The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise between now and the end of February off – a barrel where it has been stuck for quite some time). U.S. Consumer Prices Changes on Energy January 1995 - 2017(see more posts on U.S. Consumer Price Index, ) - Click to enlarge The last time oil retraced a similar pattern was at the prior peak in late April 2011. After rising above 0, up sharply from before August 2010 when Ben Bernanke whispered QE2 at Jackson Hole, for the next fourteen months WTI traded sideways to lower (in more volatile fashion). As soon as June 2012 the year-over-year comparison was negative again, as was the energy component of the CPI even though for the most part that year oil prices traded around to 0. U.S. Consumer Prices Less Food and Energy January 1991 - 2017(see more posts on U.S.

Topics:

Jeffrey P. Snider considers the following as important: base effects, core inflation, CPI, currencies, earnings, economy, Featured, Federal Reserve/Monetary Policy, full employment, inflation, Markets, newslettersent, oil prices, Recession, Rent, slack unemployment rate, The United States, U.S. Consumer Price index, wages, WTI

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

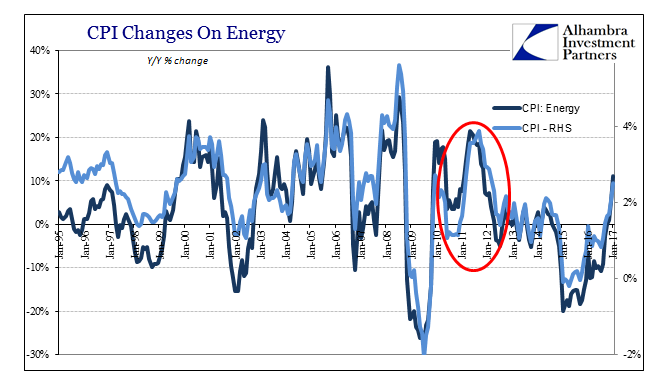

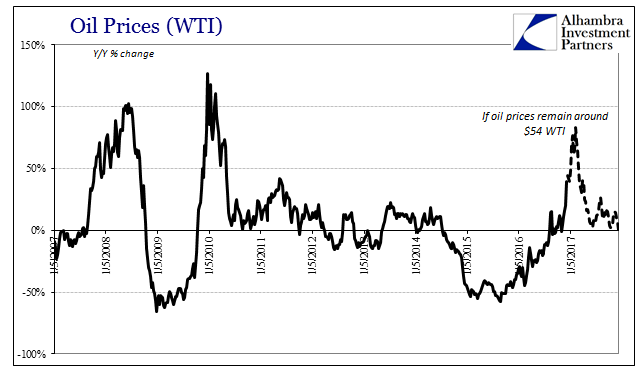

| The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise between now and the end of February off $53 – $54 a barrel where it has been stuck for quite some time). |

U.S. Consumer Prices Changes on Energy January 1995 - 2017(see more posts on U.S. Consumer Price Index, ) |

| The last time oil retraced a similar pattern was at the prior peak in late April 2011. After rising above $110, up sharply from before August 2010 when Ben Bernanke whispered QE2 at Jackson Hole, for the next fourteen months WTI traded sideways to lower (in more volatile fashion). As soon as June 2012 the year-over-year comparison was negative again, as was the energy component of the CPI even though for the most part that year oil prices traded around $95 to $100. |

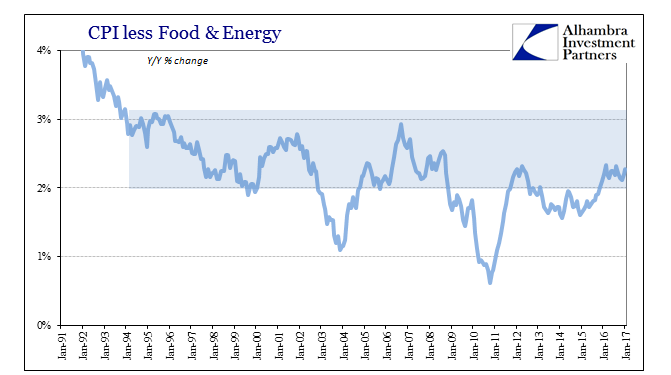

U.S. Consumer Prices Less Food and Energy January 1991 - 2017(see more posts on U.S. Consumer Price Index, ) |

| Excluding energy and food prices, the so-called core CPI index has not budged since the start of 2016, confirming the nearly exclusive influence of oil prices on the overall index. The core rate while above 2% is actually at the lower end of its historical range (for the Great “Moderation”) which then suggests price increases outside of energy (and rent) at below what would produce a stable price change (the Fed’s definition, not mine) near or at the target inflation rate. |

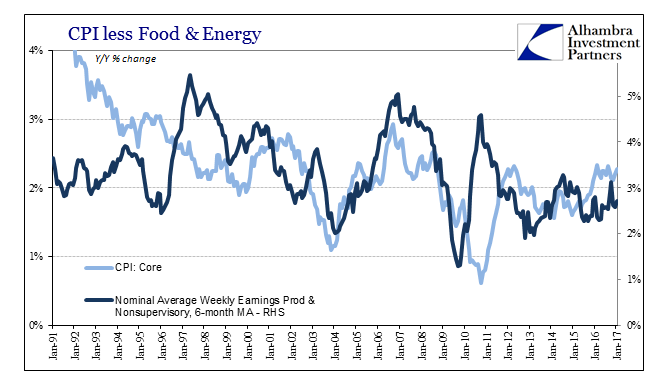

U.S. Consumer Prices Less Food and Energy vs. Wage January 1991 - 2017(see more posts on U.S. Consumer Price Index, ) |

| The view of core inflation largely fits the lack of wage acceleration, as in terms of consumer prices wage inflation (the end of slack) would be confirmed in the CPI here absent the noise of energy or food prices. No rising wages, no acceleration in the core CPI, and again we are left with serious questions about an unemployment rate that has suggested “full employment” for well over a year now.

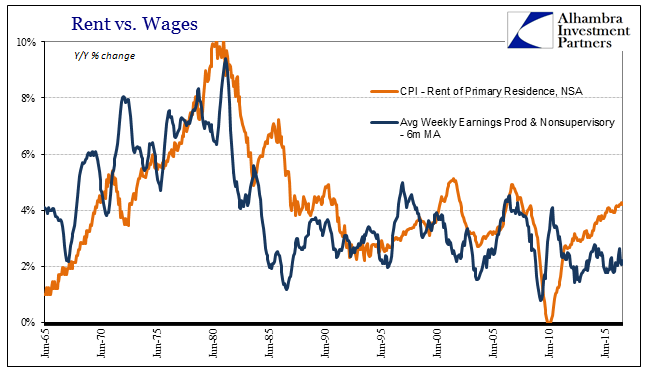

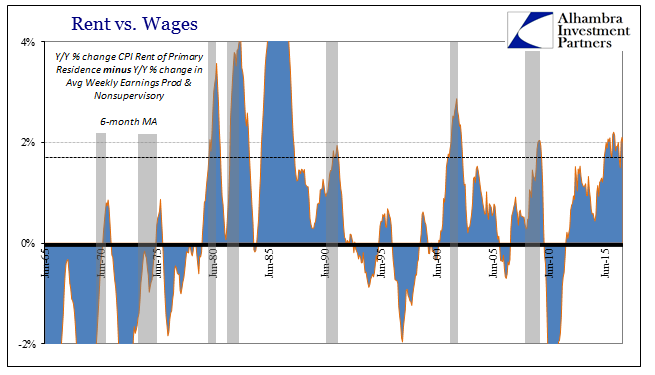

Where wages and inflation have departed, however, is where it probably hurts consumers the most. Given the weight of rent and housing costs in the CPI index, it is actually somewhat surprising that the core CPI rate isn’t higher given the acceleration in its rental component. |

U.S. Consumer Prices Rent vs. Wages June 1965 - 2015(see more posts on U.S. Consumer Price Index, ) |

| Typically, when earnings and rents have diverged to this degree it has been in past recessions, and usually not anywhere near to this length of time. The average difference over the past 19 months dating back to July 2015 has been about 2%, which has a recession-like feel. During the Great “Recession” the 2% disparity between rent and wages lasted for just three months in 2009 (as both rental costs and wages decelerated sharply together), while during and after the dot-com recession it continued for just 12 months total. |

U.S. Consumer Prices Rent vs. Wages June 1965 - 2015(see more posts on U.S. Consumer Price Index, ) |

| It is a sharply stagflationary result, even where nominally wages and earnings remain stuck. Without a further sharp rise in oil prices, by as soon as March the lift on the whole CPI index will start to dissipate, so that by May it may have disappeared altogether (again, if oil prices remain as they are). Unlike the 2014-15 oil crash as well as the economic weakness related to what caused it (the “rising dollar”), the CPI above 2% may actually turn out to be “transitory.” |

U.S. Oil Prices May 2007 - 2017 |

Tags: base effects,Core Inflation,CPI,currencies,earnings,economy,Featured,Federal Reserve/Monetary Policy,full employment,inflation,Markets,newslettersent,oil prices,recession,rent,slack unemployment rate,U.S. Consumer Price Index,wages,WTI