Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists. We frame it that way, because nearly everyone loves to tout GDP (though some do so only when it suits their political agenda). It is fashionable to say variously that the Fed is doing a good job, Obama did a good job, and Trump is doing a good job. This is because GDP is up. It’s also because stocks and real estate are up. And because employment is up. We have shown that assets go up because interest rates go down. We have shown that GDP is

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basic Reports, capital consumption, capital destruction, Featured, GDP, newsletter, Newspeak, Orwell

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Folks in the liberty movement often say that the economy is fake. But this does not persuade anyone. It’s just preaching to the choir! We hope that this series on GDP provides more effective ammunition to argue with the Left-Right-Wall-Street-Main-Street-Capitalists-Socialists.

We frame it that way, because nearly everyone loves to tout GDP (though some do so only when it suits their political agenda). It is fashionable to say variously that the Fed is doing a good job, Obama did a good job, and Trump is doing a good job. This is because GDP is up. It’s also because stocks and real estate are up. And because employment is up.

We have shown that assets go up because interest rates go down. We have shown that GDP is not necessarily a measure of new production, that consumption of old capital is added in as well. We have shown that consuming capital is labor-intensive. That is, consuming capital provides jobs.

Consumption of Capital

Suppose someone earns $60,000. He could spend $100,000, by withdrawing $40,000 from his savings. Next year, he could spend another $100,000 if he racks up $40,000 in credit card debt. The first year, he consumes his own capital. The second year, he consumes someone else’s capital. At best, he will have to pay this capital back by consuming less than his income for several years (and he likely will not repay it).

It is harder to see it when there are 300,000,000 people aggregated into a single statistic. A household budget is not so complicated. Macroeconomics is rather more so.

We looked at the concept of a national balance sheet. If we could see how much spending is really capital consumption, then we could subtract that amount from GDP.

Or more.

Let’s look at a simple example. Harry Hapless is sailing in the south pacific, and a storm causes his boat to run into a reef. It sinks, and he swims to a nearby island. Devastated, he doesn’t know what to do other than accumulate food. So he spends his days spearing fish, and letting them dry in the hot wind which seems to constantly blow. The first year, he catches 730 fish. He eats one every day, and dries one to keep for later.

What is the GDP of his island? The economy—such as it is, with only one person and only the one commodity—has produced 730 fish. However, it consumes only 365. Is GDP 730 or 365? We’ll get back to that.

In any case, the next year, Harry looks at his heap of dried fish, and decides he does not have to work. So he sits on a rock, staring at the horizon in despair of ever seeing a rescue ship. Each day, he eats one fish.

Gross and Production

In order to discuss GDP for this island, we need to drill down into what it means. We won’t debate this based on the conventional definition. We have already shown in prior essays that the conventional definition is, at best, misleading. We want to drill down to the root. What ought we to be measuring?

GDP contains two important concepts. Let’s look at the second one first: product. Isn’t it interesting that a concept that is nominally about production has come to mean consumption?

Anyways in year one, production is 730. In year two, it is 0.

The other key concept in GDP is: gross. Compare and contrast with net.

In year one, gross production is 730. Or perhaps in the context of national account statements, this is akin to gross revenue. This was correctly stated as 730.

And net is now clear: net income. This is what’s left after consumption. In year one, gross production is 730, and net income is 365. Simple.

In year two, gross production is 0. But the net is actually -365. That is, we did not produce but we consumed. We removed 365 fish from the balance sheet, and got poorer (and closer to the edge of starvation). It is possible for those who do not toil, to eat! To consume without producing (in the present). At least for a while. They can consume what was accumulated in happier times, while the dried fish—the accumulated capital—holds out.

If Harry’s friend, David Dismale, were to look at the GDP of the island, he might say that GDP was 365 in each year (depending on factors outside the scope of this simple example). Does that feel right? Does it pass a basic sniff test?

The Purpose of GDP: Newspeak

So back to a proper reckoning of this macroeconomic statistic in the real world. It is not precise, and not really accurate, to say our rising-GDP economy is fake. Real people are flying on real planes to real hotels and eating real food in real restaurants that employ real chefs. Now we can express it more clearly. It’s not fake, it is unsustainable, based on consumption of capital.

The GDP statistic is not fake. We are sure that the government economists who gather and tally the data do so to the best of their ability. That’s not the problem (in the US, we will not discuss the incredible nominal GDP of the nominally communist countries). The problem is that GDP is a socialist tool touted by socialist tools (in many cases, unwittingly, AKA “useless idiots” as Vladimir Lenin is believed to have sneered).

A proper accounting of economic activity does not add consumption of capital—i.e. destruction—to production. GDP could be said to be a fake statistic, in the sense that it is measuring production + destruction.

If we can distinguish gross from net, and production from consumption, we might just have something.

We might have something like a national income statement, and a national balance sheet. The income statement could account for revenue and expenses. And the balance sheet would measure changes in liabilities and assets—i.e. equity, i.e. capital.

But we live in a world where this is actively avoided. The government keeps its books on the cash basis. This is illegal for any private business of more than $5 million revenues, or any private insurance business. Yet when the government takes in a dollar of insurance premium, against a certain obligation to pay $100 next year, it blithely books only the $1 income. Thus many people will insist that the government ran a budget surplus under President Clinton. We assure you that it was no surplus, if you account for the liabilities that were accrued during that time.

And we live in a world where credit is deemed to be money, where credit taken without means or intent to repay is called borrowing, where an increase in all asset prices due to a drop in the interest rate is deemed to be increasing wealth, where an endless game of musical chairs, each party buying the same chairs from the previous at higher prices is deemed to be investment, where eating the seed stocks is deemed to be economic growth, where the central bank’s interference in the market is deemed to be stabilizing the economy.

It should not be a surprise that those who profiteer on this system have developed a language to reinforce it. George Orwell was on to something, when he coined the term Newspeak. According to Wikipedia:

“…Newspeak limits the user’s communications (thought, spoken, and written) with a vocabulary that diminishes the intellectual range allowed…”

We propose to induct the word “GDP” into Newspeak. If one is limited to arguing if GDP has gone up or down, then one is left to assume up is good. At least it’s good, if the one double-plus-ungood thing does not occur: inflation. Rising prices are the one thing of which Newspeak allows criticism, or we should say, to which Nespeak deflects all would-be critical thought.

Keynes and Orwell would be looking at us, smiling, “good, good…”

And this is why we need to return to the gold standard: to return to honesty in credit.

Supply and Demand Fundamentals

Well, wasn’t this an interesting week! The price of gold was up a pedestrian $10, mere noise in the long-term signal. But in silver, we see plus one dollar. It was practically inevitable with the gold-silver ratio at an all-time high, after a big run up in the gold price with no corresponding run in silver. When the silver speculators get their game on, they can push the price up far more in percentage terms than in gold (which is a much larger, deeper, more liquid market).

This will be a short Report, due to Keith’s challenging travel schedule.

Monetary Metals is excited to be bringing the first gold bond to market. Please contact us if you are interested in investing.

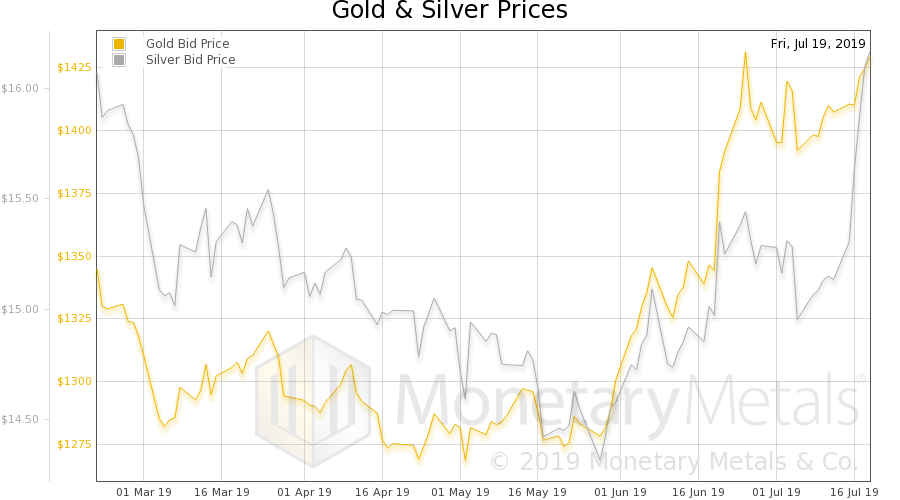

| Now let’s look at the only true picture of supply and demand for gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver prices, ) |

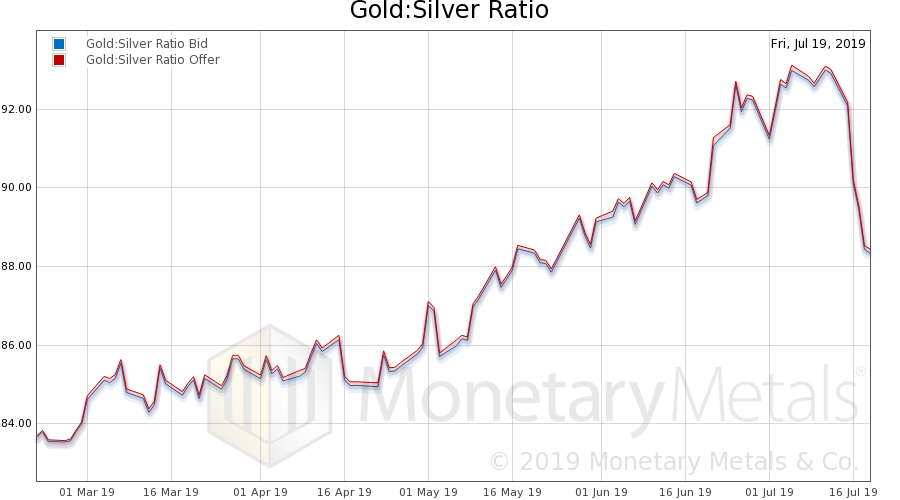

| Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio dropped substantially this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

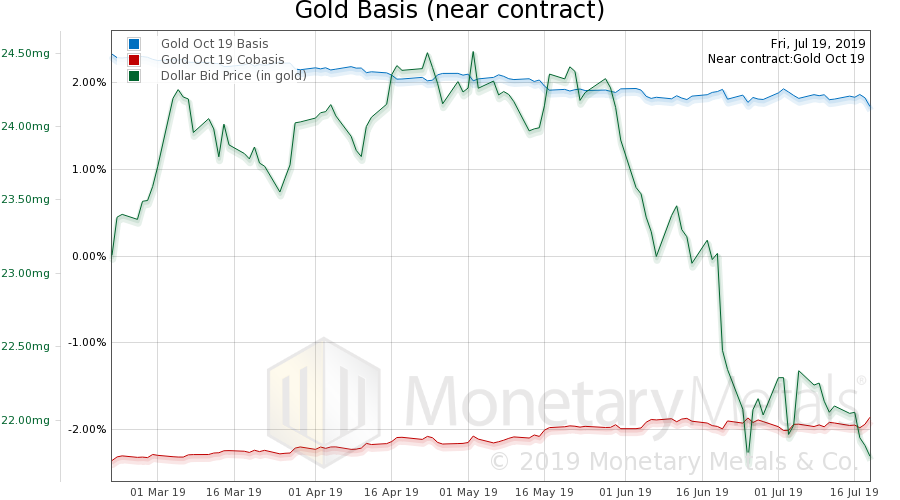

| Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

We see little change in the scarcity of gold (i.e. cobasis), and the price did not change that much either. The Monetary Metals Gold Fundamental Price fell $4 to $1,403. We note that the fundamental is below the market price for the first time since the end of 2017 (which was a brief spike down in the fundamental, a flash in the pan). |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

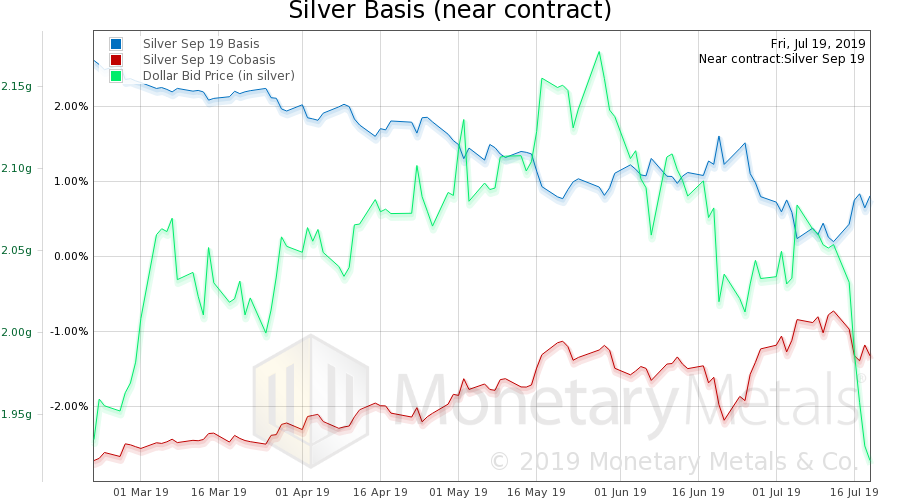

| Now let’s look at silver.

With silver, we can see the scarcity continuing to follow the dollar price. That is, silver becomes scarcer when it sells, and more abundant when it is bid up. The Monetary Metals Silver Fundamental Price moved up just as much as the market price, one dollar: from $15.52 to $16.50. The Monetary Metals calculated fundamental gold-silver ratio fell from 90.6 to 85.0. If this, too, is not just a flash in the pan, watch out! © 2019 Monetary Metals |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: Basic Reports,capital consumption,capital destruction,Featured,GDP,newsletter,Newspeak,Orwell