Two Swiss NGOs have started a petition calling for Swiss retailers to reduce or remove palm oil from their products. Present in many processed foods, cosmetics and detergents, the ingredient has a bad reputation. The NGOs Bread for All and the Swiss Catholic Lenten Fund want to see a reduction in palm oil consumption. They believe voluntary initiatives by the palm oil sector to clean up the industry have done nothing to...

Read More »Bitcoin, Sour Grapes and the Institutional Herd

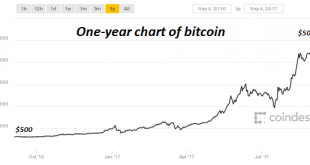

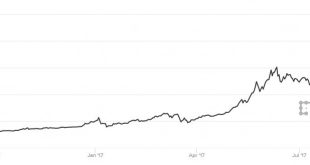

The point is institutional ownership of bitcoin is in the very early stages. If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I’d be a billionaire. There are three problems with opining that bitcoin and cryptocurrencies are bubblicious: 1. Everything is in a bubble now: stocks, bonds, housing, heck, even bat guano is bubblicious. Exactly what insight is being added by yet another guru...

Read More »2017 Is Two-Thirds Done And Still No Payroll Pickup

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a...

Read More »How to Make the Financial System Radically Safer

Preventing the Last Crisis Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism. The terrible scourge of bruxism and its potentially terrifying...

Read More »Dommage que Monnaie pleine ait omis de prévoir des mesures pour brider les risques que fait porter la BNS sur le contribuable.

Site de l’initiative Monnaie pleine: http://www.initiative-monnaie-pleine.ch/texte-de-linitiative/ Le peuple suisse va voter sur une initiative qui porte le nom de « monnaie pleine ». Cette initiative est partie du constat que les banques émettent de la monnaie scripturale dite monnaie-dette ou monnaie bancaire, et souhaite rendre la BNS seule responsable de la création monétaire, comme c’est d’ailleurs prévue par...

Read More »FX Daily, September 06: Wake Me up when September Ends

Swiss Franc The Euro has risen by 0.17% to 1.1396 CHF. EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank’s decision. We are concerned that given the strong performance and market positioning, a rate...

Read More »Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

– Bitcoin falls 20% as Mobius and Chinese regulators warn – “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius – Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold– Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt– China is home to majority of bitcoin miners– Paris Hilton latest...

Read More »Switzerland’s most expensive apartments in Zurich, Maloja and Lavaux

Lavaux – © Annanahabed | Dreamstime According to data from comparis.ch, Switzerland’s most expensive apartments are found in Zurich, Maloja – home to Saint-Moritz, and Lavaux-Oron. One square metre will cost you CHF 12,250 (US$ 13,000) in Zurich, CHF 11,500 in Maloja and CHF 11,250 in Lavaux-Oron. Lavaux-Oron contains posh parts of Greater Lausanne, such as Lutry, and the UNESCO-listed wine terraces of Lavaux on the...

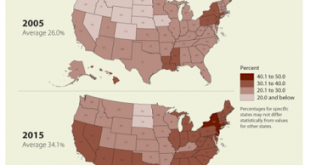

Read More »Great Graphic: Young American Adults Living at Home

This Great Graphic caught our eye (h/t to Gregor Samsa @macromon). It comes from the US Census Department, and shows, by state, the percentage of young American adults (18-34 year-olds). The top map is a snap shot of from 2005. A little more than a quarter of this cohort lived at home. A decade later, and on the other side of the Great Financial Crisis, the percentage has risen to a little more than a third. The deeper...

Read More »The Forking Paradise – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Forking Incentives A month ago, we wrote about the bitcoin fork. We described the fork: Picture a bank, the old-fashioned kind. Call it Acme (sorry, we watched too much Coyote and Road Runner growing up). A group of disgruntled employees leave. They take a copy of the book of accounts. They set up a new bank across the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org