At current levels, the oil price is close to equilibrium, with little in the fundamentals to suggest a sustained move higher in prices in the coming months There were sharp movements in the price over the summer, and further volatility is likely in the coming months. WTI oil prices dropped around 25% between June and early August. Prices subsequently rallied, rising by around 20% to close to USD50/b, before dipping again at the close of August. High inventories played a key role in pushing prices down between June and early August, as US crude oil stocks reached record levels. But dollar weakness and signs of a possible OPEC deal then supported a rally. The slip in prices at end-August reflects worries about demand, as well as ongoing concerns about inventory levels.Overall, these sharp fluctuations suggest that the market is still finding a new equilibrium, as it seeks to calibrate the continuing impact of US unconventionals (shale oil). So signs of shifts in supply and demand can have a sizeable impact. This may well presage further abrupt price movements. However, our macro-econometric model—based on the long-term relationship between the oil price, global economic growth and the US dollar, point to a current equilibrium level of around USD49/b at present, not far from where it is.

Topics:

Jean-Pierre Durante considers the following as important: goldilocks economy, macro-econometric models, Macroview, oil price equilibrium, oil prices

This could be interesting, too:

Jeffrey P. Snider writes I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Jeffrey P. Snider writes Houston, We Have An Oil (and inventory) Problem

Cesar Perez Ruiz writes Weekly View – Big Splits

At current levels, the oil price is close to equilibrium, with little in the fundamentals to suggest a sustained move higher in prices in the coming months

There were sharp movements in the price over the summer, and further volatility is likely in the coming months. WTI oil prices dropped around 25% between June and early August. Prices subsequently rallied, rising by around 20% to close to USD50/b, before dipping again at the close of August. High inventories played a key role in pushing prices down between June and early August, as US crude oil stocks reached record levels. But dollar weakness and signs of a possible OPEC deal then supported a rally. The slip in prices at end-August reflects worries about demand, as well as ongoing concerns about inventory levels.

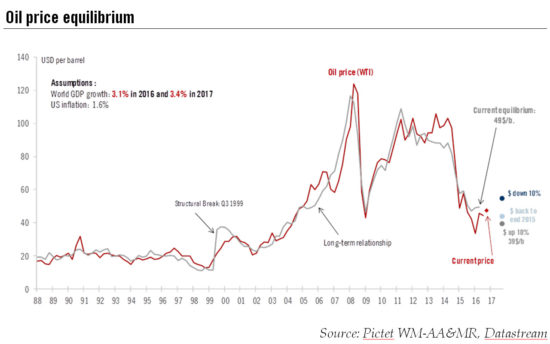

Overall, these sharp fluctuations suggest that the market is still finding a new equilibrium, as it seeks to calibrate the continuing impact of US unconventionals (shale oil). So signs of shifts in supply and demand can have a sizeable impact. This may well presage further abrupt price movements. However, our macro-econometric model—based on the long-term relationship between the oil price, global economic growth and the US dollar, point to a current equilibrium level of around USD49/b at present, not far from where it is.

Fundamentals suggest that a sustained move in the price much higher in the coming months is unlikely. For a markedly higher oil price equilibrium, global growth would need to be stronger than currently expected. Or the US dollar would need to weaken significantly—which, given prospective Fed tightening and the resilience of the US economy also seems unlikely.

The current level of oil prices may actually be part of a ‘goldilocks’ moment for the world economy: it is high enough for oil producers to be profitable, but not so high as to be a drag on global growth. However, while it is difficult to make a case for a higher equilibrium price based on fundamentals, a major disruption to supply that pushes up prices is a constant risk.