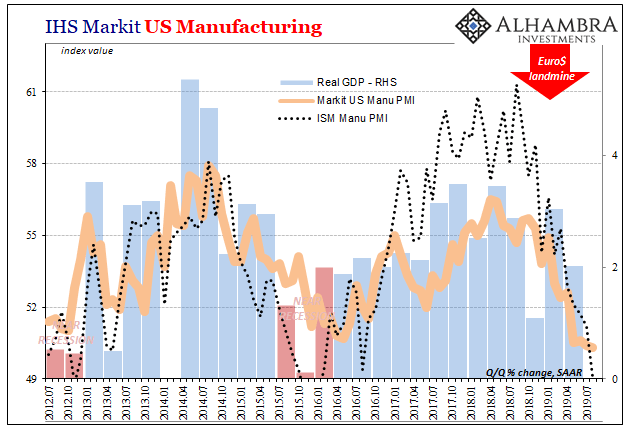

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding. Back in November 2018, at just about 59 the overall index had still been close to its multi-decade high. Over the next nine months through the latest update for August 2019, it has shed almost 10 points. Dropping into the 40s, still on the downswing through as late as August, it is a powerful rebuke to some of the more optimistic narratives that have been haphazardly put together as this year has developed the wrong way. U.S. ISM Manufacturing PMI, Markit Manufacturing PMI and GDP, July 2012 - August

Topics:

Jeffrey P. Snider considers the following as important: 5.) The United States, 5) Global Macro, bonds, currencies, economy, Featured, Federal Reserve/Monetary Policy, Global Growth, manufacturing, Markets, new export orders, newsletter, tariffs, Trade Wars, U.S. Gross Domestic Product, U.S. ISM Manufacturing PMI, U.S. Markit Manufacturing PMI, U.S. Treasuries

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding.

Back in November 2018, at just about 59 the overall index had still been close to its multi-decade high. Over the next nine months through the latest update for August 2019, it has shed almost 10 points. Dropping into the 40s, still on the downswing through as late as August, it is a powerful rebuke to some of the more optimistic narratives that have been haphazardly put together as this year has developed the wrong way. |

U.S. ISM Manufacturing PMI, Markit Manufacturing PMI and GDP, July 2012 - August 2019(see more posts on U.S. Gross Domestic Product, U.S. ISM Manufacturing PMI, U.S. Markit Manufacturing PMI, ) |

| The economy of 2018 was supposed to have been strong; unusually strong, in fact, since the major message had been how the US and global economy had finally shifted into a growth paradigm for the first time in more than a decade. Shaking of whatever lingering effects of the Great “Recession”, we were told that this time truly was different.

The only way to (try to) reconcile that view with 2019 was to claim “transitory” factors had temporarily disrupted the otherwise massive global boom. Since every single boom in modern economic history has had to overcome transitory factors of one kind or another, it was already a questionable assertion. What kind of unequivocally strong growth trend could and would be so seriously threatened by small and non-specific influences? These “cross currents” were supposed to have abated months ago. |

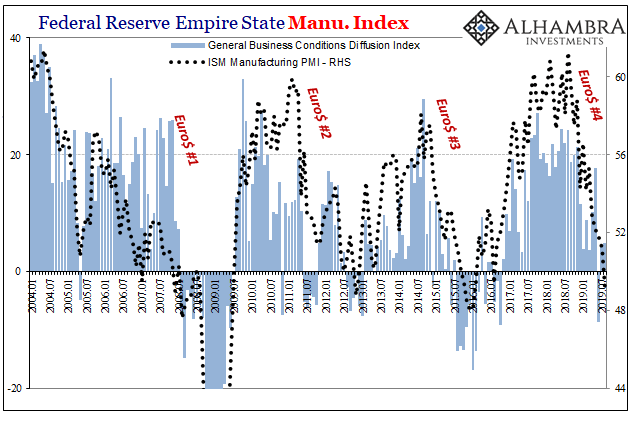

U.S. ISM Manufacturing and Fed Empire, January 2004 - August 2019(see more posts on U.S. ISM Manufacturing PMI, ) |

| Replaced by “green shoots”, the initial downswing evident all across the globe would have quickly disappeared and been replaced by a generalized upswing. The kind of thing maybe a single rate cut or two from the Fed would ensure.

The ISM dropping below 50 undercuts the notion – as well as another one related to it. In the absence of any monetary recognition, the only possible explanation for what we see has been “trade wars.” The geopolitics of protectionism don’t really amount to much which is why they’ve been classified with the other transitory stuff. But as the wrong-way global economy marches onward now through the third quarter of 2019, what else could it be? A few billion in US tariffs imposed on Chinese goods entering the country can’t account for a contraction or even a slowdown in the American manufacturing. Nor can China’s retaliation on mostly US agricultural products. Some last year had warned that beyond import levies, there might develop supply chain bottlenecks which would create raw material shortages and then hold back some production. A widespread industrial downswing here just isn’t consistent with the mechanics behind the trade wars. Nor are the components underneath the headline ISM. The category for New Export Orders, in particular, plunged nearly 5 points to 43.3 in August, down from an already weak 48.8. That’s why more and more mainstream accounts have had to appeal to non-specific qualifiers like trade tensions or “global growth concerns.” There is less demand for US goods which isn’t at all consistent with the main elements behind “trade wars.” One Economist for Bloomberg puzzled over today’s inconsistencies:

Is negative confidence and harmful currency being made negative and harmful by tariffs, or is currency (rising dollar) responsible for the broad and broadening damage to the whole global economy first in confidence then in activity which in the absence of explanation people can only see “trade wars” as a near enough plausible cause? The reason these “second-order impacts appear to be having the more substantial impact” is because they are the first order cause. In the absence of a monetary explanation, since the Fed “printed dollars” under four QE’s, the only way to try to explain the reversal in 2019 is to somehow make something very small into something huge. A relatively small amount of tariffs and the concerns for bottlenecks become trade tensions which is destroying confidence. Not just in terms of goods flowing this way into the US, but somehow for goods flowing out of the US into the rest of the world. It’s suspiciously convoluted because the dollar hasn’t been moved higher by sentiment over tariffs, it began to wreak havoc long before these were talked about seriously. The reason the global economy is weak, and therefore a lot less demand for US goods, is simply the global dollar shortage’s ravaging impact. The very kind we’ve seen three times before now. |

|

The ISM’s reverse is particularly noteworthy not just for its status in the mainstream view, but more so because of what it had suggested last year. It had been one of the very few indications actually consistent with the basic idea of a booming, different economy. The Manufacturing PMI had pushed up to more than 60 at one point, a high – for this one measure, anyway – not seen in a very long time.

It was highlighted and emphasized over and over and over for that very reason.

For it to now completely, totally reverse and embrace the opposite side and condition, that’s a huge blow to the boom, to the green shoots, and, underneath it all, to the mis-ordering of effects.

Why did the bond market react so harshly to August’s ISM? If the economy is no longer booming, if there weren’t any green shoots, and, most of all, if it isn’t really trade wars, then the potential for big trouble isn’t just talk. That’s for the Jay Powell and his one and done. Bonds and the ISM, the greater monetary conundrum.

Tags: Bonds,currencies,economy,Featured,Federal Reserve/Monetary Policy,global growth,manufacturing,Markets,new export orders,newsletter,tariffs,Trade Wars,U.S. Gross Domestic Product,U.S. ISM Manufacturing PMI,U.S. Markit Manufacturing PMI,U.S. Treasuries