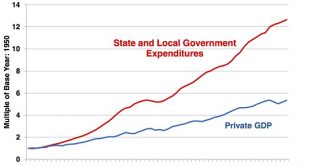

People love their big paychecks, but they also value their sanity. One of the most astonishing manifestations of disconnected-from-reality hubris is public authorities’ sublime confidence that employers and entrepreneurs will continue starting and operating enterprises no matter how difficult and costly it becomes to keep the doors open, much less net a profit. The average employee / state dependent reckons that the...

Read More »FX Daily, April 26: Greenback Consolidates Ahead of Q1 GDP

Swiss Franc The Euro has risen by 0.14% at 1.1373 EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe’s...

Read More »Oldest Swiss school in South America gets ministerial visit

Minister Cassis meets pupils at the Colegio Suizo Foreign Affairs Minister Ignazio Cassis, currently visiting Chile, has hailed education ties as he visited the country’s Swiss school abroad, the Colegio Suizo. The school, the oldest Swiss school abroad in South America and the only official Swiss school abroad in Chile, is celebrating its 80th anniversary this year. The “solid institution”, which offers a...

Read More »SWOT Analysis:Venezuela Sells $400 Million Worth Of Gold Bullion

Strengths The best performing metal this week was palladium, up 3.52 percent as CPM Group noted that the price could climb to $1,800 on supply constraints. Gold traders and analysts switched from bullish to mostly neutral or bearish on the yellow metal this week, according to the weekly Bloomberg survey. Turkey’s gold reserves reversed this week by rising $227 million from the previous week. The central bank’s holdings...

Read More »The Feedback Loop of Doom: When Mobile Creatives and Capital Abandon Unaffordable, Dysfunctional Cities

When the 4% who generate the jobs and tax revenues have had enough and leave, the effects quickly impact the 64%. At the end of any trend, everyone’s a true believer: this trend is so enduring, so broad-based, so based on unchanging fundamentals that it will never ever reverse. One such trend is the white-hot growth of housing, employment, tax revenues, etc. in major urban magnets for global capital and talent: you know...

Read More »FX Daily, April 25: Equities Waiver, the Dollar Does Not

Swiss Franc The Euro has fallen by 0.12% at 1.1364 EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After closing at record highs on Tuesday, the S&P 500 slipped yesterday, and the Dow Jones Stoxx 600 snapped an eight-session advance. Asia followed suit, with the Shanghai Composite posting its biggest loss (~2.4%) in over a...

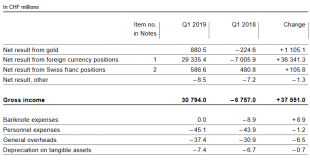

Read More »SNB Results: Big Win After Big Loss in Q4 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »Switzerland’s workforce participation – Swiss versus foreigners

© Arturoosorno | Dreamstime.com In 2018, 68.5% of the nation’s residents aged 15 or older was working, 1.5% more than in 2010. This rise was largely driven by an increase in the percentage of women in the workforce. In 2010, 60.0% were working. By 2018, 62.9% were, a rise of 2.9%. On the other hand, the overall percentage of men working declined slightly (-0.1%) to reach 74.2% by 2018. Swiss versus foreigners Overall,...

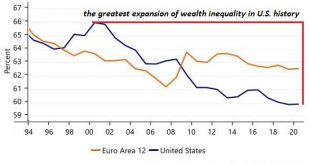

Read More »If “Getting Ahead” Depends on Asset Bubbles, It’s Not “Getting Ahead,” It’s Gambling

Given that the economy is now totally and completely dependent on inflating asset bubbles, it makes no sense to invest for the long-term. Beneath the endlessly hyped expansion in gross domestic product (GDP) of the past two decades, the economy has changed dramatically. The American Dream boils down to social and economic mobility, a.k.a. getting ahead through hard work, merit and wise investments in oneself and one’s...

Read More »FX Daily, April 24: Dollar Bloc in Focus, while Germany’s IFO Disappoints

Swiss Franc The Euro is unchanged at 1.1448 EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The record high close for the S&P 500 failed to lift global equities. Far East trading was mixed. The Nikkei opened strong and closed weaker, while the Shanghai Composite began softer and closed firmly. Australian shares and bonds...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org