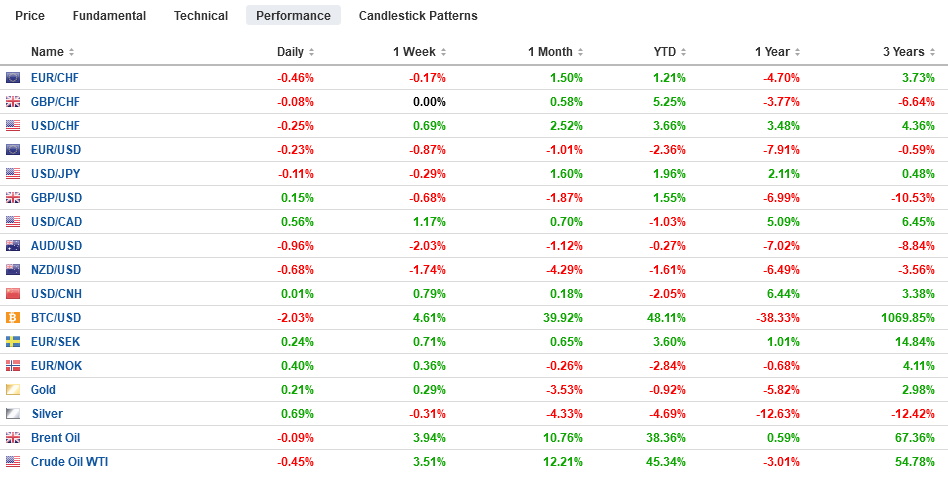

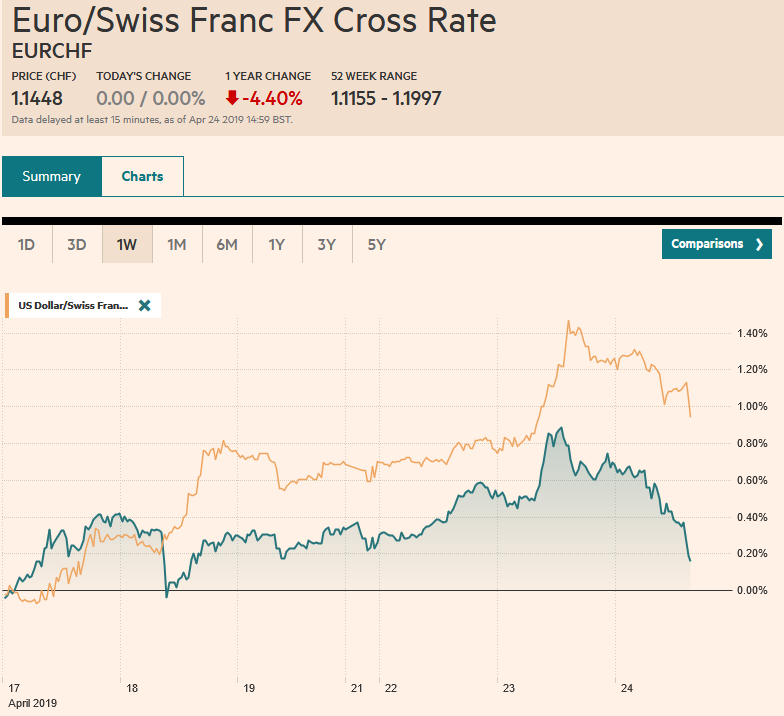

Swiss Franc The Euro is unchanged at 1.1448 EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The record high close for the S&P 500 failed to lift global equities. Far East trading was mixed. The Nikkei opened strong and closed weaker, while the Shanghai Composite began softer and closed firmly. Australian shares and bonds rallied on the back of mild inflation, while the Australian dollar tumbled. Oil in easing for the first time in four-sessions and this is weighing on benchmark 10-year yields were are one-two basis points lower. Europe’s Dow Jones Stoxx 600 has an eight-day rally on the line. It has only retreated in three

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Bank of Canada, Featured, FX Daily, Germany IFO Business Climate Index, Germany IFO Business Expectations, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro is unchanged at 1.1448 |

EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The record high close for the S&P 500 failed to lift global equities. Far East trading was mixed. The Nikkei opened strong and closed weaker, while the Shanghai Composite began softer and closed firmly. Australian shares and bonds rallied on the back of mild inflation, while the Australian dollar tumbled. Oil in easing for the first time in four-sessions and this is weighing on benchmark 10-year yields were are one-two basis points lower. Europe’s Dow Jones Stoxx 600 has an eight-day rally on the line. It has only retreated in three sessions this month. It is slightly lower today past the midway point in today’s local session. The US dollar is firm against most of the majors and nearly all the emerging market currencies but the Chinese yuan. The dollar is near the highs for the year against the Turkish lira (~TRY5.88) and is near the highs for the month against the South African rand (~ZAR14.35). The Australian dollar is the weakest of the majors, off around 0.8%, while the yen and Swiss franc are steady to slightly higher. Disappointment with the German IFO survey kept the euro on the defensive, while sterling is near two-month lows. |

FX Performance, April 24 |

Asia Pacific

Soft Australian inflation data boosted the likelihood of a rate cut and sent the Australian dollar below $0.7030 to its lowest level since mid-March. Consumer prices were unchanged in Q1. The median forecast in the Bloomberg survey was 0.2% after a 0.5% gain in Q4 18. This translate to a 1.3% year-over-year pace, down from 1.8%. The underlying measures softened as well. Australia’s two-year yield tumbled 15 basis points to 1.30%. The cash rate sits at 1.5%. The pendulum of market expectations has swung from around a 1 in 9 chance of cut next month at the end of last week to better than even money now.

The market is trying to decipher the policy signal of the injection of liquidity by the People’s Bank of China via the targeted medium-term lending facility. Many see this as a sign of restraint and reluctance to ease policy broadly. We are hesitant to read much into this operation. Officials surprised at the start of the week by announcing the May 1 holiday would be extended for three days. Western press accounts play up official wariness of unrest and report some types of censorship have risen (e.g., some music removed from streaming platforms and controls on academics have tightened). The May Fourth Movement’s 100-year anniversary is the ostensible catalyst. Although the May Fourth Movement gave rise to modern China and the Communist Party claims to be the heir, the vision of universal and individual freedoms has withered and left a gap between the CCP and the people, which Chinese leaders seem well aware of, even if it is an example of affirmation through negation. Then in June (June 4) is the 50th anniversary of the violent suppression of the Tiananmen Square demonstration.

The dollar continues to hover around JPY112.00. Today it is holding in a quarter yen range below this nemesis. It had closed a few days near the middle of the month above JPY112, but there has not been a convincing break. A convincing break of JPY111.60 may suggest the market has given up for the moment. The Australian dollar was testing the upper end of its range last week near $0.7200. After the soft CPI, the Aussie was sold through $0.7030 were some bids emerged. The $0.7060-$0.7080 should offer resistance. Note that the lower Bollinger Band (two standard deviations below the 20-day moving average) is near $0.7050 today.

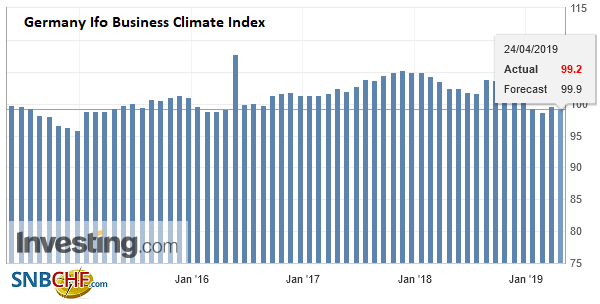

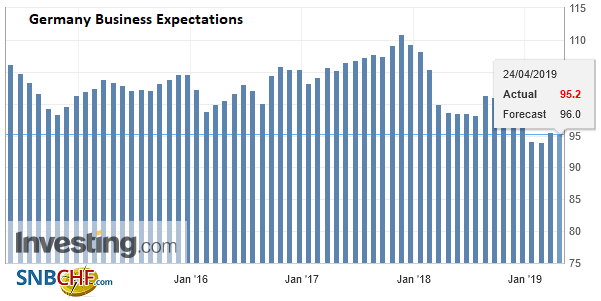

GermanyGermany disappointed again. Sentiment, as picked up by the IFO survey, deteriorated in April, suggesting that Europe’s largest economy is continuing to struggle with its manufacturing and trade. The weakness is carrying into Q2. The overall assessment of the business climate slipped back to 99.2 from a revised 99.7 in March (from 99.6). Note that this measure has increased only twice since the middle of last year–once last August and once in March. |

Germany Ifo Business Climate Index, April 2019(see more posts on Germany IFO Business Climate Index, ) Source: Investing.com - Click to enlarge |

| Measures of the current assessment and expectations both retreated. That said, the pessimism may be checked by news that sentiment in the service sector has risen to a four-month high. |

Germany Business Expectations, April 2019(see more posts on Germany IFO Business Expectations, ) Source: Investing.com - Click to enlarge |

The UK government talks with Labour do not appear to be going anywhere quickly. Prime Minister May seems to be of two minds. After the Withdrawal Bill failed to draw much support from the Tories for the third time, May has made some overtures toward Labour, but reports indicate she is unwilling to make the necessary concessions, such as a customs union. Perhaps, this is because she is using talks with Labour to force the Conservatives to back her. Reports are suggesting that May could offer her bill again in a way to allow amendments to be attached that might enable it to pass. We are not particularly hopeful that May’s tactics will succeed. Indeed, it may not be original, but the end of May might very well be the end of May.

The euro has traded below $1.12 during five sessions this year, including today, and has consistently found bids. Thus far, it has not closed below it once. There is an option struck at $1.12 for 630 mln euros that will be cut today. Initial resistance is pegged near $1.1230 and then $1.1250. On the downside, note that the euro has held above the March low near$1.1175 and the low from earlier this month around $1.1185. Today is the fifth session that sterling is trading below $1.30, which had been its shelf (on a closing basis) since the early in the second half of February. Resistance is now seen near $1.2950. Psychological support may be seen near $1.29, but strong chart support may not be found until closer to $1.28.

America

The Bank of Canada meets today, and no one expects a change in policy. The central bank’s new forecasts and comments by Governor Poloz will be the focus, within the context of the Canadian dollar being sold to new lows for the month. As of April 16, speculators in the IMM futures has the largest net short Canadian dollar position in two months. The gross longs are at their smallest level(~18.3k contracts) since 2009. The gross shorts have risen by around 10k contracts since early March, and around 67.4k contracts, it is still well below the January high near 85k contracts. The macro picture is mixed. Business investment and trade has not improved as expected, while the consumer is proving more resilient than anticipated. Overall, the economy appears to be doing better than the 0.8% the Bank of Canada. Inflation has recovered back toward 2% like officials expected. What the pundits will debate is the shade of neutrality, and the recognition of stronger Q1 growth prevent a dovish hold judgment.

Consider the three macro-drivers of the US-Canadian dollar exchange rate: the two-year interest rate differential, oil, and the general risk appetite. The rate differential narrowed by about 10 bp in March but it recent weeks has recouped half of that it lost. The peak near 85 bp in early March was the largest US premium since the financial crisis. Oil prices are at six-month highs amid supply concerns, but note that on purely directional terms, over the past 60-day, the correlation is positive-that is to say the US dollar and WTI are more often moving in the same direction. Over the past five years, there have been seven such episodes. Risk appetites seem unsatiated judging from the performance of equities, illustrated by the new record high close in the S&P 500, the 15.5% gain in MSCI World Index of developed markets and the nearly 13% rally in the MSCI Emerging Markets equity index.

Favorable earnings helped lift US shares yesterday, and the S&P 500 posted a record closing high. The NASDAQ managed to post a new record high and a new closing high. The earnings reports continue today with big names, like Facebook, Microsoft, Boeing, and Tesla. The US 10-year yield peaked last week near 2.60%. We had noted the significance of this area. Now the market appears to be fishing for the lower end of a new range. It may be found near 2.50%. A big build (6.8 mln barrels) of US oil inventory, according to the API estimate, and Saudi’s pledge to ensure the enforcement of the US embargo against Iran does not disrupt the oil market is seeing prices consolidate today. The US dollar is building on yesterday’s gains against the Canadian dollar. It has surpassed last month’s high near CAD1.3450 to approach the February high a little shy of CAD1.3470. The high for the year was set in early January by CAD1.3660. The Dollar Index recorded a new 20-month high yesterday. It is consolidating in the upper end of yesterday’s range. Initial support is seen in the 97.50 area. Lastly, we note the greenback is testing resistance in the MXN19.00-MXN19.02 area against the peso. A move above there could see a run toward MXN19.20.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Bank of Canada,Featured,FX Daily,Germany IFO Business Climate Index,Germany IFO Business Expectations,newsletter