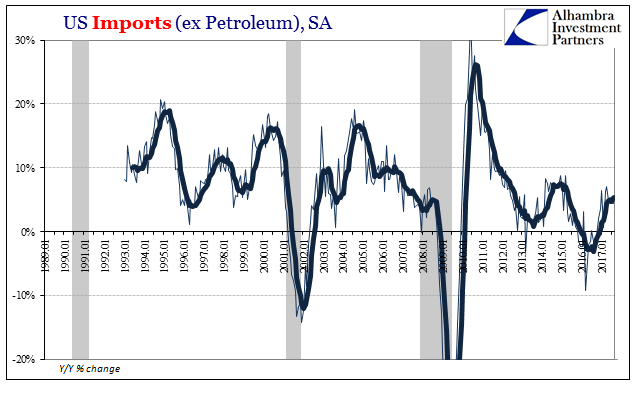

US Imports, Jan 1989 - 2017 |

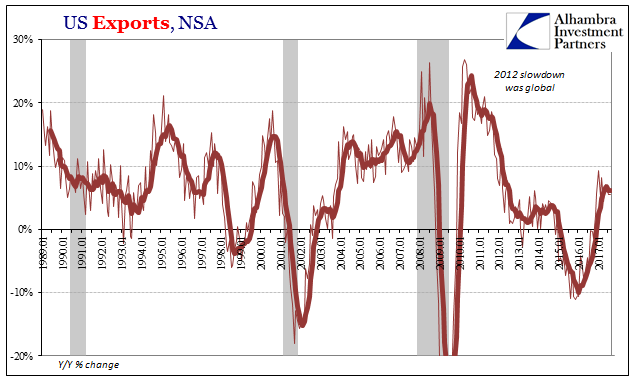

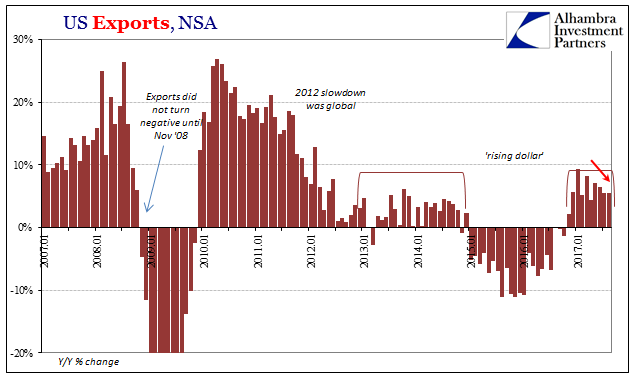

| The latest data to confirm the pre-storm contradiction is from the Census Bureau. Both US exports as well as US imports continue to underwhelm not just in comparison to last year but with respect symmetry. The economy falls off around the world at each of these downturns and it just doesn’t come back, at least not like it used to. |

US Exports, Jan 1989 - 2017 |

| Imports were up just 4% in August 2017, the lowest rate of expansion since February. On the other side, exports were up 5.5%, a slower pace compared to earlier in the year after never having broken double digits. |

US Exports, Jan 2007 - 2017 |

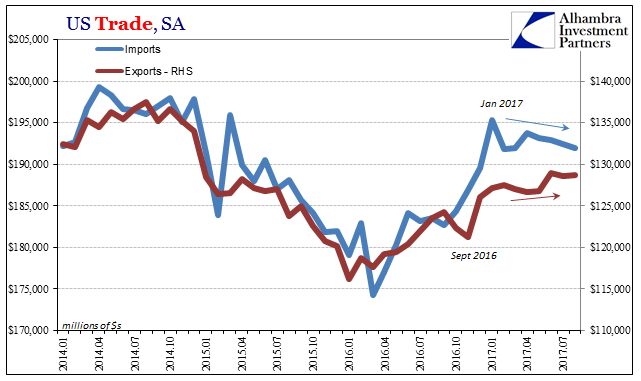

| The seasonally-adjusted estimates better illuminate this disappointment. In the last six months of 2016 plus January 2017, imports were up a respectable (though still stunted) 6.1% for those seven months. |

US Trade, Jan 2014 - Jul 2017 |

| In the seven months since January, including August, imports are down 1.7%. It’s a pattern we see repeated all throughout the economic accounts. |

US Trade, Jan 2006 - Jul 2017 |

| That same result over a few months might be left to monthly variation or “transitory” factors, but a term of seven months declares openly a problem with US demand. |

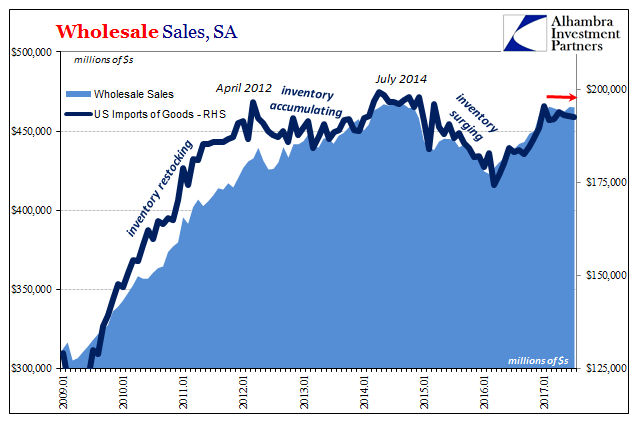

US Wholesale Sales, Jan 2009 - 2017(see more posts on wholesale sales, ) |

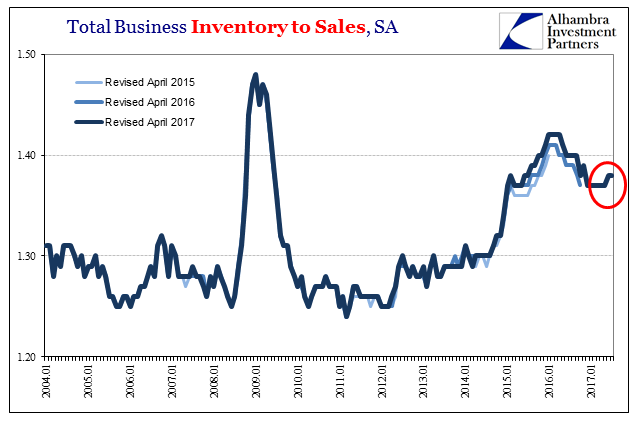

| We don’t have to wonder what that problem is, stated quite directly by the Census Bureau’s estimates for inventories up and down the supply chain. With inventories still unusually high, US demand for foreign goods must be restrained; no cyclical restocking is required nor possible. |

US Total Business Inventory to Sales, Jan 2004 - 2017 |

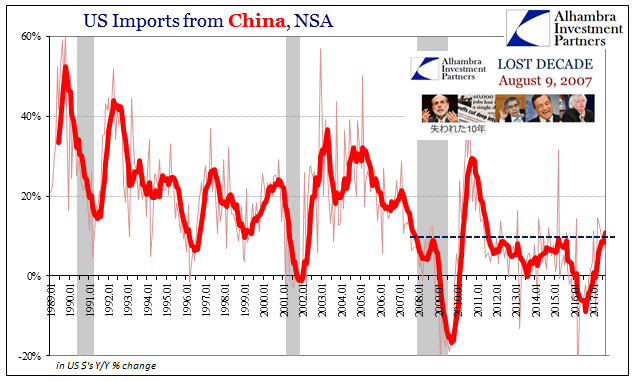

| That has, of course, hampered economic resurgence all over the world. Imports from China were barely positive in August, rising just 4% when the Chinese economy really needs 25-30% growth from the US. There was barely any detectible difference even during that upturn in 2016 from the pace of 2014 despite a rather serious contraction in between. |

US Imports from China, Jan 1989 - 2017 |

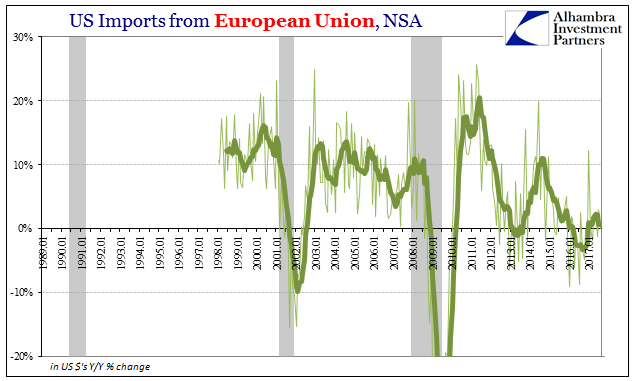

| We find the same problem for Europe, where US imports from that part of the world haven’t even come close to matching the weak results from just before the “rising dollar” began. |

US Imports from European Union, Jan 1989 - 2017 |

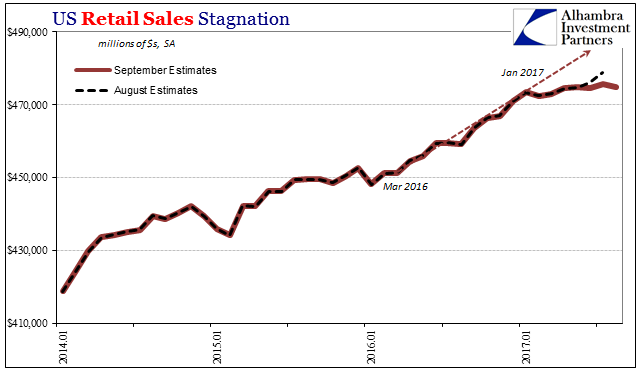

| Inventories are high because sales have flagged. Retail sales have behaved this year as imports, rising in the back half of last year and then just about zeroing out thereafter. |

US Retail Sales, Jan 2014 - 2017(see more posts on U.S. Retail Sales, ) |

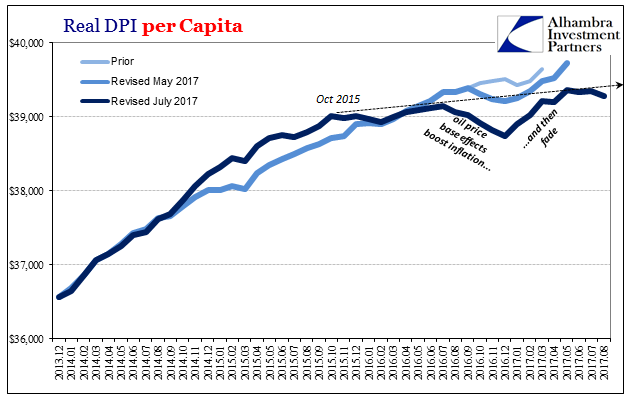

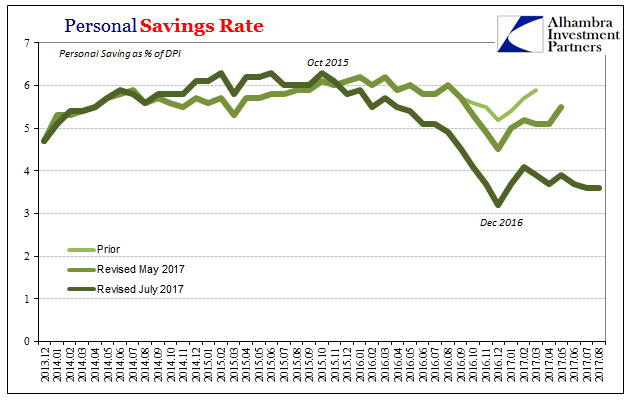

| Consumer spending has been weak because consumers exhausted themselves during that upturn very likely on the premise incomes would rebound, too. They didn’t. |

US Real DPI, Dec 2013 - Aug 2017(see more posts on U.S. Disposable Personal Income, ) |

| In fact, incomes have remained rather weak all throughout. And incomes are in that situation because the labor market slowed with the “rising dollar” and kept on slowing through all of the rest. Despite the rhetoric about the unemployment rate, the jobs market has yet to accelerate again.

It’s fine to blame severe hurricanes for some of the dip that might present itself during these months in question. Any temporary impediment that may have been thrown up, however, hit while the underlying baseline was already in trouble. |

US Savings Rate, Dec 2013 - Aug 2017(see more posts on U.S. Savings Rate, ) |

Tags: consumer spending,currencies,economy,exports,Featured,Federal Reserve/Monetary Policy,global trade,imports,incomes,Labor Market,Markets,newslettersent,Retail sales,Trade Balance,U.S. Disposable Personal Income,U.S. Retail Sales,U.S. Savings Rate,us demand,wholesale sales