We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list. To

Topics:

George Dorgan considers the following as important: 2.) Trade Balance News Service Bunt [FR], 2) Swiss and European Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

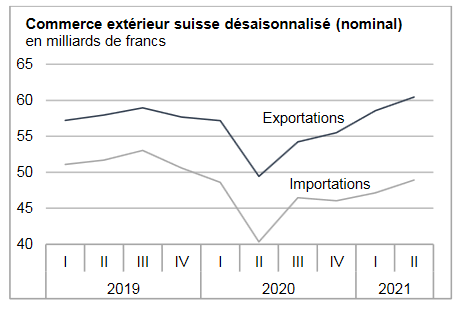

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

| In October 2021, Swiss foreign trade lost its vigor. Exports declined 1.4% and imports 2.3% from the previous month. The chemicals and pharmaceuticals sector weighed on the result in both directions of traffic. The trade balance closed with a surplus of 4.4 billion francs, similar to that of previous months.

In short ⇑ Watch exports continue their momentum ⇑ Increase in exports to Europe ⇑ Trade in jewelry and jewelry takes the lift ⇓ Exports to the US fall for the second month in a row |

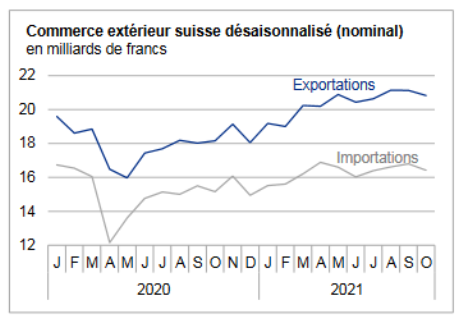

Swiss exports and imports, seasonally adjusted (in bn CHF), October 2021 |

Global evolutionIn October 2021, seasonally adjusted exports fell 1.4% (actual: -1.5%), after stagnating in September. Overall, they remain on a positive trend, albeit slower. Imports fell 2.3% over one month (actual: -4.4%). These have stagnated since April. The trade balance closes with a surplus of 4.4 billion francs. |

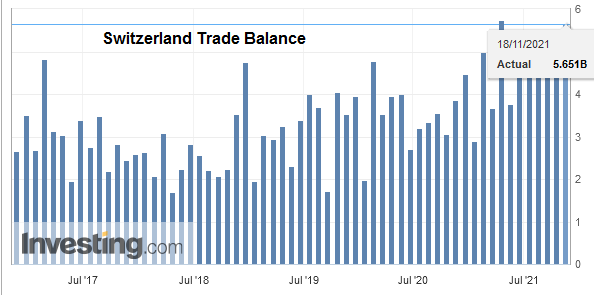

Switzerland Trade Balance, October 2021(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

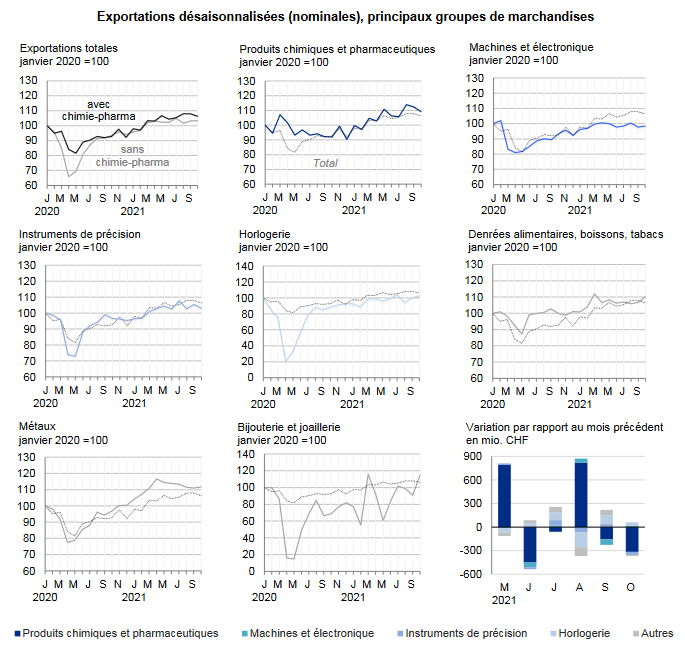

Exports: immunological products plunge by 613 million francsIn October 2021 for exports, a third of the groups of goods declined and two thirds increased. Among the losers, the flagship group, chemicals and pharmaceuticals, fell 2.8% (-317 million francs), weighing heavily on the overall result. The immunologics segment in particular fell by a sixth (-613 million). Among the winners, the jewelry and jewelry business with a jump of 233 million francs. Watch sales also continued to grow (+ 2.2% or +43 million). Of the top three markets, only North America declined (-10.1%). Here, the USA fell by 411 million francs (chemistry-pharma); after taking off in August, this partner shows a second consecutive monthly decline. Exports to Asia have generally stagnated. Sales to Saudi Arabia and Hong Kong took off as sales to China fell 3.4%. Towards Europe, turnover increased by 3.3% or 404 million francs. This increase was mainly rooted in Spain and the Netherlands, which posted cumulative growth of 231 million francs. |

Swiss Exports per Sector October 2021 vs. 2020 |

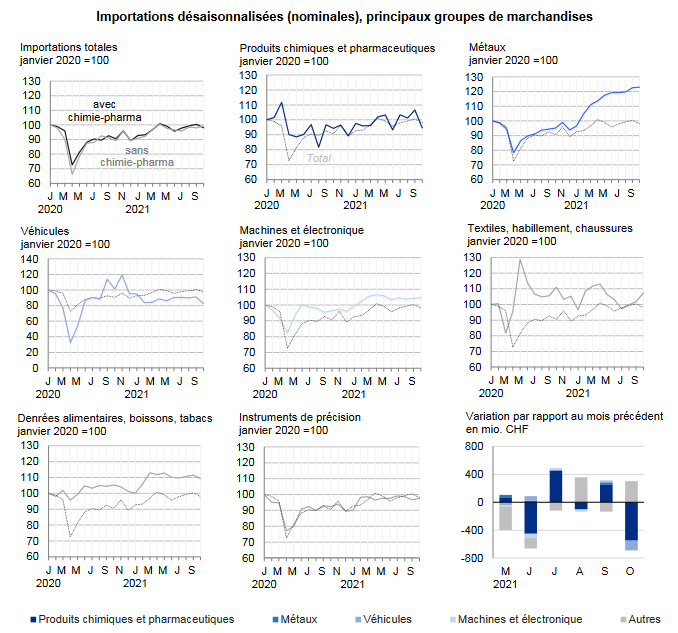

North American imports increase by one tenthAt the start, the fall of more than half a billion francs in chemicals and pharmaceuticals (-11.4%) had a major impact on the result. Medicines as well as immunological products have suffered serious setbacks. Vehicle imports also suffered (-142 million francs; primarily aeronautics). Conversely, jewelry and jewelry making stood out (+ 18.3%), reaching its highest level since March 2020. The textiles, clothing and footwear sectors as well as energy products increased, but to a lesser extent. For the latter, the increase was only due to the price effect. A disparate pattern characterized the three main supply markets: imports from Europe and Asia fell by 4.4% and 0.7% respectively, while those from North America swelled by a tenth. However, the latter had fallen by almost as much the previous month. On the European side, the fall of 373 million francs from Germany and Ireland pulled the continental result into the red numbers. With the Asian partner, the rise in China and the United Arab Emirates (jewelry and jewelry) contrasted with the similar decline in Singapore and Japan. |

Swiss Imports per Sector October 2021 vs. 2020 |

Tags: Featured,newsletter