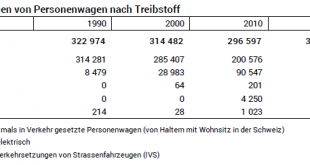

31.01.2020 – In 2019, 6 160 300 motor vehicles circulated on Swiss roads. This was 46 500 or 0.8% more than in the previous year. Three quarters of the entire fleet were passenger cars, including an increasing number of electric cars: of the 312 900 cars that were newly registered in 2019, 13 200 or 4.2% were purely battery operated. This meant that new registrations of electric cars increased substantially year-on-year (+143.9%) while the number of petrol-driven...

Read More »Second-Order Effects: The Unexpectedly Slippery Path to Dow 10,000

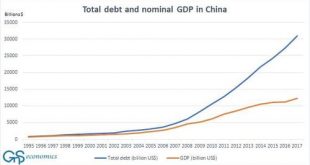

Dow 30,000 is “unsinkable,” just like the Titanic. A recent Barrons cover celebrating the euphoric inevitability of Dow 30,000 captured the mainstream zeitgeist perfectly: Corporate America is firing on all cylinders, the Federal Reserve’s god-like powers will push stocks higher regardless of any other reality, blah blah blah. While the financial media looked elsewhere for its amusement, the coronavirus epidemic in China just poured fentanyl in the Dow 30,000...

Read More »Hawaii Representatives Consider Ending Taxation on Sound Money

Introduced by Representative Okimoto (R-36), House Bill 1830 removes sales and use tax against gold and silver bullion and currency in Hawaii. Under current law, Hawaii citizens are discouraged from insuring their savings against the devaluation of the dollar because they are penalized with taxation for doing so. Passage of this measure would remove disincentives to holding gold and silver for this purpose. HB 1830 is important for a few reasons: Levying sales taxes...

Read More »FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Swiss Franc The Euro has fallen by 0.09% to 1.0681 EUR/CHF and USD/CHF, January 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It was as if the World Health Organization’s recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and...

Read More »Swiss Retail Sales, December 2019: -0.4 percent Nominal and 0.1 percent Real

31.01.2020 – Turnover adjusted for sales days and holidays fell in the retail sector by 0.4% in nominal terms in December 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 0.1% in December 2019 compared with the previous year. Real growth takes...

Read More »USD/CHF Price Analysis: 21-day SMA limits immediate downside

USD/CHF confronts 23.6% Fibonacci retracement following the bounce off 21-day SMA. Early month lows add to the support while 38.2% Fibonacci retracement, 50-day SMA will challenge recovery moves. USD/CHF takes the bids to 0.9707 during the pre-Europe session on Friday. In doing so, the pair repeats the tendency of staying beyond 21-day SMA while also confronting 23.6% Fibonacci retracement of its declines from November 29, 2019, to January 16, 2020. The sustained...

Read More »Dollar Firm Ahead of BOE Decision

The World Health Organization called an emergency meeting today; the dollar continues to climb The FOMC meeting was a non-event; US advance Q4 GDP will be reported Risk-off sentiment has derailed curve steepening trades Implied rates still suggest that today’s BOE meeting is a coin toss Turkish central bank released its quarterly inflation report; Asian markets got hit hard again with rising virus concerns The dollar is broadly firmer against the majors ahead of the...

Read More »Peru cracks down on illegal gold mining

. Wildcat mining has devastated large chunks of the Peruvian Amazon, where gold is extracted and makes its way to the refineries and banks in Switzerland. swissinfo.ch visited the southeastern region of Madre de Dios and spoke to artisanal miners who have benefited from the gold rush to educate their families and create jobs, as well as those who have fallen afoul of the law. In the past three decades, 960 square kilometres of forests were lost here to gold mining,...

Read More »Freedom and Prosperity: The Importance of Sound Money

Sound money is a key to a free and prosperous society. That principle was clearly reflected in the monetary system that the Constitution established when it called the federal government into existence. Our ancestors didn’t trust government officials with power. They believed that the greatest threat to their own freedom and well-being lay not with some foreign regime but rather with their own government. They understood that historically most people had lost their...

Read More »FX Daily, January 30: Contagion Impact not Peaked, Weighs on Risk Appetites

Swiss Franc The Euro has fallen by 0.21% to 1.0689 EUR/CHF and USD/CHF, January 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org