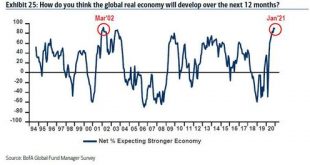

On Saturday, we showed why according to observations from Credit Suisse and BofA, the “US Economy Is Set To Overheat As Households Are Flooded With $2 Trillion In Excess Savings.” Then, in a note this morning from Morgan Stanley asking “What To Do About All This Optimism” the bank said that “in November, December and now January, no question or concern has come up more often than ‘everyone is optimistic’.” Finally, the latest Fund Managers Survey showed that...

Read More »What Biden/Harris Will Do

Paraphrasing the late Murray Rothbard, the “two party” system in America during the twentieth century worked something like this: Democrats engineered the Great Leaps Forward, and Republicans consolidated the gains. Wilson, Roosevelt, and Johnson were the transformative presidents; Eisenhower, Nixon, and Reagan offered only rhetoric and weak tea compromises. In politics, being for something always beats being against something, and Republicans were never much...

Read More »How Vaccine Technology, Choice and Supply Work in Switzerland

A nurse administers the Pfizer-BioNTech Covid-19 vaccine on the opening day of the new vaccination centre at the Lausanne University Hospital (CHUV) on January 11, 2021. Keystone / Laurent Gillieron The Swiss Covid-19 vaccination campaign is up and running with two approved vaccines available to accelerate the fight against the virus, and others set to follow. How do the vaccine technologies work and compare, and can people choose which one they get? So far, there...

Read More »New Opportunities 2021: Fiscal policy for the recovery

This GIS 2021 Outlook series focuses on the opportunities that stem from the upheaval of the past year. Coronavirus vaccine distribution has begun, most probably marking the beginning of the end of the global health crisis. A receding pandemic will leave behind intertwined economic and fiscal challenges for countries around the world. Those that address rising debts with expenditure-based reforms in 2021 and eschew higher taxes can expect to benefit from faster and...

Read More »Swiss Corporate Merger Activity Dampened by Covid

M&A activity for the year as a whole was most intense in the TMT (technology, media and telecommunications) sector Keystone / Obs/caritas Schweiz / Caritas Su - Click to enlarge The coronavirus pandemic left its mark on mergers and acquisitions (M&A) in Switzerland last year. The volume of transactions halved, and the number of deals was also down. Overall, the number of transactions with Swiss participation fell from 402 to 363. At $63.1 billion (CHF56...

Read More »$1.9 Trillion American Rescue Plan Positive for Gold

The Massive $1.9 Trillion American Rescue Plan is Just the Start Massive $1.9 Tr. American rescue plan to affect markets Yellen takes over at US Treasury, what to expect More spending initiatives to come How all this is positive for gold and silver prices The Biden Administration’s policies are positive for gold and silver prices. The $1.9 trillion – American Rescue Plan released on January 14 is just the beginning of spending initiatives. The plan is chocked full...

Read More »“Victim-Centered” Justice Is a Threat to Due Process

“Trauma-informed justice” has percolated in academia and activism for decades. It is now knocking on the door of local police departments to demand changes that could upend the basics of how people relate to law enforcement. The approach converts the police into social workers or therapists and erases the due process upon which traditional Western justice hinges. It also increases the odds of wrongful convictions. Trauma-informed justice—sometimes called...

Read More »FX Daily, January 22: Faltering Friday

Swiss Franc The Euro has risen by 0.07% to 1.0773 EUR/CHF, January 22(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Fear that social restrictions may have to be broadened and extended is helping spur a wave of profit-taking and de-risking, which has also been encouraged by disappointingly high-frequency data. The equity rally seemed to falter a bit in the US, as the S&P 500 eked out a minor 0.03% gain yesterday. In...

Read More »Dollar Weakness Continues Ahead of ECB Decision

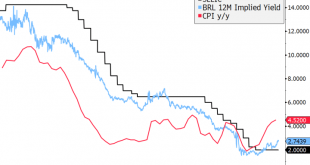

Joe Biden became the 46th President of the US; three Democratic Senators were also sworn in; weekly jobless claims data will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; Brazil kept rates on hold at 2.0%, as expected ECB is expected to keep policy unchanged; Norges Bank kept rates steady at 0%, as expected; Chancellor Sunak is reportedly drawing up plans to extend support for the UK labor market in...

Read More »Yet Another Study Shows—Yet Again—That Lockdowns Don’t Work

Although advocates for covid-19 lockdowns continue to insist that they save lives, actual experience keeps suggesting otherwise. On a national level, just eyeballing the data makes this clear. Countries that have implemented harsh lockdowns shouldn’t expect to have comparatively lower numbers of covid-19 deaths per million. In Italy and the United Kingdom, for example, where lockdowns have been repeatedly imposed, death totals per million remain among the worst in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org