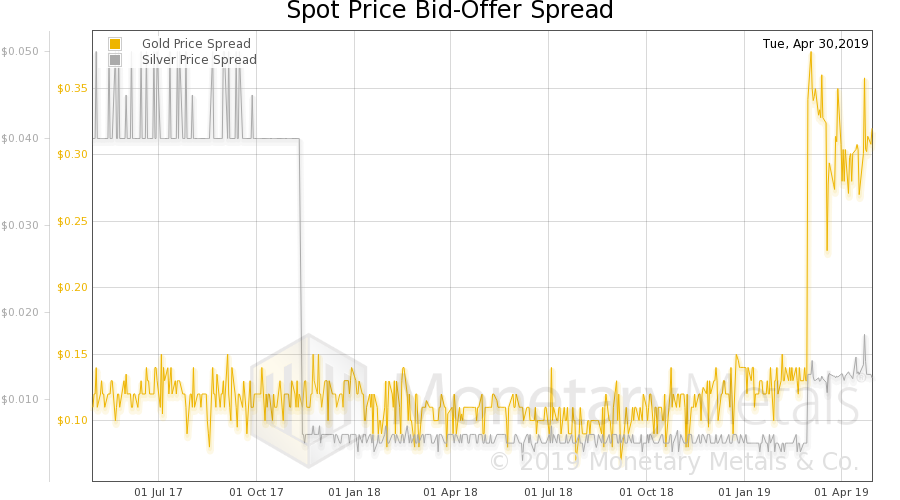

The bid-ask spread of both (spot) gold and silver has blown out. Both, on March 1. In gold, the spread had been humming along around 13 cents—gold is the most marketable commodity, and this is the proof, a bid-ask spread around 1bps—until… *BAM!* It explodes to around 35 cents, or two and half times as wide. On the same day, silver went from half a cent to 1.5 cents, or about triple. We zoomed out far enough—it does not interfere with chart readability in the slightest—to see the last time the silver spread changed radically. That was Nov 13, 2017, and the spread had been three times higher again (i.e. over 4 cents). Nothing happened to the price at that time, though a few weeks later the price began dropping and

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basel III, bid-ask spread, Featured, Gold, Liquidity, marketability, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The bid-ask spread of both (spot) gold and silver has blown out. Both, on March 1.

| In gold, the spread had been humming along around 13 cents—gold is the most marketable commodity, and this is the proof, a bid-ask spread around 1bps—until… *BAM!* It explodes to around 35 cents, or two and half times as wide. On the same day, silver went from half a cent to 1.5 cents, or about triple.

We zoomed out far enough—it does not interfere with chart readability in the slightest—to see the last time the silver spread changed radically. That was Nov 13, 2017, and the spread had been three times higher again (i.e. over 4 cents). Nothing happened to the price at that time, though a few weeks later the price began dropping and then it recovered as quickly as it dropped. The last time the silver spread spiked up (from around 3 cents to 10 cents) was April 2006. Then, the price of silver was rising. We do not believe that a change in spread necessarily means a price drop or rise. That is too facile, and it does not work like that. It is possible that this rise is an anomaly. We don’t think this is likely, as it is affecting both metals and has endured so far for two months. But we mention it for completeness. |

Spot Price Bid-Offer Spread, 2017-2019 |

Assuming it’s real, it means that the metals have become less liquid. This could be due to a decline in trading volumes at the institutional level, to correspond with moribund volumes at retail. Or it could be due to consequences of Basel III regulations, which make it more expensive for banks to hold gold.

There was no noticeable change in the gold basis continuous on March 1. Nor the silver basis continuous. So there is not a big shift in supply and demand fundamentals to correspond with the change in spread.

If we had to take a guess, we would assume the culprit is low (or at least not high, and not rising) volumes, combined with regulation that forces banks to add useless ingredients. This may be early implementation of Basel III, or other regulations.

© 2019 Monetary Metals

Tags: Basel III,bid-ask spread,Featured,Gold,Liquidity,marketability,newsletter