Swiss Franc The Euro has fallen by 0.06% to 1.0821 EUR/CHF and USD/CHF, January 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The first day of the New Year, but it feels a lot like last year. The dollar is under pressure, and equities are higher. Outside of Japan and Malaysia, The MSCI Asia Pacific Index extended last week’s 3.6% gain. It has not rallied for seven consecutive sessions. Led by mining and...

Read More »FX Daily, November 4: Indecision Keeps Investors on Edge, but the Dollar Rides High

Swiss Franc The Euro has risen by 0.05% to 1.0682 EUR/CHF and USD/CHF, November 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Initially, the markets built on Tuesday’s price action, but as soon as a few counties in Florida indicated that it was not going to be the “blue wave,” risk came off, and it was most evident in the bond and currency markets. Equities rallied in the Asia Pacific area, and all but Hong...

Read More »FX Daily, October 23: Disappointing PMIs may Sharpen ECB’s Dovishness but the Euro Remains Firm

Swiss Franc The Euro has fallen by 0.06% to 1.071 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is finishing the week on a soft note, falling against all the major currencies. On the week, it is off by at least one percent against most of them, with the Australian and Canadian dollars and Japanese yen, laggards, rising 0.5%-0.75%. Emerging market currencies are...

Read More »FX Daily, October 05: Monday’s Dollar Blues

Swiss Franc The Euro has fallen by 0.05% to 1.0782 EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: New actions to contain the virus are being taken in the US and Europe, but investors are looking past it and taking equities and risk assets, in general, higher to start the new week. MSCI Asia Pacific recouped most of last week’s 0.7% loss with gains of move than 1% in Japan, Hong...

Read More »What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying. Zambia did what everyone does, the country floated its first Eurobond ($750 million). At that point, copper was only down modestly from its 2011 peak. By 2014,...

Read More »FX Daily, September 23: Trying to Find Solid Ground

Swiss Franc The Euro has risen by 0.04% to 1.0769 EUR/CHF and USD/CHF, September 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A more stable tone is evident in the capital markets after the S&P 500, and NASDAQ rose more than one percent yesterday. Japan returned from a two-day holiday, and local shares slipped fractionally, while China, Hong Kong, South Korea, and Australian shares rallied. India and...

Read More »Gratuitously Impatient (For a) Rebound

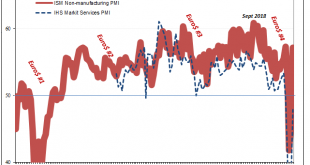

Jay Powell’s 2018 case for his economic “boom”, the one which was presumably behind his hawkish aggression, rested largely upon the unemployment rate alone. A curiously thin roster for a period of purported economic acceleration, one of the few sets joining that particular headline statistic in its optimism resides in the lower tiers of all statistics. The sentiment contained within the ISM’s PMI’s were at least in the same area as the unemployment rate, and...

Read More »What The PMIs Aren’t Really Saying, In China As Elsewhere

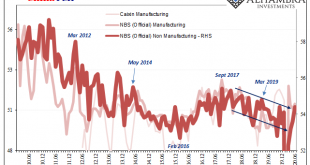

China’s PMI’s continue to impress despite the fact they continue to be wholly unimpressive. As with most economic numbers in today’s stock-focused obsessiveness, everything is judged solely by how much it “surprises.” Surprises who? Doesn’t matter; some faceless group of analysts and Economists whose short-term modeling has somehow become the very standard of performance. According to one such group, China’s official manufacturing index, the one calculated and...

Read More »Not COVID-19, Watch For The Second Wave of GFC2

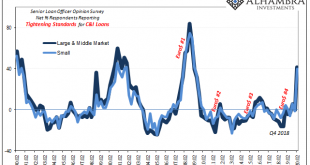

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own. Fill up the bathtub, so to speak, with artificial stimulus water (aggregate demand) until such time as the basin stops...

Read More »China’s Back!

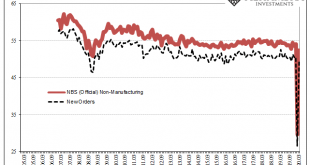

The Washington Post began this week by noting how the US economy seems to have lost its purported zip just when it needed that vitality the most. Never missing a chance to take a partisan swipe, of course, still there’s quite a lot of truth behind the charge. An actual economic boom produces cushion, enough of one that President Trump and his administration may have been counting on it when opting for full-blown shutdown. The coronavirus recession is exposing how...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org