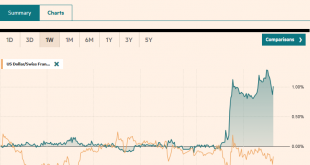

Swiss Franc The Euro has fallen by 0.13% to 1.0592 EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Another late sell-off of US equities, ostensibly on questions over Moderna’s progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little...

Read More »Modern Monetary Theory makes inroads following coronavirus crisis

US policymakers’ bold actions in response to the coronavirus bear some traces of the free-wheeling deficits, repressed interest rates and central bank activism (money creation) that form the cornerstones of the Modern Monetary Theory (MMT) playbook. MMT’s popularity is likely to persist, gaining converts among those who previously supported classic assumptions about budget constraints or the ‘crowding out’ of private investment by growing government indebtedness....

Read More »Italy set to reopen borders with Switzerland from 3 June 2020

© Ellesi | Dreamstime.com Italy is preparing to reopen its borders with the rest of Europe, according to the newspaper La Repubblica. A draft law on new rules was published on 15 May 2020 by the Italian Council of Ministers. It provides for the possibility of allowing entry to Italy from 3 June 2020 without requiring those arriving from certain countries to quarantine for 14 days. The countries include EU nations and Schengen members, including Switzerland and...

Read More »How crypto mining tried, but failed, to gain a Swiss toehold

This crypto mine in Gondo could not keep up with competitors with cheaper electricity. (Keystone/ Valentin Flauraud) There was a time when any Tom, Dick or Harry could create (or “mine”) bitcoin with a modified PC. Now only warehouses packed full of specialised computing gear stand any real chance. The bones of defunct crypto mines litter the Swiss Alps. This week saw a special event in the bitcoin life cycle, called “Halving”. Like a super-rapid solar eclipse, blink...

Read More »Consumer Spending Will Not Rebound–Here’s Why

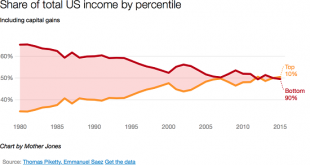

Any economy that concentrates its wealth and income in the top tier is a fragile economy. There are two structural reasons why consumer spending will not rebound, no matter how “open” the economy may be. Virtually everyone who glances at headlines knows the global economy is lurching into either a deep recession or a full-blown depression, depending on the definitions one is using. Everyone also knows the stock market has roared back as if nothing has happened. While...

Read More »The ECB Has Been Hiding Risk. They Won’t Be Able to Do It Much Longer.

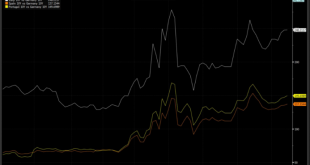

Despite the unprecedented increase in the European Central Bank’s asset purchase program, the spread of southern European sovereign bonds versus German ones is rising. The ECB balance sheet has soared to more than 42 percent of the eurozone’s GDP, compared to the Fed 27 percent of US GDP. However, at the same time, excess liquidity has ballooned to more than €2.1 trillion. The ECB has been implementing aggressive asset purchases as well as negative rates for...

Read More »FX Daily, May 19: Optimism Burns Eternal

Swiss Franc The Euro has risen by 0.08% to 1.0601 EUR/CHF and USD/CHF, May 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Hopes for a vaccine and a German-French proposal to break the logjam at the EU for a joint recovery effort helped propel equities higher yesterday. There was strong follow-through in the Asia Pacific region, where most markets advanced by more than 1% today. However, the bloom came off...

Read More »Why is the Pound to Euro Rate Falling? Will it Continue?

U.K jobless claims were released in early morning trading today, much like many economic data releases the figures were posted at an earlier than usual 07:00, we normally would see a release such as this out at 09:30. The figures, as expected were not particularly great reading for the U.K economy however there was a slight surprise in the fact that the official unemployment rate came in at 3.9% as opposed to the 4.3% which had been expected. This news shows that...

Read More »House View, May 2020

Macroeconomy With leading economies likely facing double-digit declines in GDP in Q1 and Q2, we expect Brent oil in the USD10–20 range in Q2 before reaching a long-term equilibrium of USD18 at year’s end. With consumers tempted to remain cautious, the oil sector in deep difficulty and a big rise in unemployment, we expect dire Q2 GDP figures for the US. We have reduced our GDP forecast for 2020 as a whole to -7.7%. Likewise, we expect the biggest hit to euro area...

Read More »Restricted Market Trading Comments

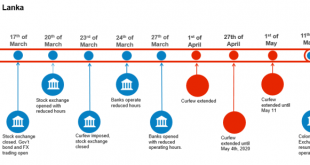

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged this week. Philippines, Bangladesh and Kuwait have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations on May 11, 2020 following an extended period of closure. Foreign exchange trading is still permitted...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org