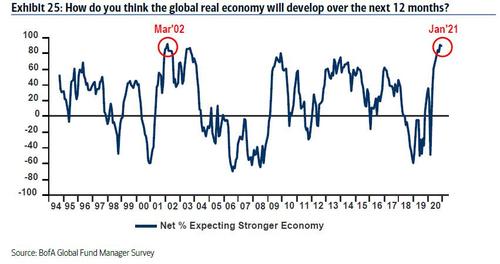

On Saturday, we showed why according to observations from Credit Suisse and BofA, the “US Economy Is Set To Overheat As Households Are Flooded With Trillion In Excess Savings.” Then, in a note this morning from Morgan Stanley asking “What To Do About All This Optimism” the bank said that “in November, December and now January, no question or concern has come up more often than ‘everyone is optimistic’.” Finally, the latest Fund Managers Survey showed that investors’ global growth expectations rose by 1% to a net 90%, the 3rd highest growth expectations ever (#1 in March 2002, #2 in November 2020). Global Real Economy, 1994-2020 - Click to enlarge This unbridled optimism prompted Goldman to boost its full year US GDP forecast to 6.6%, nearly 50% higher than

Topics:

Tyler Durden considers the following as important: 3.) Swiss Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| On Saturday, we showed why according to observations from Credit Suisse and BofA, the “US Economy Is Set To Overheat As Households Are Flooded With $2 Trillion In Excess Savings.” Then, in a note this morning from Morgan Stanley asking “What To Do About All This Optimism” the bank said that “in November, December and now January, no question or concern has come up more often than ‘everyone is optimistic’.” Finally, the latest Fund Managers Survey showed that investors’ global growth expectations rose by 1% to a net 90%, the 3rd highest growth expectations ever (#1 in March 2002, #2 in November 2020). |

Global Real Economy, 1994-2020 |

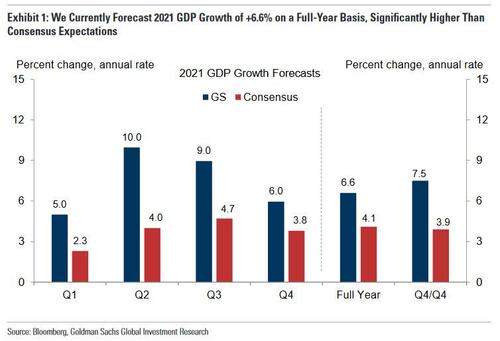

| This unbridled optimism prompted Goldman to boost its full year US GDP forecast to 6.6%, nearly 50% higher than the 4.1% consensus.

The common theme: record euphoria has gripped not just markets – Wall Street is just as euphoric about the broader economy where “everyone is optimistic” and for a very simple reason: with the Biden admin set to (realistically) unleash at least $1 trillion in new stimulus (down from Biden’s $1.9 trillion target), and also planning to unveil a new multi-trillion infrastructure program later in the year, negative numbers and bearish narratives simply do not matter ahead of this stimulus tsunami. Whether or not such euphoria is justified – after all, thanks to the Blue Wave, risks from insufficient fiscal aid or substantial scarring effects now look much less likely than a few months ago – but as Goldman’s chief economist Jan Hatzius wrote today in a lengthy note titled “What Could Go Wrong” with the 2021 rebound, other downside risks remain “including uncertainty about how consumers will respond to lingering risks and how new virus mutations will affect virus spread and vaccine efficacy.” Some more details on these three risks: |

2021 GDP Growth Forecasts |

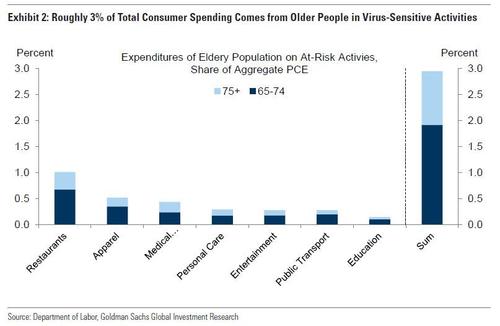

Some more details on each of these points as excerpted from the Goldman report: Downside Risk #1: Greater Consumer Caution

|

Consumer Spending |

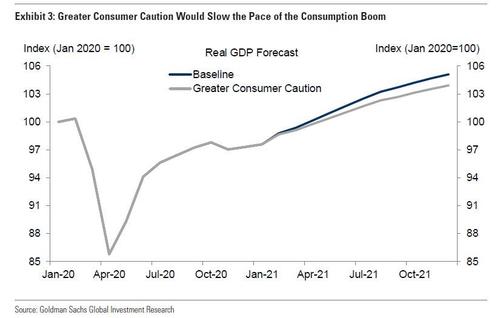

| To assess a downside case with increased consumer caution, we first use surveys of social distancing by age group to project our baseline services spending forecast across age groups, and then assume that services spending recovers 50% more slowly than in our baseline forecast for the older population and 10% more slowly for everyone else. As shown in Exhibit 3, more caution would slow the pace of the consumption boom, but would still likely imply fairly robust growth throughout 2021 of +5.9% on a full year basis (vs. +6.6% in our baseline forecast) and +6.3% on a Q4/Q4 basis (vs. +7.5%). |

Greater Consumer Caution Would Slow the Pace of the Consumption Boom |

Downside Risk #2: A Highly Infectious Strain

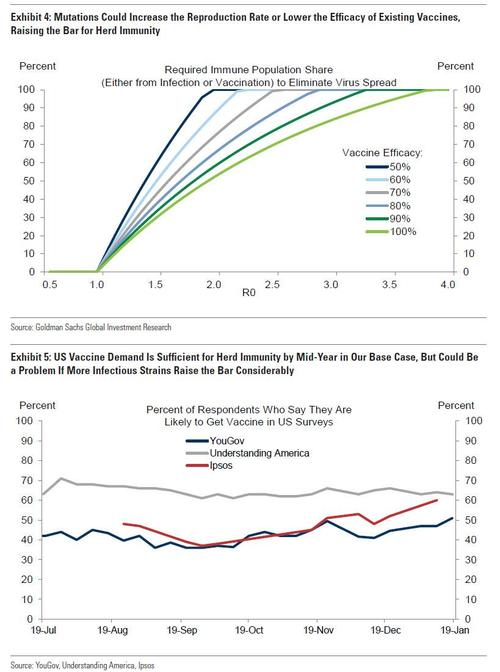

If R0 were 2.5, for example, and infections and vaccines provided an average protection of 80%, reaching herd immunity would require immunity of 86% of the population, acquired either through infection or through vaccination. While vaccine demand appears to have edged up over time (Exhibit 5) and is likely to rise as awareness of efficacy grows, achieving very elevated vaccine coverage might be challenging. This is especially true if lower efficacy or uncertainty about efficacy against new strains further discourages vaccination. |

|

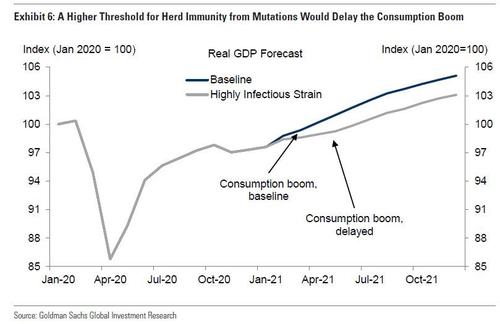

| Under the scenario where virus mutations significantly increase the bar for herd immunity, virus spread would remain considerably higher for longer and the consumption boom would likely be both delayed and softer. Exhibit 6 shows a stylized scenario where we assume that the boost from the recovery in services spending is pushed back by two months due to the delay in reaching herd immunity, and subsequent growth in services spending is 30% slower than in our baseline forecast. In this scenario we would expect moderately lower growth in 2021 of +5.1% on a full year basis (vs. +6.6% in our baseline forecast) and +5.4% on a Q4/Q4 basis (vs. +7.5%). | |

Downside Risk #3: Vaccine-Resistant Variant

|

Sign of Relief, 2020-2021 |

Richard Lessels (lead author of one study) characterized the results as showing that it was “possible” that that vaccine efficacy may be “slightly diminished.” At this point, it seems unlikely that vaccines will need to be adjusted to remain effective against either new strain, although the South African virus strain has more downside potential.

In addition to the risks from current strains, nearly all experts anticipate that vaccine-resistant strains could evolve, although generally do not believe such an evolution is imminent (Table 1). Instead, a vaccine-resistant virus would likely reflect the accumulation of mutations that lower the efficacy of vaccines over time. The risk that a vaccine-resistant virus strain emerges have risen recently, since higher case counts and more infectious strains increase opportunities for efficacy-lowering mutations to occur. Nevertheless, most viruses (with the seasonal flu as a notable exception) do not mutate in a manner that regularly renders vaccines ineffective, and so we do not incorporate such a mutation in our baseline forecast.

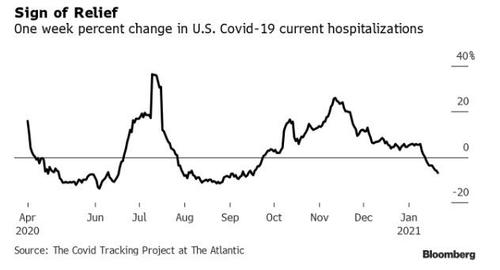

They don’t… but they just might and soon, considering the highly “political” nature of the covid pandemic, which in addition to directly toppling the Trump presidency, has emerged as the most palatable way of mainstreaming MMT and helicopter money, and overhauling the entire fiscal and monetary structure virtually overnight. It’s why one doesn’t have to be a deranged conspiracy theorist to conclude that despite the sudden improvement in the US covid picture since Biden’s inauguration, which as we reported on Friday resulted in a record one-day drop in covid hospitalizations…

… if it means that trillions more will be pumped into the economy – again, for political purposes, that the third risk, one of a “vaccine resistant virus strain”, is quite likely to emerge some time around the summer, not only to extend the lockdowns into 2022 but to give Congress and the Fed political cover for more trillions in Universal Basic Income-funding stimmy checks (while politicians quietly embezzle trillions more).

Tags: Featured,newsletter