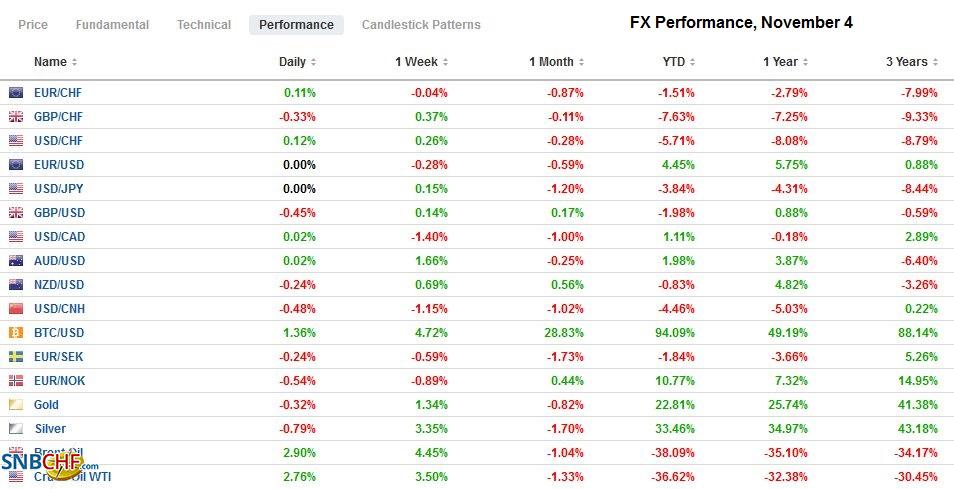

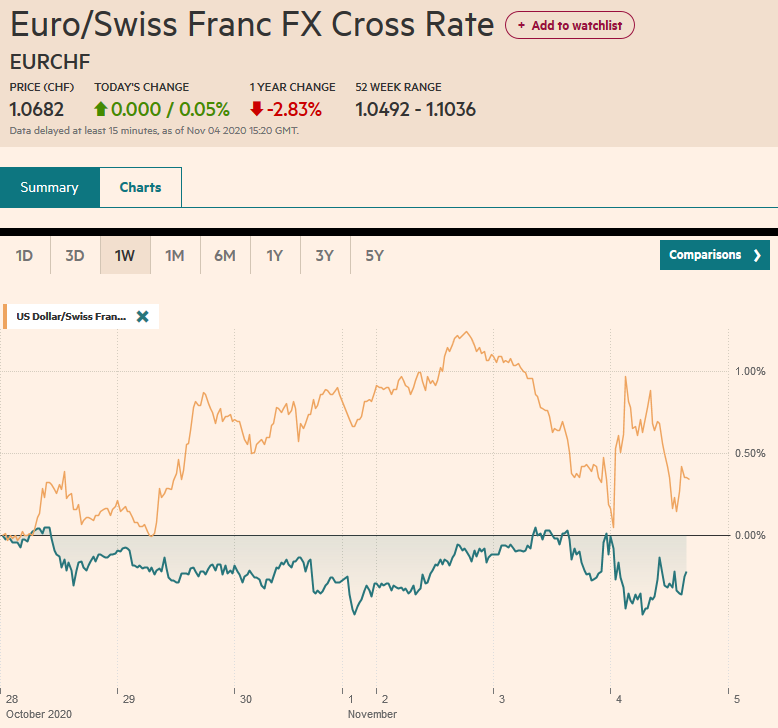

Swiss Franc The Euro has risen by 0.05% to 1.0682 EUR/CHF and USD/CHF, November 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Initially, the markets built on Tuesday’s price action, but as soon as a few counties in Florida indicated that it was not going to be the “blue wave,” risk came off, and it was most evident in the bond and currency markets. Equities rallied in the Asia Pacific area, and all but Hong Kong, Australia, and Indonesia advanced. European equities are firm and marginally extended yesterday’s 2.3% gain, led by healthcare, consumer staples, and information technology. US shares are higher. The S&P 500 is around 0.5% better in electronic activity, while the NASDAQ is almost 2.5% better.

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, 4.) Marc to Market, Currency Movement, Featured, newsletter, PMI, Politics, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has risen by 0.05% to 1.0682 |

EUR/CHF and USD/CHF, November 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Initially, the markets built on Tuesday’s price action, but as soon as a few counties in Florida indicated that it was not going to be the “blue wave,” risk came off, and it was most evident in the bond and currency markets. Equities rallied in the Asia Pacific area, and all but Hong Kong, Australia, and Indonesia advanced. European equities are firm and marginally extended yesterday’s 2.3% gain, led by healthcare, consumer staples, and information technology. US shares are higher. The S&P 500 is around 0.5% better in electronic activity, while the NASDAQ is almost 2.5% better. European bond yields are 1-3 basis points lower, though the UK 10-year Gilt yield is off nearly five. The US 10-year yield has tumbled 11 bp to slip below 0.79%. Earlier, it had reached 0.94%, a five-month high. The dollar, which fell on Tuesday, is recovering smartly today. It has risen against nearly all currencies. Among the majors, the Australian dollar has been hit the hardest and is off around 0.6% (~$0.7120). The Swiss franc is the strongest, and it is virtually flat. Emerging market currencies have seen some dramatic moves. The Mexican peso, which often acts as a proxy for emerging market currencies, is off around 1%, though at one point was more than 3% lower. Along with the peso, the South African rand, and the beleaguered Turkish lira have recouped some of their earlier losses are still off around 0.5% Gold fell around $33 from its high to nearly $1883 and has traded about $10 off its lows in late morning turnover in Europe. Oil is extending yesterday’s gains, and WTI for December delivery approached $39 a barrel. The low from Monday was near $33.65. |

FX Performance, November 4 |

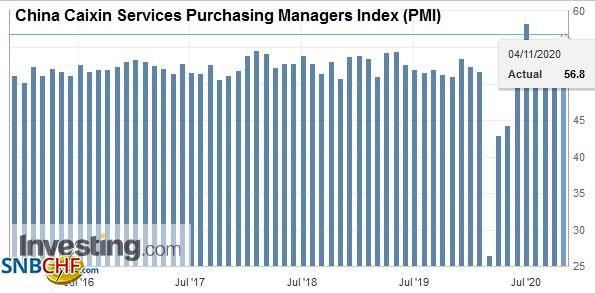

Asia PacificChinese officials caught the market by surprise when it postponed the $34.5 bln IPO of Ant, the internet finance spin-off from Alibaba. The Shanghai launch for Thursday was first postponed, but when it became clear the Hong Kong IPO was also going to be delayed, the Hong Kong dollar weakened. Two considerations may be at work. First, there may be some genuine regulatory issues. The main idea being that such fintech companies may be more like financial institutions rather than technology companies. If that is the case, then capital and leverage regulations may be different than anticipated by Alibaba. Second, a couple of political considerations may also be at work. The most obvious political dimension is the founder (and controlling owner of Ant) Jack Ma’s criticism of Beijing in general and regulators in particular. That seems petty. However, the other political dimension may be more serious. The Alibaba app has encroached on activity previously conducted by banks, including small loans, the purchase of insurance, and investment products. Alibaba’s role has evolved from providing the funds to being an introducing broker of sorts. On Monday, the banking and insurance regulators announced new rules for online microfinance, including higher capital requirements for loans and tighter controls of inter-provincial lending. The net effect is to boost its capital at its micro-lending units and seek nationwide licenses. The Caixin service PMI rose to 56.8 from 54.8. This, coupled with the rise in the manufacturing PMI (53.6 vs. 53.0), lifted the composite to 55.7 from 54.5. The report confirms what the official PMI already had shown, namely, that the recovery of the world’s second-largest economy remained intact. The strength of the services components in both the official and Caixin measures suggest the recovery is broadening and not just a supply-side phenomenon. |

China Caixin Services Purchasing Managers Index (PMI), October 2020(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

Hong Kong formally asked for consultations with the US. The security law that China insisted Hong Kong adopt prompted near-universal criticism and the US’s decision that imports coming from HK are marked “made in China.” Under the WTO auspices, for which HK is a member in its own right, the consultations are a prelude to formal grievances and a request for arbitration. HK argues that the US has generally allowed goods that originate in other WTO members’ territory can designate that it came from that territory. The WTO rules would seem to require uniform treatment. The US rules were initially to come into effect in late September but have been extended to November 10.

The Us dollar spiked to nearly JPY105.35 in early Asia, a two-week high, but was quickly sold back into the JPY104.70-JPY104.80 area. It traded within a 20-point range on either side of JPY105.00, where a $1.4 bln option is set to expire today. There is another band of chart support in the JPY104.50-JPY104.60 area. A $535 mln option that expires today is struck at the bottom of that range. That the Australian dollar led the currencies against the greenback yesterday, after the RBA eased policy, was notable. On Monday, it dipped below $0.7000 briefly, and earlier today, it pushed above $0.7200 for here the first time since October 13. In the risk-off adjustment, the Aussie was sold to about $0.7050. Since that sell-off in early Asia, the Aussie has been in a half-cent range centered on $0.7100. The Chinese yuan has fallen by 0.5% (offshore yuan ~ -0.65%), the most among Asian currencies today. It snaps a four-day advance. The PBOC set the dollar’s reference rate at CNY6.6771, which was stronger than the estimates (~CNY6.6727, Bloomberg). The dollar reached nearly CNY6.75 (highest since October 13) before settling down to around CNY6.71.

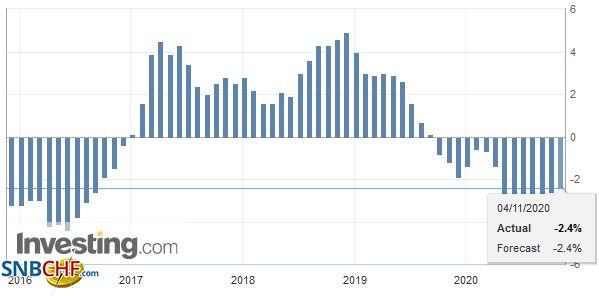

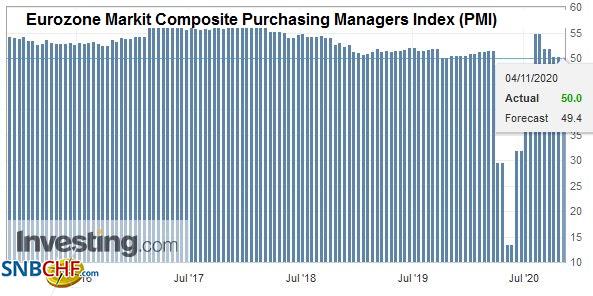

EuropeThe October service and composite PMI have been reported. German’s service sector was not as weak as the flash report suggested. The final reading was 49.5 rather than 48.9, but still below the 50 boom/bust level and below September’s 50.6. The composite improved to 55.0 from 54.5 and September’s 54.7. The composite peaked in July at 55.3. France saw no improvement from the flash service reading of 47.5, but due to the uptick in manufacturing, the composite PMI stands at 47.5 rather than 47.3 (flash) and 48.5 in September. It is the third consecutive decline in the composite. Spain’s service PMI was 41.4, down from 42.4, though not as weak as feared (40.0). |

Eurozone Producer Price Index (PPI) YoY, September 2020(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

| The composite PMI slipped slightly to 44.1 from 44.3. Italy’s composite fell to 49.2 from 50.4, dragged by the weaker than expected 46.7 service PMI (48.8 in September). In the EMU aggregate, the services PMI fell to 46.9, rather than 46.2, as the flash estimate had it, from 48.0 in September. |

Eurozone Services Purchasing Managers Index (PMI), October 2020(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

| The composite held at 50, down from 50.4, but better than the 49.4 preliminary estimates. The takeaway is two-fold. First, new social restrictions suggest more weakness. Second, it reinforces ideas that the ECB will ease next month and likely do more than extend its bond purchases. |

Eurozone Markit Composite Purchasing Managers Index (PMI), October 2020(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

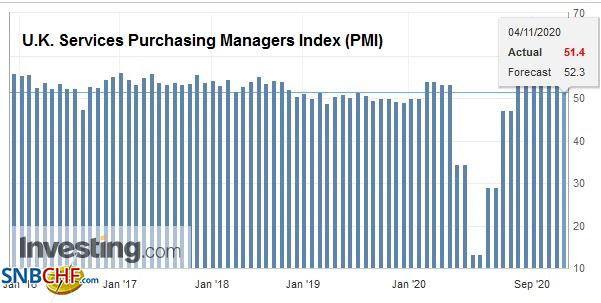

| The UK PMI was poor. The service PMI fell to 51.4. This is lower than the preliminary estimate of 52.3, which already had marked slowing from September’s 56.1. Similarly, the composite stands at 52.1. The flash reading had it at 52.9 after 56.5 in September. Here too, with the new national lockdown, the risk is that the PMIs fall below 50. The Bank of England meets tomorrow. Most expect a GBP100 bln increase in bond purchases. Many see scope to cut the base rate to zero from 10 bp. Growth projections will be reduced. Next week, the UK reports October employment and Q3 GDP. After a 19.8% contraction in Q2, the economy may have rebounded by around 16% in Q3. |

U.K. Services Purchasing Managers Index (PMI), October 2020(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

The UK and EU agree that they still have not reached an understanding on three key areas to move forward the trade talks: fisheries, fair competition, and conflict resolution. Fisheries draw attention far disproportionate to its economic size. As we have suggested before, there appears some willingness to agree to postpone addressing the issue to some time in the future. The UK insists on setting quotas annually. If it keeps 2021 quotas in line with 2020 practices, then it can be negotiating next year. The same cannot be said of the rules of engagement (competition, state-assistance, etc.) and a conflict-resolution mechanism. They are the bedrock of any such agreement. There is headline risk as the EU’s negotiator Barnier is set to brief the EU members about developments over the past two weeks as talks intensified.

The euro has traded on both sides of yesterday’s range (~$1.1630-$1.1740). Follow-through buying initially was seen in Asia, but the changing outlook for the US election, saw it sell off hard to almost $1.16, the lower end of the 3-4 month trading range. It has since recovered but has been unable to recover the $1.17-handle. Sterling initially went for the ride higher and reached $1.3140 before the fortunes turned. It did not find a base until early European turnover when it was near $1.2915. Resistance now is seen in the $1.3000-$1.3020 area.

AmericaThe US election outcome is still not known, and the uncertainty may persist. Nevertheless, a few things are known. There is no blue wave, and the implication is that even if Biden wins the presidency, the Democratic Party is unlikely to capture the Senate. This would seem to curb the scope for a large fiscal stimulus and means that the redistricting based on the 2020 census may be limited. |

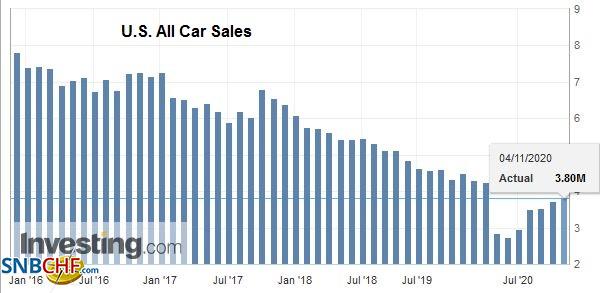

U.S. All Car Sales, October 2020(see more posts on U.S. All Car Sales, ) Source: investing.com - Click to enlarge |

| There are several states that the outcome is too close to call a winner. Of those states, Biden seems to be ahead in Arizona, New Hampshire, Wisconsin, and Nevada. Together, they account for 31 electoral college votes. Without those, Biden is seen winning 238 electoral college votes. That is one shy of the 270 needed and puts the burden on the Democratic Party. The focus is now on four states, Georgia, Michigan, North Carolina, and Pennsylvania, all of which are said to lean toward Trump. |

U.S. Services Purchasing Managers Index (PMI), October 2020(see more posts on U.S. Services PMI, ) Source: investing.com - Click to enlarge |

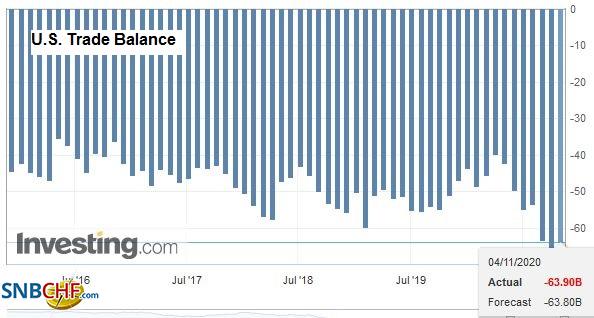

| The election will, of course, dominate the focus today. ADP will make its private sector employment estimate and is expected to be around 650k. At the same time, the median forecast in the Bloomberg survey calls for a 700k increase in private-sector payrolls in the October jobs report at the end of the week. The September trade balance is also on tap, and it could influence forecasts for revisions of Q3 GDP. |

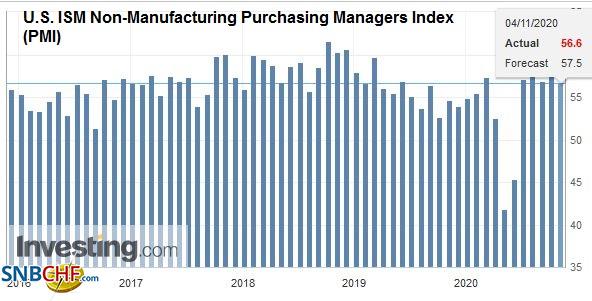

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), October 2020(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: investing.com - Click to enlarge |

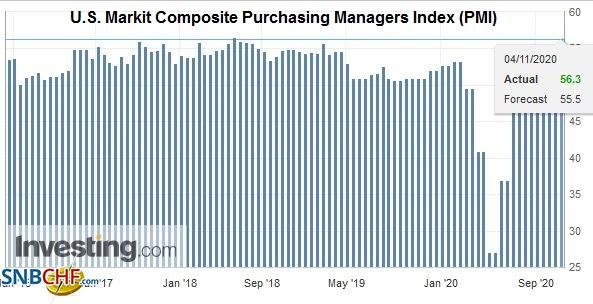

| Markit issues its final service and composite PMI, while ISM releases its October service index. The FOMC meeting concludes tomorrow. No change in policy is expected. Canada reports September trade figures today. At the end of the week, October employment data will also be released. |

U.S. Markit Composite Purchasing Managers Index (PMI), October 2020(see more posts on U.S. Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| The US dollar fell by about 1.3% against the Canadian dollar in the first two sessions this week and dipped slightly below CAD1.31 for the first time since October 21 earlier today. It subsequently rebounded to CAD1.33 and returned to CAD1.3200 in the European morning. Yesterday’s high was about CAD1.3230, and a close above there would be technically constructive. For the past three months, the greenback has rarely been above CAD1.34. The US dollar settled yesterday near MXN21.11 and initially fell to MXN20.91. However, as it became clear that the blue wave was not materializing, the dollar jumped to almost MXN22.00. As things settled down, the dollar has been confined to a mostly MXN21.25-MXN21.80 range. |

U.S. Trade Balance, September 2020(see more posts on U.S. Trade Balance, ) Source: investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Currency Movement,Featured,newsletter,PMI,Politics