Given that the economy is now totally and completely dependent on inflating asset bubbles, it makes no sense to invest for the long-term. Beneath the endlessly hyped expansion in gross domestic product (GDP) of the past two decades, the economy has changed dramatically. The American Dream boils down to social and economic mobility, a.k.a. getting ahead through hard work, merit and wise investments in oneself and one’s family. The opportunities for this mobility in the post World War 2 era broadened as civil rights and equal rights expanded. The 1970s saw a disruption of working-class mobility as high-paying factory jobs disappeared, leaving services jobs that paid less or required more training, i.e. a college

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

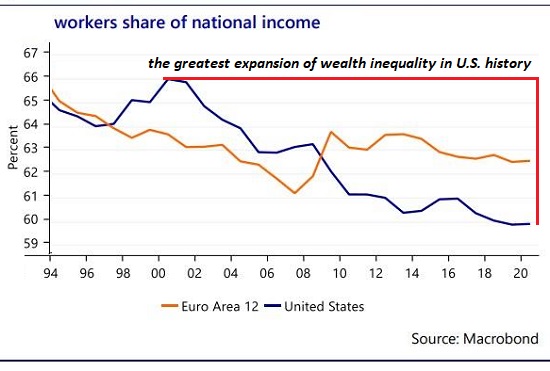

| After the mortgage-securitization-fraud-housing bubble popped, a secular trend– wages for the bottom 95% of wage earners stagnating–accelerated. “Getting ahead” via earning a college diploma, working hard and counting on merit no longer worked; families with privileges and capital got wealthier, and everyone else found the purchasing power of their earnings declined even as stocks and housing soared.

The only way to “get ahead” in a globalized, financialized economy is either 1) earn at least $200,000 a year from one’s labor or 2) gamble in the inflating bubbles of stocks and housing. In high-cost regions, even $200,000 isn’t enough to get ahead (i.e. buy a crumbling bungalow on a tiny lot for $800,000) if the wage-earner has student loans and/or children; the household needs two earners making top-5% salaries. The more money the central banks throw at stock-housing asset bubbles, the higher they loft, a process that has pushed housing in high-cost regions out of reach of all those with average jobs and incomes. So much for “getting ahead.” |

Workers share of national income 1994-2020 |

| The economy has changed dramatically for the worse: getting a graduate degree no longer guarantees getting ahead (millions of other workers globally have the same credentials); working hard is equally iffy, and traditional investments in one’s family either no longer yields gains (higher education) or they are gambles in the guise of “investments” (housing).

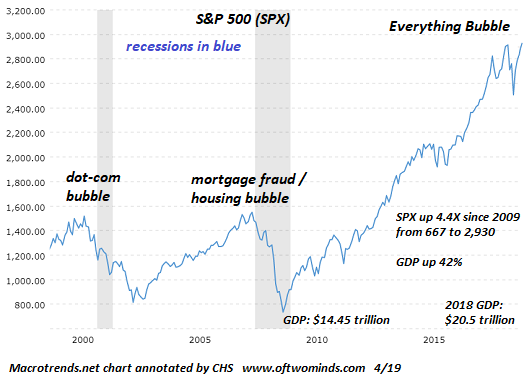

Given that the economy is now totally and completely dependent on inflating asset bubbles, it makes no sense to invest for the long-term: a short-term gambling mentality is required to avoid getting destroyed when the bubble-du-jour pops. Everyone who believes bubbles never pop, they only expand forever and ever, has never looked at a chart of the S&P 500 (SPX), which illustrates that bubbles always pop, destroying the capital of all who neglected to sell at the top. |

S&P 500, Everything Bubble, 2000-2015 |

Tags: Featured,newsletter