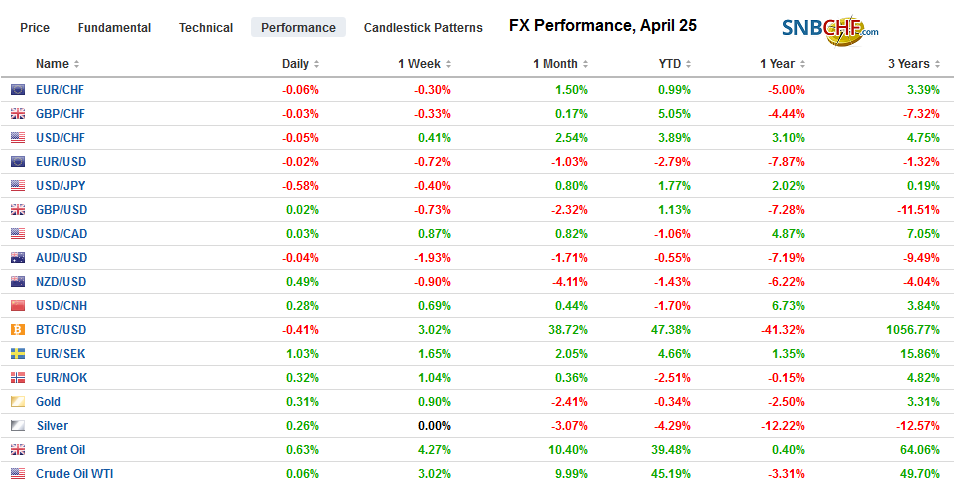

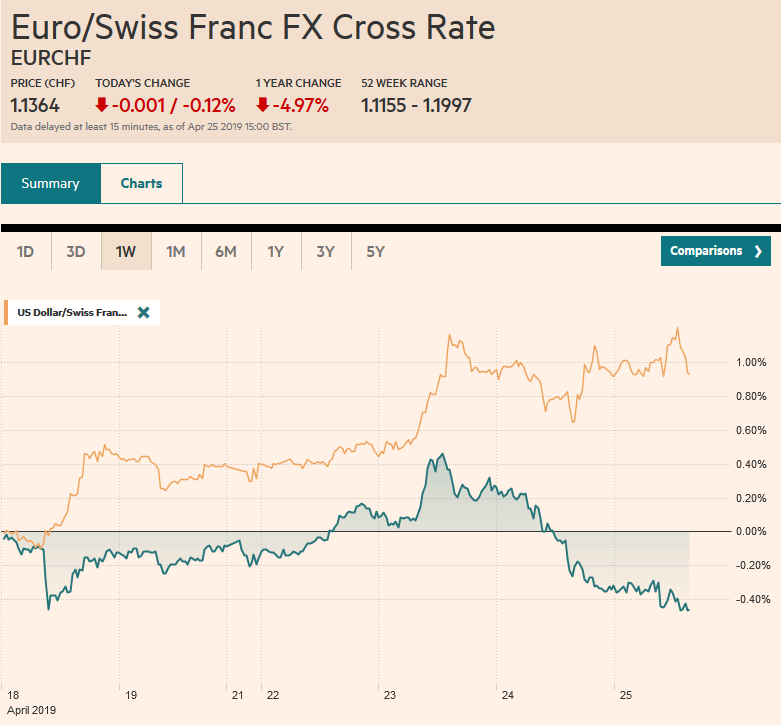

Swiss Franc The Euro has fallen by 0.12% at 1.1364 EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After closing at record highs on Tuesday, the S&P 500 slipped yesterday, and the Dow Jones Stoxx 600 snapped an eight-session advance. Asia followed suit, with the Shanghai Composite posting its biggest loss (~2.4%) in over a month. It is off about 4.6% this week, which if sustained tomorrow, would be the largest loss in six months. European stocks are heavy today, led by information, materials, and consumer staples. European bank earnings have been mixed, and shares are broadly lower. US stocks are little changed. Deutsche and

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Argentina, Bank of Japan, Featured, newsletter, Riksbank, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.12% at 1.1364 |

EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: After closing at record highs on Tuesday, the S&P 500 slipped yesterday, and the Dow Jones Stoxx 600 snapped an eight-session advance. Asia followed suit, with the Shanghai Composite posting its biggest loss (~2.4%) in over a month. It is off about 4.6% this week, which if sustained tomorrow, would be the largest loss in six months. European stocks are heavy today, led by information, materials, and consumer staples. European bank earnings have been mixed, and shares are broadly lower. US stocks are little changed. Deutsche and Commerz announced their merger talks have ended. Bond yields are firmer, though the 10-year German Bund still has a negative yield. Swedish bonds react positively to the dovish Riksbank, and the 10-year is off five basis points to 32 bp. The dollar remains in demand and is firm against nearly all the major and emerging market currencies. The yen is the notable exception, as unwinding short funding positions appears to be offsetting the impact of a dovish BOJ statement. The South Korean won solidified its hold as the worst performing Asian currency year-to-date -3.85%), with a 0.85% drop following the unexpected contraction in Q1 GDP. In contrast, China’s yuan is the best performer in Asia, rising 2% this year, which is more than any of the major currencies. |

FX Performance, April 25 |

Asia Pacific

The Bank of Japan extended its forward guidance by indicating that it will not raise rates at least through next spring. Previous it had indicated no hike for an extended period. The BOJ also admitted that it is unlikely to achieve its inflation target for three more years. Iy also downgraded its growth outlook. Although Governor Kuroda played down the need to alter the JREIT purchases, they have fallen. On the other hand, the decline in ETF purchases seems to be more a function of lack of opportunity given the performance of the Nikkei, it has advanced in four of the past five weeks before this week. However, in one of the few surprises, the BOJ indicated it would explore the launching of a facility that would lend the ETFs back to the market. The BOJ owns about 3% of the Japanese stock market but accounts for 70-80% of the ETF market, according to Kuroda and bid-offer spreads appear to have widened.

The South Korean economy unexpected contracted in Q1. The 0.3% decline contrasts with expectations of an expansion of the same magnitude. Investment in facilities collapsed by 11% quarter-over-quarter. South Korea exports around 50% of GDP and exports look to have fallen here in April for the fifth consecutive month. Export volumes were off 2.6% in Q1 after a 1.5% fall in Q4 18. Imports fell 3.3% in Q1 after a 1.5% decline in Q4 18. Private spending rose a miserly 0.1%. Last week the central bank cut its 2019 growth forecast and offered a supplemental budget on top of the already record large regular budget. Earlier this week, foreign investors had been buyers of Korean shares, but the selling today offset the same net buyers earlier. Still, this month foreign investors bought more than $2 bln of Korean shares, edging out Taiwan, after being small sellers in February and March.

The dollar made new highs for the year yesterday against the Japanese yen, popping up to JPY112.40. The breakout was premature, and the greenback is below JPY112.00 again. The dollar has been to JPY111.75. The week’s low is about JPY111.65. There are nearly $3 bln in expiring options struck between JPY111.40 and JPY111.50, and $1.3 bln at JPY112.00. Australia’s local markets are closed today, but the Australian dollar has been given no reprieve. It briefly traded below $0.7000 for the first time since January 4, as the market reacts to the low Q1 CPI and brings forward the rate hike the RBA has still not embraced. It has stabilized a little above $0.7000, but the move may not be over. Immediate resistance is seen near $0.7025.

Europe

A dovish Riksbank has sent the krona reeling. It is off around 1.2% against the dollar, bringing the loss this year to 7.3%, giving it the dubious honor of being the weakest major currency, and globally third worst behind Argentina and Turkey. The central bank pushed out its next hike, keeping interest rates below zero for longer than expected and extended its bond purchases until the end of next year. The Federal Reserve finished the bond purchases before hiking rates. Other central banks are expected to follow the sequence. Sweden is an exception. Rather than the next hike coming around September, it sees the next move late this year or early next year. It sees the repo rate averaging 0.4% in Q2 2020. In February it was projected to be 23 bp.

The Tories retreated from its threat to change to the party rules to force Prime Minister May out. She survived a vote of confidence within the party at the end of last year, and that should prevent another challenge before the end of this year. Many Tories object to a second referendum on the grounds that it would violate the sanctity of the first referendum results but thinks nothing of voting for the same Withdrawal Bill in Parliament three times already, and possibly a fourth. Threatening to change the rules in the middle of the game also did not insult their sense of democracy. May has offered to resign once Brexit is passed, but as this is looking difficult, to say the least, many in the party apparently want a date certain in Brexit does not pass. Some play down the importance of May’s departure, but many Tories seem to think otherwise, and Boris Johnson, a divisive figure, is seen as her most likely successor. That would increase the risk again of a no-deal exit.

We had thought the euro’s breakdown would come next week, with the FOMC and US jobs data underscoring the divergence between the US and Europe. However, the euro dropped through $1.12 and record a new 18-month low yesterday near $1.1140 and has edged a little lower today. There is a 595 mln euro option struck at $1.1150 that expires today and a little more than 635 mln euros at $1.1170. The $1.1180-$1.1200 area that had been support is now likely resistance. The next big target is $1.10. Sterling also can’t sustain the barest of upticks. In the first two sessions of the week, sterling straddled $1.30. Yesterday and today, it is straddling $1.29. It is lower for the fourth consecutive sessions and has lost to the dollar in seven of the past eight sessions. The next target is $1.28.

America

The US dollar had been mostly confined to a CAD1.33-CAD1.34 trading range this month. The greenback moved above the range a day before the Bank of Canada meeting. The Bank of Canada was more dovish than the market expected. The US dollar’s broadly firmer tone coupled with the Bank of Canada saw CAD1.3520 yesterday. It remains there now. The year’s high is near CAD1.3665, and that is the next major technical target.

For the first time since the end of 2017, the Bank of Canada dropped its reference to the need for higher rates. Just as importantly, it shaved its estimate of the neutral rate by 25 bp to 2.25%-3.25%. The BOC also slashed this year’s GDP forecast by a third to 1.2% from 1.7% and assumed little growth in Q1. Governor Poloz continues to argue the slowdown is not a prelude to a more severe downturn, and the central bank kept its 2020 and 2021 economic forecasts unchanged.

In the sell-off in emerging markets, Argentine assets and currency got hit hard. Investors are worried that the country could default for the third time in two decades. The cost of insurance (credit default swaps) surged by 17% yesterday, according to indicative prices. Current pricing is consistent with an almost 60% chance fo default. The peso fell more than 3.5%. President Macri’s support ahead of the October election is falling, and there is speculation that Cristina Kirchner could return. Policies, real and anticipated, appears to offset in full and more the country’s $56 bln line of credit from the IMF and the $76 bln in reserves.

The US reports weekly initial jobless claims, durable goods orders, and the Kansas City Fed’s manufacturing index. Recall that weekly jobless claims are near 50-year lows, and although long-term comparisons need to be taken with the proverbial grain of salt due to qualification changes over the year, the labor market remains robust. The April non-farm payroll report is out at the end of next week, and the early call is for around 185k increase. Durable goods orders are expected to have rebounded in March from a soft February. The risk may be on the downside due to Boeing, but ahead of tomorrow’s first official look at Q1 GDP, today’s report may not have much impact.

Mexico is expected to report a flat retail sales report for February after a 1.9% jump in January. However, with inflation (yesterday) coming out on the firm side of expectations, the central bank cannot yet respond to signs of economic weakness. The peso bore the burden. The dollar moved back above MXN19.00 for the first time since April 8. A convincing move now above MXN19.12 may see MXN19.20.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Argentina,Bank of Japan,Featured,newsletter,Riksbank,South Korea