Einer Umfrage zufolge haben insgesamt rund 16 Prozent aller US-Amerikaner bereits Kryptowährungen wie Bitcoin oder Ether besessen. Eine am Donnerstag vom Pew Research Center veröffentlichte Umfrage ergab, dass etwa 16 Prozent der Amerikaner in irgendeiner Form in Kryptowährungen investiert, mit ihnen gehandelt oder sie verwendet haben. Die Zahl springt auf 31 Prozent für Menschen im Alter von 18-29 und sogar auf 43 Prozent für Männer in der gleichen Altersgruppe....

Read More »Swiss government moots international monetary assistance

Switzerland joined the IMF in 1992 and is one of 24 members of the International Monetary and Financial Committee IMFC (Archive picture) Keystone/Stephen Jaffe/Handout The government seeks to renew its policy to support assistance measures by the International Monetary Fund (IMF). It asked parliament to approve plans to continue international monetary cooperation to the tune of CHF10 billion ($10.8 billion) by 2028. The existing legal basis expires in April 2023,...

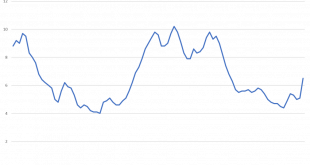

Read More »Since 2008, Monetary Policy Has Cost American Savers about $4 Trillion

With inflation running at over 6 percent and interest rates on savings near zero, the Federal Reserve is delivering a negative 6 percent real (inflation-adjusted) return on trillions of dollars in savings. This is effectively expropriating American savers’ nest eggs at the rate of 6 percent a year. It is not only a problem in 2021, however, but an ongoing monetary policy problem of long standing. The Fed has been delivering negative real returns on savings for more...

Read More »Swiss National Bank Fights Climate Change

The latest quarterly filing statement of the Swiss National Bank (SNB) has been issued. Switzerland’s publicly traded central bank had a decrease in the value of its US stock holdings by around $5 billion in Q3 of 2021, ending the quarter with a value of $157 billion. SNB currently has a profit of over $40 billion for the 9 months ended in the year. Perhaps subjective, it looks like a banner year for an entity who turns a profit through currency manipulation. As for...

Read More »Swiss Trade Balance October 2021: chemistry-pharma tarnishes the foreign trade table

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »Top 1% Gains More Wealth Than the Combined GDPs of Japan, Germany, UK, France, India and Italy, Bottom 50%–You Get Nothing

Given that political power in America is a pay-to-play auction in which the highest bidder wins, how this incomprehensibly lopsided ownership of wealth plays out is an open question. Wealth inequality easily falls into an abstraction unless we contextualize it in meaningful ways. I’ve annotated two St. Louis Federal Reserve (FRED) charts–the net worth of America’s top 1% and the net worth of America’s bottom 50% of households, roughly 66 million households–to show...

Read More »Homicide Rates in 2020 Rose to a 24-Year High. Is This a Crisis of State Legitimacy?

By mid 2020, it was already becoming clear that the United States was experiencing a spike in crime. Indeed, by midyear, numerous media outlets were already reporting remarkably large increases in homicide in a number of cities. It was clear that if then-current trends continued, homicide rates in the United States would reach levels not seen in over a decade. With full-year data for 2020 now available from the FBI’s Crime in the USA report, we can see that those...

Read More »UBS celebrates 50 years in Singapore, as a window to the world, connecting people and ideas

Singapore, 17 November – UBS is celebrating 50 successful years in Singapore with the official opening of its largest Asia Pacific office at 9 Penang Road. In the launch ceremony officiated by Axel A. Weber, Chairman of the Board of Directors UBS Group AG and Ralph Hamers, UBS Group CEO, the bank marked the occasion with clients, employees, and community activities in Singapore. Singapore’s Minister for Finance, Lawrence Wong, was the guest-of-honor for the event,...

Read More »Devisen: Euro weiter unter Druck – EUR/CHF knapp über 1,05

Zum Franken blieb der Euro auch im Tagestief nur noch knapp oberhalb der Marke von 1,05. Aktuell wird die Gemeinschaftswährung mit 1,0511 Franken tiefer bewertet als noch am Morgen und am Vortag. “Die Devisenhändler bei der Schweizerischen Nationalbank dürften wieder etwas strammer vor ihren Bildschirmen sitzen”, heisst es in einem Kommentar der Commerzbank. Die SNB sehe die Marke von 1,05 als aktuelle “Schmerzgrenze”, welche mit Devisenmarktinterventionen...

Read More »What the United States Can Learn from the European City-States

Over the past year and a half, we have seen some of the largest divides in US state policy in recent history. Certain states such as California have implemented heavy lockdowns, mask mandates, curfews, and other restrictions for months on end, whereas states such as South Dakota never had an official lockdown to begin with. There is now also the heated policy issue of vaccine mandates, with certain locations such as New York City and Los Angeles requiring proof of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org