. The pound is now trading close to a 6 week high to against the Swiss franc which has come as welcome news to the Swiss central bank. Swiss policy makers appear to favour a weaker currency as they aim to control low inflation. Inflation in Switzerland has remained below 1% for quite a while even though interest rates have remained in a negative territory. Since the start of the year as markets have lacked volatility...

Read More »Over a third of Swiss jobs are part-time

About 80% of women in Switzerland work, and of these, about 40% work part time The number of people working in Switzerland is on the rise. Meanwhile, part-time work is much more widespread in Switzerland than in the rest of Europe. In Switzerland, 84.2% of the population aged 15 to 64 had a job in 2018 – an increase of 2.9 percentage points since 2010. Within the European Union (EU), only Iceland has a higher level of...

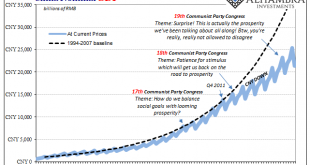

Read More »The Eurodollar, Unfortunately, Is What Is Rebalancing China’s Services Economy

If the “equation” CNY DOWN = BAD is valid, and it is, then what drives CNY downward in the first place? In conventional Economics, authorities command the currency to affect the level of exports. In reality, that’s not at all how it works. The eurodollar system of shadow money is almost purely calculated risk versus return. Before August 2007, everywhere there was believed (far) more return than risk. It’s the nature...

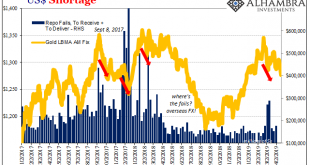

Read More »COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge. Corroboration and consistency are paramount. Gold had been...

Read More »The Two Faces of Inflation, Report 22 Apr

We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees. The producer may give you less milk...

Read More »FX Daily, April 23: Oil Extends Gains While Markets Await Fresh Incentives

Swiss Franc The Euro has risen by 0.15% at 1.1447 EUR/CHF and USD/CHF, April 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Financial centers that have been closed for the extended holiday have re-opened, but the news stream is light and market participants are digesting developments and positioning for this week’s central bank meetings and the first look at Q1...

Read More »Geneva bans sale of single-use plastic on public land

Soon to be history, at least at events in Geneva Starting in 2020, the city of Geneva will prohibit the sale of disposable plastics at events as well as at sales points on public property – a year ahead of a similar EU ban. The new law will apply to kiosks, terraces, vending vans and ice cream parlours, as well as to all city-approved events held on public property. Banned products include plastic straws, cutlery, cups...

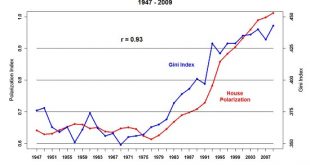

Read More »How Empires Fall: Moral Decay

There is a name for this institutionalized, commoditized fraud: moral decay. Moral decay is an interesting phenomenon: we spot it easily in our partisan-politics opponents and BAU (business as usual) government/private-sector dealings (are those $3,000 Pentagon hammers now $5,000 each or $10,000 each? It’s hard to keep current…), and we’re suitably indignant when non-partisan corruption is discovered in supposed...

Read More »Cool Video: Discussion of the Deflationary Risks in Japan and Brexit

[embedded content] I joined CNBC Asia’s Amanda Drury and Sri Jegarajah via Skype earlier today as the new week was beginning in Asia. In this three minute clip, we discuss the outlook for the BOJ and sterling. Most of the rise in Japan’s inflation is due to food and energy prices. Despite an aggressive balance-sheet expansion effort, the BOJ has missed its target by a long shot. It appears to have all but given up on...

Read More »FX Daily, April 22: Surge in Oil Punctures Holiday Markets

Swiss Franc The Euro has risen by 0.16% at 1.1424 EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: With many centers closed for the extended holiday, the calm in the global capital markets has been punctuated by reports that the US is considering ending its exemption for eight countries to have bought Iranian oil over the past six...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org