Swiss Franc The Euro has risen by 0.07% to 1.0773 EUR/CHF, January 22(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Fear that social restrictions may have to be broadened and extended is helping spur a wave of profit-taking and de-risking, which has also been encouraged by disappointingly high-frequency data. The equity rally seemed to falter a bit in the US, as the S&P 500 eked out a minor 0.03% gain yesterday. In the Asia Pacific region, Hong Kong shares, which had been the high-flyers this week, got hit the hardest today, falling by 1.6% (still up 3% on the week), while India and several smaller bourses also fell by more than 1%. On the back of soft preliminary PMIs, Europe’s Dow Jones Stoxx 600 is off 1% to give

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, China, Currency Movement, ECB, Featured, Japan, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.07% to 1.0773 |

EUR/CHF, January 22(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Fear that social restrictions may have to be broadened and extended is helping spur a wave of profit-taking and de-risking, which has also been encouraged by disappointingly high-frequency data. The equity rally seemed to falter a bit in the US, as the S&P 500 eked out a minor 0.03% gain yesterday. In the Asia Pacific region, Hong Kong shares, which had been the high-flyers this week, got hit the hardest today, falling by 1.6% (still up 3% on the week), while India and several smaller bourses also fell by more than 1%. On the back of soft preliminary PMIs, Europe’s Dow Jones Stoxx 600 is off 1% to give back this week’s gains. The S&P 500 is up 2.25% on the week coming into today, and the benchmark is trading about 0.75% lower. The US 10-year is slightly lower, around 1.09%, while most European bond yields are softer, but Italy and Greece. Australia and New Zealand yields jumped 5-6 bp. The dollar is mostly higher against the major and emerging market currencies. Those currencies that were the better performers this week, like sterling, the Australian and Canadian dollar, and the Norwegian krone, are leading to the downside today. The JP Morgan Emerging Market Currency Index is off for the second consecutive session. Recall that it had fallen for the past four straight weeks. With the 0.2% decline today, it is holding on to about a 0.35% gain on the week. Gold’s recovery from the test on $1800 at the start of the week stalled yesterday near $1875, and it is trading nearly $30 off its peak in the European morning. March WTI failed in the middle of the week to rise above $54 and eased a little yesterday (~-0.35%) but has come under stronger selling pressure today, ostensibly on demand worries. Near $51.80, it is off around 1.2% on the week, which would snap a three-week, nearly $5 advance. |

FX Performance, January 22 |

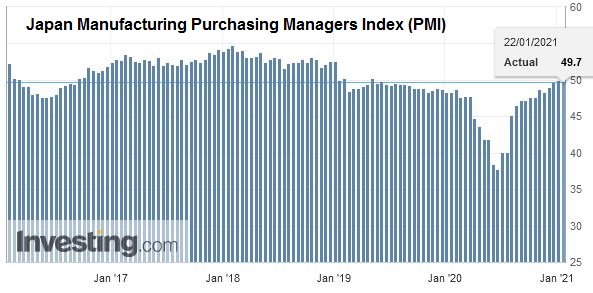

Asia PacificJapan reported both December CPI and the preliminary January PMI. Note too that press accounts suggest the Suga government is on the verge of concluding that the summer Olympics need to be canceled. Japan is still gripped by deflationary forces. Headline CPI stands at -1.2% after -0.9% in November. The core rate, which excludes fresh food, is at -1.1% (-0.9% in November). Even if fresh food and energy are removed, Japan’s deflationary conditions remain (-0.4%). The preliminary PMI shows the difficult straits the third-largest economy is facing. The manufacturing PMI slipped to 49.7 from 50.0. The service sector contraction deepened (45.7 vs. 47.7), pushing the composite to 46.7 (from 48.5). |

Japan Manufacturing Purchasing Managers Index (PMI), January 2021(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Australia’s economy is holding up better. The manufacturing PMI rose to 57.2 from 55.7, though the service PMI softened to 55.8 from 57.0. The composite was shaved to 56.0 from 56.6. Australia also reported a disappointingly large decline in December retail sales. The economists surveyed by Bloomberg expected a 1.5% decline. Instead, the preliminary estimate points to a 4.2% decline, denting November’s 7.1% gain. Separately, news that New Zealand’s inflation was firmer than expected (unchanged at 1.4% in Q4 20 rather than easing to 1.1%) may deter the central bank from fresh measures.

China is threatening to strike out at Sweden for blocking Huawei and ZTE from its 5G rollout. While Sweden would not be the first to be subject to Beijing’s wrath, it seems ill-advised. The EU and China struck an investment deal after several years of negotiations at the end of last year. The approval process is not complete. China’s actions could put the treaty at risk.

The dollar is recovering from a two-week low against the yen scored yesterday (~JPY103.35). Still, it has been confined to about a 10-tick range on either side of JPY103.60. Near-term trendline resistance is seen a little below JPY104.00 today, where an option for $430 mln expires today. The dollar finished last year near JPY103.25 and settled last week around JPY103.50. The Australian dollar’s three-day advance stalled yesterday near $0.7780, and profit-taking today has pushed back to its 20-day moving average (~$0.7715). A break of $0.7700 signals a return to the week’s low near $0.7660, and perhaps more. The PBOC set the dollar’s reference rate at CNY6.4617, a little firmer than the bank models suggested. Net-net, the dollar is little changed on the week against the yuan. It is trading around CNY6.4770 and closed last week about CNY4.4810. The PBOC made a net injection this week of almost CNY600 bln via open-market operations this week, the most since last May.

Europe

ECB’s Lagarde was asked repeatedly by reporters yesterday about financial conditions and the PEPP envelope of 1.85 trillion euros. Lagarde was clear and consistent. The central bank is flexible, and the full range of its tools can be adjusted in either direction. If financial conditions are sufficiently supportive, it may not need to use its full allotment, and if conditions worsen, it could boost the amount of the PEPP. The fact that it is not a commitment like the Fed’s $80 bln a month of Treasuries and $40 bln a month of Agency MBS made it into the statement is of little real significance. It does not limit the ECB’s options in any way.

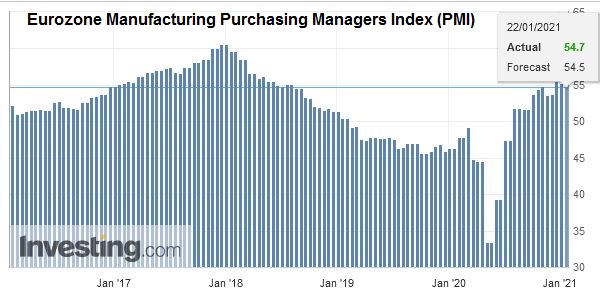

| The preliminary January eurozone PMI reflected the impact of the new social restrictions. The manufacturing PMI slipped to 54.7 from 55.2, |

Eurozone Manufacturing Purchasing Managers Index (PMI), January 2021(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

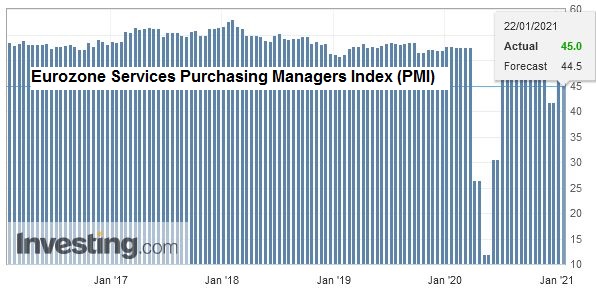

| while the contraction in services deepened to 45.0 from 46.4. While these were a little better than expected, |

Eurozone Services Purchasing Managers Index (PMI), January 2021(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

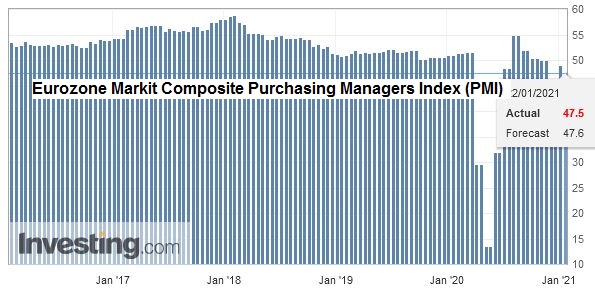

| the composite came in worse. It stands at 47.5, down from 49.1 and just below the Bloomberg survey median of 47.6. A year ago, it stood at 52.5. Of note, the German composite was a little better than expected at 50.8 (50.0 expected and 52.0 in November). The French composite fell to 47.0 from 49.5, which was slightly weaker than expected (49.0). Note that Lagarde warned of a possible contraction in Q1 21. |

Eurozone Markit Composite Purchasing Managers Index (PMI), January 2021(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| The UK reported disappointing data. December retail sales missed by a wide margin. Instead of rising by 1.3% as the Bloomberg survey’s median forecast had it, UK retail sales rose by 0.3%, and the November series was revised to show a 4.1% drop instead of a 3.8% slide. Excluding gasoline did not help much. Without it, retail sales rose by 0.3%. The flash PMI also undershot expectations. The manufacturing PMI fell to 52.9 from 57.5, and the service PMI tumbled to 38.8 from 49.4. These developments took the composite to 40.6 from 50.4 and well below the median forecast of 45.5. |

U.K. Retail Sales YoY, December 2020(see more posts on U.K. Retail Sales, ) Source: investing.com - Click to enlarge |

The euro has edged up to a new high for the week near $1.2190. The $1.2200 area houses the 20-day moving average and the (50%) retracement objective of the leg lower from the January 6 high near $1.2350. Cross rate demand appears to be helping. Initial support is seen around $1.2140. Sterling reached $1.3745 yesterday, new highs since the spring of 2018, but it is threatening to fall through yesterday’s low (~$1.3650) after the disappointing data. A break would target $1.3575 initially. The week’s low is closer to $1.3520.

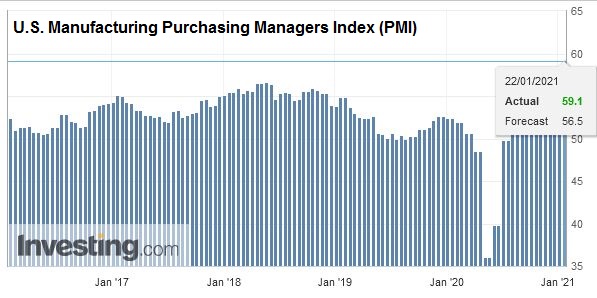

AmericaUS data reported yesterday (housing starts, permits, weekly jobless claims, and the Philadelphia Fed survey) were all better than expected. Housing remains a bright spot for the US economy. Today’s existing home sales may decline for the second month, but the level of activity is the best since 2006. The preliminary December PMI will be reported, and both manufacturing and service components are expected to have slipped. The highlight next week is the FOMC meeting and the first official look at Q4 20 GDP. |

U.S. Manufacturing Purchasing Managers Index (PMI), January 2021(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Canada reports November retail sales. They are too dated to have much impact, but the pace is expected to have ground to a halt after a 0.4% gain in October. Recall that in October, excluding autos, retail sales were flat. Next week, Canada reports its November GDP figures. The economy expanded by 0.4% in October. Mexico reports its bi-weekly CPI figures today for the middle of January. Price may have accelerated a little, and the year-over-year rate may have ticked up to 3.25% from 3.08%. Next week’s highlights include November retail sales and the first look at Q4 GDP (where the year-over-year contraction likely slowed to -7.4% from -8.6%), though recall that on a year-over-year basis, the Mexican economy contracted from April-December 2019.

The US dollar slipped below CAD1.26 yesterday for the first time since April 2018 but rebounded smartly, leaving a hammer candlestick in its wake. Follow-through greenback buying today is testing the CAD1.27 area in European turnover, where an option for about $670 mln will expire today. A move above CAD1.2720 would immediately target the CAD1.2750 area. Recall that the US dollar settled last week near CAD1.2730. The greenback posted a key reversal against the Mexican peso yesterday by making a new low for the move (~MXN19.55) before recovering and settling above the previous session’s high (~MXN19.80). Follow-through buying today has lifted the US dollar to almost MXN19.91. The week’s high was set Monday near MXN19.9670, and last week it settled just below MXN19.80.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,China,Currency Movement,ECB,Featured,Japan,newsletter,U.K.