Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank, in einem früheren Interview mit cash. Die Schweizerische Nationalbank (SNB) misst Kryptowährungen wie Bitcoin wenig Potenzial zu. Die Chancen darauf, als Zahlungsmittel akzeptiert zu werden, sind aus Sicht der Zentralbank gering. Kryptowährungen hätten “eher den Charakter von spekulativen Anlageinstrumenten als von ‘gutem’ Geld”, sagte der SNB-Präsident in einer Rede an der Universität...

Read More »USD/CHF bounces from trend-line support on trade news

US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October. USD/CHF is currently trading 0.26% higher and bouning of trend-line support. The announcement that trade talks are back on track as given the markets the extra fuel needed to recover with respect to risk appetite. Currencies, such as the Yn and CHF, would otherwise benefit from investment, but in such a case that a trade deal could eventually emerge from the...

Read More »Will Everything Change in 2020-2025 or Will Nothing Change?

Any domino-like expanding crisis will unfold in a status quo lacking any coherent response. Longtime readers know I’ve often referenced The Fourth Turning, the book that makes the case for an 80-year cycle of existential crisis in U.S. history. The first crisis was the constitutional process (1781) following the end of the Revolutionary War, whether the states could agree on a federal structure; the 2nd crisis was the Civil War (1861) and the 3rd crisis was global...

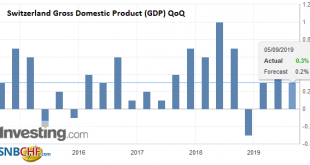

Read More »Switzerland GDP Q2 2019: +0.3 percent QoQ, -0.2 percent YoY

Switzerland’s GDP rose by 0.3% in the 2nd quarter of 2019, after increasing by 0.4% (revised) in the previous quarter.1 The development of domestic and foreign demand was weak, as in other European countries, which had a particularly negative impact on the service sectors. Switzerland Gross Domestic Product (GDP) QoQ, Q2 2019(see more posts on Switzerland Gross Domestic Product, ) Source: Investing.com - Click to enlarge Switzerland’s GDP rose by 0.3% in the...

Read More »FX Daily, September 05: Brexit becomes a Dog’s Breakfast as Dollar’s Correction Continues

Swiss Franc The Euro has risen by 0.79% to 1.0905 EUR/CHF and USD/CHF, September 05(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Dollar Index fell the most in three months yesterday and is experiencing mild follow-through selling today. With hopes that Hong Kong has turned a corner, news that in-person US-China talks will resume next month, and a no-deal Brexit is well on the way to being averted,...

Read More »Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul

◆ Where Does Gold Go From Here? — Ron Paul’s “Cautious” Prediction ◆ “Gold is an ‘insurance policy’ as the dollar will continue go down in value as it is printed” and it will end in a monetary “calamity” ◆ “Gold is not money due to any man-made laws. Gold is money despite man-made laws, and is a product of the voluntary marketplace” ◆ Ron Paul has a “cautious” and “modest” prediction for gold and encourages people to own physical gold not as a speculation but for...

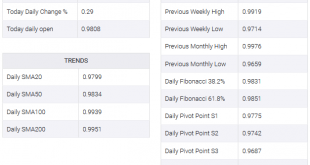

Read More »USD/CHF Technical Analysis: The ongoing corrective slide challenges 200-hour SMA support, around mid-0.9800s

Extends overnight retracement slide from an ascending trend-channel resistance. A follow-through selling has the potential to drag the pair towards channel support. The USD/CHF pair remained under some selling pressure for the second consecutive session on Wednesday and retreated farther from over one-month tops set in the previous session. The pair on Tuesday started retreating from a resistance marked by the top end of a short-term ascending trend-channel,...

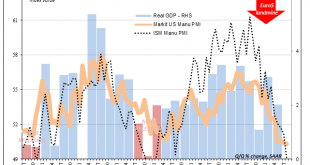

Read More »United States: The ISM Conundrum

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding. Back in November 2018, at just about 59 the overall index had still been close to its multi-decade high. Over the next nine months through the latest update for August 2019, it has shed almost 10 points....

Read More »FX Daily, September 04: HK Concession and Better EMU PMI Overshadows Self-Inflicted Trade and Brexit Woes

Swiss Franc The Euro has risen by 0.09% to 1.0835 EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites have been bolstered by three developments. The UK appears to have taken a tentative step away from leaving the EU without a deal. Hong Kong’s Chief Executive Lam has agreed to formally withdraw the controversial extradition measure that had been suspended. The...

Read More »USD/CHF Technical Analysis: 61.8% Fibo, 0.9822/17 Confluence on Sellers’ Radar

USD/CHF extends declines on the break of one-week-old support-line (now resistance). Sellers look for key technical levels amid bearish signals from MACD. Following its break of immediate support-line, the USD/CHF pair remains on the back foot while taking rounds to 0.9870 amid Wednesday’s Asian session. Sellers now aim for 61.8% Fibonacci retracement level of August month downpour, at 0.9854, as immediate support ahead of targeting 0.9822/17 confluence including...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637031895419073883-310x165.png)