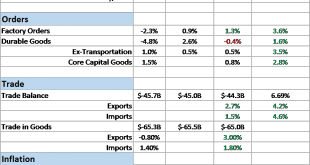

Economic Reports Scorecard The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher. The incoming, current...

Read More »Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

Read More »Real Disposable Income: Headwinds of the Negative

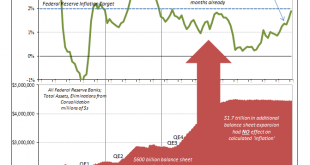

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability). Though there is a chance that the streak will end with the update for February, it should not go unnoticed how weak that number is given that oil prices in January were...

Read More »U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise...

Read More »The crisis in the Middle East and oil prices

We expect oil prices broadly to stabilise in 2017—but prices will continue to be affected by geopolitical shocks in the region, which will also create tremors on financial markets.Oil currently seems to have reached its fair value at around USD50 per barrel for Brent crude. We expect prices to average around USD55/b in 2017, while supply continues to adapt to sluggish demand. The agreement between OPEC members on 30 November and with non-OPEC producers a week later should reinforce the trend...

Read More »Oil prices: looking for equilibrium

At current levels, the oil price is close to equilibrium, with little in the fundamentals to suggest a sustained move higher in prices in the coming months There were sharp movements in the price over the summer, and further volatility is likely in the coming months. WTI oil prices dropped around 25% between June and early August. Prices subsequently rallied, rising by around 20% to close to USD50/b, before dipping again at the close of August. High inventories played a key role in pushing...

Read More »Navigating through rollercoaster markets

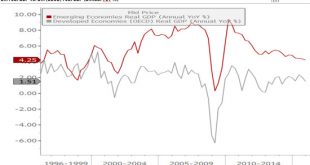

Macroview As growth fails to attain a stronger trajectory and deflation remains a threat, the credibility of central banks has begun to suffer. Yet we remain relatively upbeat on prospects for world growth although we expect continued volatility in some asset classes. April insights from Pictet Wealth Management's Asset Allocation & Macro Research team The current decline in US profit margins would usually herald a recession. The continued decline in earnings expectations is a concern,...

Read More »Oil prices should rise gradually

Despite the lowering of global economic prospects, oil prices could rise to USD 50/b by early 2017. On April 12, the International Monetary Fund (IMF) published its World Economic Outlook survey, containing its economic forecasts for 2016 and 2017. The IMF revised downward its global growth forecast for 2016 by 0.2%. In a recent post we presented our macro-econometric model, which showed a stable long-term relationship between oil price, global economic growth and the US dollar. Based on...

Read More »Euro area business surveys regain some momentum in March

Hard activity data for the euro area have improved since January, but downside risks still dominate despite the ECB’s support. At the very least, monetary policy looks set to remain exceptionally accommodative for an extended period of time. Euro area business surveys (PMIs and IFO) showed renewed signs of life in March after the drops seen in the first two months of the year. Surveys also highlighted the contrasting trend between the manufacturing sector, dented by a subdued external...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org