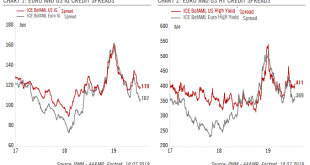

Despite the impressive year-to-date performance of corporate credit, we remain prudent about prospects in the remainder of 2019. Corporate bonds have posted stellar total returns year to date, thanks to the positive combination of lower sovereign yields and tighter credit spreads. While high yield (HY) bonds have performed slightly better than investment grade (IG) ones on both sides of the Atlantic, the additional...

Read More »Switzerland has the Highest Underemployment Rate in Europe

Swiss women are particularly keen to work more. - Click to enlarge 2018, 7% of Switzerland’s workforce claimed they would like to work more. Women are the most affected. According to the Federal Statistical Office (FSO) figures publsihed on Tuesday, Switzerland’s labour pool has 830,000 people. This includes 356,000 underemployed individuals, 231,000 unemployed and 243,000 people who are looking for work but not...

Read More »World growth forecast revised down

Signs of a potential global recession are appearing, such as a fall in fixed investment and industrial production and a build-up in unwanted inventories. We are revising down our world growth forecast. The effects of a negative shock dating back to early 2018 are still being propagated throughout the world economy. Sentiment was the first to be hit, but there have been increasing signs of a marked slowdown in hard data...

Read More »FX Daily, July 23: Debt Deal Help Lifts the Dollar

Swiss Franc The Euro has fallen by 0.32% at 1.097 EUR/CHF and USD/CHF, July 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The gains in US equities and the apparent US budget agreement has underpinned equities today and the US dollar. Asia Pacific equities recouped yesterday’s losses, and Europe’s Dow Jones Stoxx is posting gains for the third consecutive...

Read More »The Fake Economy, Report 21 Jul

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists. We frame it that way, because nearly everyone loves to tout GDP (though some do so only when it suits their political agenda). It is fashionable...

Read More »Semaña grande for Sánchez

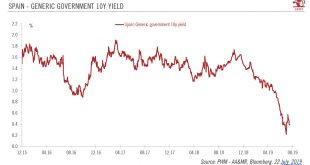

The interim Spanish prime minister, the socialist Pedro Sánchez, will aim to form a government this week. Outside the political noise, the Spanish economy continues to do well. April’s elections in Spain resulted in a fragmented parliament, making the formation of a government complicated. Acting prime minister Pedro Sánchez of the Socialist Party (PSOE) goes to parliament this week to seek backing for his bid to form a...

Read More »Swiss tourist chief warns against Europe-only strategy

Tourists from Asia are still outnumbered by guests from Europe and the US despite a growing number of Chinese and Indian holiday makers in Switzerland. (Archive picture) The director of Switzerland’s tourism marketing company has dismissed criticism that the country is overrun by Asian tourists. Martin Nydegger said concerns by the local population about too many tourists should be taken seriously. But the perception of...

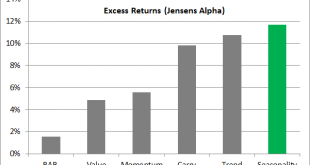

Read More »Scientific Long-Term Study Confirms: Seasonality is the Best Investment Strategy!

A Pleasant Surprise You can probably imagine that I am convinced of the merits of seasonality. However, even I was surprised that an investment strategy based on seasonality is apparently leaving numerous far more popular strategies in the dust. And yet, this is exactly what a recent comprehensive scientific study asserts – a study that probably considers a longer time span than most: it examines up to 217 years of...

Read More »FX Daily, July 22: Greenback is Mostly Firmer to Start New Week, while the Euro is Pinned near $1.12

Swiss Franc The Euro has fallen by 0.03% at 1.1007 EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new...

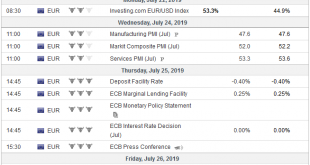

Read More »FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market’s attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa. Japan goes to the polls on July 21 to elect the upper chamber of the Diet. There...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org