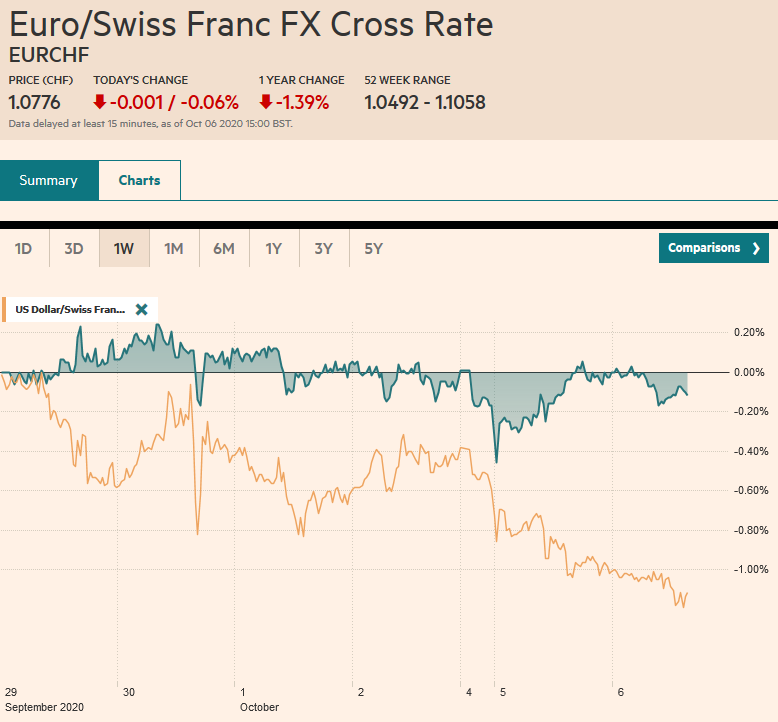

Swiss Franc The Euro has fallen by 0.06% to 1.0776 EUR/CHF and USD/CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: investing.com - Click to enlarge FX Rates Overview: Market moves have stalled. The MSCI Asia Pacific Index did manage to extend Monday’s gains, but other markets are heavier. Europe’s Dow Jones Stoxx 600 is snapping a three-day advance. The communications sector is the sole standout, though financials and energy are little changed. Most sectors are lower. US shares are also paring yesterday’s gain. The sell-off in US Treasuries, the most in a month, stopped, and the US 10-year yield is a couple of basis points lower near 0.76%. European benchmark yields are slightly lower, while the yields in the Asia Pacific played catch-up after

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Currency Movement, Featured, newsletter, trade, USD, Venezuela

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.06% to 1.0776 |

EUR/CHF and USD/CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: investing.com - Click to enlarge |

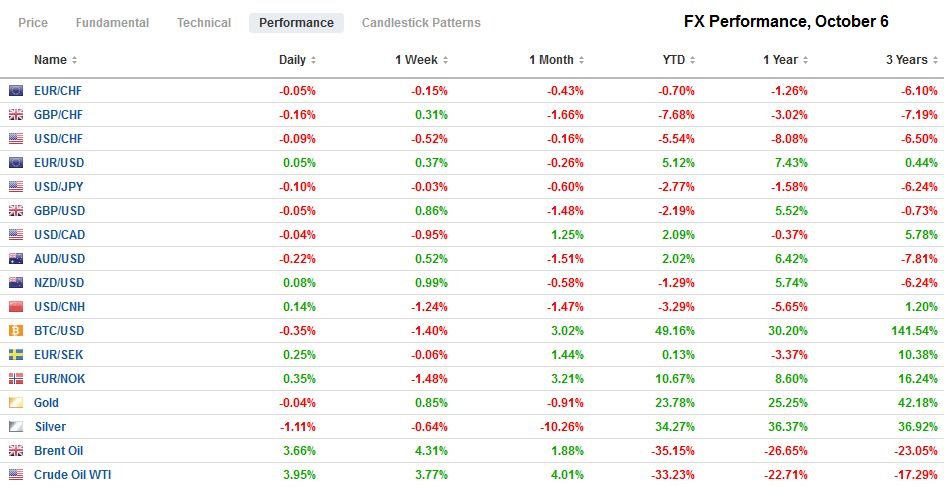

FX RatesOverview: Market moves have stalled. The MSCI Asia Pacific Index did manage to extend Monday’s gains, but other markets are heavier. Europe’s Dow Jones Stoxx 600 is snapping a three-day advance. The communications sector is the sole standout, though financials and energy are little changed. Most sectors are lower. US shares are also paring yesterday’s gain. The sell-off in US Treasuries, the most in a month, stopped, and the US 10-year yield is a couple of basis points lower near 0.76%. European benchmark yields are slightly lower, while the yields in the Asia Pacific played catch-up after the US yields rose eight basis points. The dollar initially extended its loss but recovered after several key chart points were tested, including $1.18 in the euro, $1.30 in sterling, and $0.7200 in the Australian dollar. While some Asian emerging market currencies are firmer, the freely accessible liquid currencies, like those of Russia, Mexico, and South Africa, are softer, and the JP Morgan Emerging Market Currency Index is breaking a five-day rally. Gold is holding yesterday’s gains that took it back about $1900 but progress stalled near $1915. Crude oil recovered smartly yesterday, with November WTI surging nearly 6% after dropping around 8% in the previous two sessions. It is approaching the $40-mark. |

FX Performance, October 6 |

Asia Pacific

As widely anticipated, the Reserve Bank of Australia stood pat with the cash rate and the 3-year yield at 25 bp. The policy focus was on the fiscal side with the government’s budget and new initiatives. A deficit of 11% of GDP is projected in the year ending June 2021, and net debt is projected at 36.1% of GDP. The key interest was in the decision to bring forward income tax cuts, boost infrastructure spending, and measures to pick up the slack in the labor markets where the unemployment rate of 7.5% in a 22-year high. In addition to a A$1.2 bln program that pays 50% of the wages of trainees or apprentices, and A$4 bln initiative to pay employers A$200 a week for new hires below the age of 29 and A$100 a week for new hires between the ages of 30 and 35.

Separately, Australia reported disappointing August trade figures. The surplus of A$2.64 was a little more than half of what had been projected and follows a A$4.65 surplus in July. Exports fell 4% after a revised 3% (initially -4%) decline, while imports rose by 2% on the month, while economists had expected a 5% decline. Of note, gold exports surge in July, which had surpassed coal imports (first time since 1998), fell back (-64% vs. 55%), while iron ore and coal exports increased. On the import side, capital equipment stands out.

Consumer prices jumped in South Korea last month. The 0.7% increase on the month was well above the 0.4% protected and follows a 0.6% gain in August. The year-over-year rate firmed to 1.0% from 0.7% and was twice the median forecast in the Bloomberg survey. The core rate ticked up to 0.9% from 0.8%. In and of itself, it is not problematic, but it is something to keep an eye on going forward.

The dollar rose within 1/100 of a yen of the JPY105.80, the two-week high set on September 30, and eased back to the JPY105.50 area. Technically, it could slip toward JPY104.90-JPY105.00, though it would likely coincide with a greater risk-off move. The Australian dollar tested last week’s high near $0.7210, which is (50%) retracement of the losses since September 1. It was sold off to a little below $0.7150, where it found new bids in the European morning. It is too early to call it double top, but a break of $0.7130 would point in that direction and project toward $0.7050.

Europe

The German industrial sector is finding traction. August factory orders rose by 4.5%, well above the median forecast in the Bloomberg survey for a 2.8% increase. Adding to recovery was the upward revision in the July series to 3.3% from 2.8%. August industrial production figures are due tomorrow and today’s report hints at the risk of an upside surprise from the median forecast for a 1.5% gain. Two elements of the orders report stick out. First, domestic orders rose 1.7% after tumbling 10.1% in July. Second, there was a surge in orders from other EMU members. The 14.6% gain follows an 8.3% increase in July. The new rise in Covid and new social restrictions may impact September’s numbers.

Separately, we note that the German construction PMI for September deepened its contraction by falling to 45.5 from 48.0. On the other hand, the UK construction PMI rose to 56.8 from 54.6 to defy expectations of a decline. The UK peak was in July at 58.1. UK Chancellor Sunak speaking at the Conservative Party Conference yesterday played up the need to get spending and borrowing back under control. While this sounded like austerity, it was meant to be post-crisis, and the UK is not there yet. It seems likely that by talking about fiscal disipline not being abandoned, he earns goodwill to spend more now during the crisis.

A British appeals court reversed a decision by a lower court that allowed the Bank of England to refuse to give Venezuela’s Maduro government access to its gold on deposit. The UK foreign office claimed it recognized Gaido as the interim president, but the appellate court saw it as more ambiguous. After all, the UK retains full consular and diplomatic relations with the current government. It is clear that Maduro controls the central bank and the Treasury. Still, the appellate court did not rule that the Bank of England must surrender the gold. It asked but did not require that the Foreign Office clarifies its stance. Gaido argues that the money would be used for nefarious purposes. At the same time, Maduro’s government says it would be immediately sent to the UN Development Program for humanitarian aid, medicine, and equipment to fight the pandemic. The case is returned to the commercial court. If the Foreign Office chooses not to clarify its position, the commercial court will decide on its own if the UK government really recognizes that Maduro is the defacto president. As an aside, but it is mentioned in many accounts of this case that in his book, former US national security adviser Bolton notes that the US lobbied that UK Foreign Office to deny Maduro’s request.

The euro stopped at $1.1800 in Asia, where a 600 mln euro is struck that expires today. We have noted that the $1.1810 level corresponds to the (50%) retracement of the drop since the $1.2010 was seen on September 1. The euro was sold back to $1.1765, where it found bids in the European morning. A move above $1.1810 would run into the 970 mln euro option struck at $1.1820 that rolls off today and then the $1.1845-$1.1860 resistance area. Sterling poked above $1.30, where a GBPO285 mln expiring option was struck but stayed below the $1.3010 level where another expiring option lies. It retreated to around $1.2960, but better support is seen near $1.2930. A close above $1.30 is needed to confirm a possible head and shoulders bottom that projects back above $1.33.

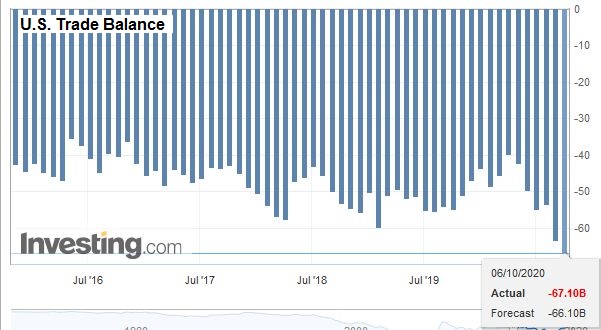

AmericaThe US reports August’s trade balance. The deficit is expected to have widened to over $66 bln and appears headed for the record seen in 2006 near $68.3 bln. Who provides the US with its goods has changed, but a substantial deficit remains constant. The average in the first seven months of 2020 is $50.7 bln. In the same period in 2019 the average was $49.8 bln and in 2018, $45.7 bln. In July 2016, the seven-month average was $39.8 bln. Rhetoric and tariffs have clearly been ratcheted higher with little perceptible impact on the US trade balance. The JOLTS report is also due and is expected to show the number of job openings fell for the first time since April, underscoring the sense that the world’s largest economy lost momentum as Q3 progressed. |

U.S. Trade Balance, August 2020(see more posts on U.S. Trade Balance, ) Source: investing.com - Click to enlarge |

Cleveland’s Fed Mester appears to have spoken for the majority at the Federal Reserve yesterday when she said there was no current need to boost the central bank’s purchases. She did break new ground by suggesting that she would like to see options to lengthen maturities of the purchases. About an hour after the US stock market opens today, Chair Powell speaks at a National Association of Business Economists in Chicago. Three other Fed officials speak today (Bostic, Harkin, and Kaplan).

Canada also reports August trade figures today. The deficit is expected to narrow a little to C$2.05 bln from C$2.45 bln in July. In the first seven months of this year, Canada reported an average shortfall of C$2.62 bln, and in the same period in 2019, the average deficit was C$1.83 bln. The highlight of the week will be the employment report on Friday. Mexico reports vehicle production and exports (September). There may be some upside here as the US auto sales have been recovering faster than expected. Note that the US September auto sales rose to a 16.34 mln (SAAR) pace, which was better than the 15.7 mln forecast on August’s 15.2 mln sales.

The US dollar retraced (38.2%) of the bounce off the September 1 low below CAD1.30 yesterday near CAD1.3260. There was a little follow-through to almost CAD1.3240 but is consolidating as is little changed on the day. The US dollar, though still feels heavy against it, and a return to the lows, cannot be ruled out. The CAD1.3205 area is the next retracement target. The greenback approached MXN21.30 yesterday, a two-week low. It recovered to MXN21.56, where new dollar sellers emerged. Resistance is seen near MXN21.60-MXN21.65. A break of MXN21.28 signals the next leg lower, which could test MXN.21.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Currency Movement,Featured,newsletter,Trade,Venezuela