Risk sentiment is likely to remain under pressure this week as the impact of the coronavirus continues to spread; demand for dollars remains strong As of this writing, the Senate-led aid bill has stalled; the US economic outlook is getting more dire; Canada is experiencing similar headwinds This is a big data week for the UK; eurozone March flash PMIs will be reported Tuesday; oil prices continue to slide Japan has a heavy data week; RBNZ will start QE; China offers...

Read More »COVID-19 – Auslegeordnung

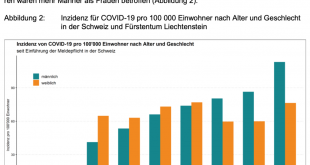

In den vergangenen Tagen habe ich mich immer wieder gefragt, “wo besteht eigentlich das Problem?” Zu oft habe ich das Gefühl, dass viele Experten, Medien und Politiker mit den Zahlen ein Durcheinander haben und so mehr zur Verwirrung als zur Klärung beitragen. Deshalb hier der Versuch einer strukturierten Aufschlüsselung. Eine Bitte an alle Leser: Ich suche Quellen (Webseiten, Videos [mit Minutenangabe], Interviews, etc.), welche meine Fragen entweder beantworten...

Read More »Mit Aktien wird man nicht reich und vermögend ??

Ja, richtig gelesen. Mit Aktien wird man nicht reich und vermögend. Was ich damit meine, möchte ich in diesem Beitrag erläutern. Keine Sorge, ich werde weiterhin in Aktien investieren, aber auch meine Motivation für Aktien Investments nochmal genauer erläutern. Wenn Aktien nicht reich machen Aktien sind ein Investmentkonstrukt, man investiert sein verdientes Geld in Unternehmen. Das investierte Geld kann somit langfristig für einen arbeiten und der Topf kann durch...

Read More »SNB belässt Leitzins unverändert und stärkt die Banken

Die SNB steht bereit, bei Bedarf zusätzliche Massnahmen zur Sicherung der Liquidität zu treffen. (Bild: Shutterstock.com/Distinctive Shots) Die Schweizerische Nationalbank (SNB) belässt ihren Leitzins sowie den Zins auf Sichtguthaben bei -0,75%, wie sie am Donnerstag im Rahmen der geldpolitischen Lagebeurteilung mitteilte. Sie interveniert verstärkt am Devisenmarkt, um zur Stabilisierung der Lage beizutragen. Dabei betrachtet sie die gesamte Währungssituation....

Read More »Coronavirus: estimating the death toll in Switzerland

© Pongmoji | Dreamstime.com COVID-19 has hit the world fast and we are racing to understand it, while struggling to come to terms with its deadly impact. When trying to estimate the impact, it is tempting to take the current number of deaths and divide it by the number of reported cases. However, the resulting percentage is meaningless. Here’s why: Jumping the gun If we divide the current number of deaths in South Korea with the current number of cases so far we get...

Read More »‘We will come through this together’

The coronavirus has spread to 173 countries as of March 19. (Copyright 2020 The Associated Press. All Rights Reserved.) The upheaval caused by the coronavirus, Covid-19, is all around us. And I know many are anxious, worried and confused. That’s absolutely natural. We are facing a health threat unlike any other in our lifetimes. Meanwhile, the virus is spreading, the danger is growing, and our health systems, economies and day-to-day lives are being severely tested....

Read More »No, Technology Shocks Aren’t Behind Recurring Business Cycles

Economic fluctuations, also known as business cycles, are seen as being driven by mysterious forces that are difficult to identify. Finn Kydland and Edward C. Prescott (KP), the 2004 Nobel laureates in economics, decided to attempt to find out what these forces were.1 They hypothesized that technology shocks are a major factor behind economic fluctuations and demonstrated that a technology-induced shock can explain 70 percent of the fluctuations in the postwar US...

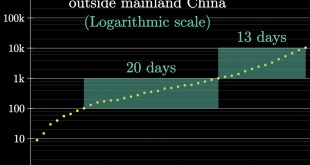

Read More »Corona’s Exponential Curve Slope Tracking, March 20

Exponential Growth and Corona The more mathematically versed folks under us have understood that it the slope (or steepness / derivation) of the Corona expansion curve is important. The following statistics is based on the Worldometer data, that rather shows the “first dimension”; we however, focus on the “second dimension”, the slope of the curve. This is far more useful, because for such exponential curve, the slope is key.The video explains the details....

Read More »Swiss central bank resists temptation to reduce interest rates

[caption id="attachment_439311" align="alignleft" width="400"] SNB chairman Thomas Jordan said the central bank will continue to defend the franc. (Keystone / Marcel Bieri)[/caption] The Swiss National Bank (SNB) has kept interest rates unchanged at -0.75% but is easing the burden on commercial banks. The SNB said on Thursday that it is also intervening on the foreign exchange markets to keep the franc from appreciating too far, too fast. The SNB’s...

Read More »Shortage of hospital beds in Ticino as virus toll rises

Efforts are underway to provide additional medical devices and beds in intensive care units in Ticino. (Keystone/Alessandro Crinari) The Swiss health authorities have raised alarm over the limited care facilities in one of its regions hardest hit by the coronavirus epidemic. “The situation in Ticino is dramatic,” said Daniel Koch of the Federal Office of Public Health at a news conference on Thursday. He said it was foreseeable that the hospitals in canton Ticino,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org